INTRODUCTION

In today’s world, sustainable development is no longer just a trend—it has become a strategic necessity for businesses and government institutions. Environmental, Social, and Governance (ESG) factors now play a central role in determining a company’s investment appeal, regulatory compliance, and global reputation. In 2024, the European Union and other international organizations significantly strengthened ESG reporting requirements, compelling companies to seek advanced technological solutions for automating ESG analysis and reporting.

SustainaNet AITE is a next-generation AI-powered ESG analytics platform designed to automate monitoring, analysis, and sustainability forecasting for businesses and public administration. After several years of development and testing, the project has officially become part of the International Research Consortium Global Initiative for Sustainable Development of Territorial Entities (GITE IRC) and has been established as its key technological initiative.

GITE has been recognized by the United Nations as an SDG Good Practices, underscoring its significance in advancing cutting-edge solutions for sustainable development. This decision reflects the consortium’s strategic focus on advancing AI-driven ESG analytics and the automation of sustainable development processes. GITE IRC now oversees the project’s management, scaling, and integration into global ESG initiatives, ensuring alignment with international sustainability standards and active collaboration with the United Nations and other global organizations.

THE GLOBAL ESG LANDSCAPE AND KEY CHALLENGES

The Growing Importance of ESG

In recent years, Environmental, Social, and Governance (ESG) factors have evolved from a corporate trend into a fundamental component of strategic decision-making. The increasing regulatory pressure, the rapid expansion of ESG-focused investments, and the growing influence of sustainability metrics on corporate competitiveness are driving businesses to adopt advanced analytical tools and automation technologies.

As sustainability reporting becomes a global standard, companies across industries face significant challenges in ESG data collection, processing, and reporting. Addressing these challenges effectively requires AI-driven automation, predictive analytics, and seamless integration with regulatory frameworks.

1. The Regulatory Landscape: Stricter ESG Disclosure Requirements

Governments and regulatory bodies worldwide are imposing stricter ESG disclosure requirements, making comprehensive sustainability reporting mandatory for companies of all sizes.

• European Union: The Corporate Sustainability Reporting Directive (CSRD), effective in 2024, mandates 50,000+ companies to publish detailed ESG reports, including non-financial disclosures and supply chain impact assessments.

• United States: The Securities and Exchange Commission (SEC) has introduced stringent ESG disclosure rules affecting 4,000+ publicly traded companies to enhance transparency for investors.

• China: Since 2023, state-owned enterprises and major private corporations have been required to report on sustainability and carbon footprint reduction measures.

• Japan: Since 2022, all companies listed on the Nikkei 225 index must include ESG metrics in their corporate disclosures.

As global sustainability standards become more rigorous, companies that fail to comply risk losing investor confidence, facing regulatory fines, and falling behind competitors that integrate ESG into their corporate strategy.

2. The Rise of ESG Investments

Financial markets increasingly prioritize ESG performance, making accurate and transparent sustainability reporting a critical requirement for securing funding and maintaining investor trust.

• According to Bloomberg Intelligence, global ESG assets under management (AUM) stood at $35 trillion and are projected to reach $50 trillion by 2025.

• ESG criteria are now fundamental in credit risk assessment, influencing banks and investment funds when issuing loans or evaluating companies.

• Major rating agencies increasingly incorporate ESG factors into their corporate credit scores, impacting market valuation and financing opportunities.

As investors demand greater ESG transparency, companies must implement data-driven solutions to provide verifiable, standardized, and high-accuracy sustainability reports.

3. The Challenges of ESG Data Management

Despite the growing importance of ESG, many organizations struggle with data accuracy, standardization, and predictive analysis.

• 68% of companies face difficulties in measuring and calculating carbon footprints.

• 40% of businesses report a lack of proper analytical tools for effective ESG monitoring.

• The absence of harmonized global reporting standards (GRI, SASB, TCFD, CSRD) makes cross-market data comparison challenging.

As a result, investors, regulatory bodies, and corporate decision-makers struggle to extract actionable insights from fragmented ESG datasets. Without automated, AI-driven solutions, sustainability reporting remains an expensive, labor-intensive, and highly inconsistent process.

4. ESG and Corporate Competitiveness

Companies with strong ESG ratings experience measurable business benefits:

• Higher investment inflows from institutional and ESG-focused investors.

• Tax incentives and financial benefits tied to sustainable operations.

• Stronger positioning in public procurement and government contracts, where sustainability criteria are now included.

• Improved global reputation, essential for businesses operating in international markets.

These factors highlight the urgent need for advanced ESG data solutions that can streamline compliance, enhance risk management, and unlock growth opportunities. This evolving landscape underscores the critical role of AI-driven platforms in ESG. Companies that adopt automated, intelligent ESG solutions will gain a competitive edge, ensuring regulatory compliance, improved investment attractiveness, and enhanced operational efficiency.

In the next section, we will explore how AI is transforming ESG analytics and enabling companies to navigate this new reality effectively.

Companies that adopt automated, intelligent ESG solutions will gain a competitive edge, ensuring regulatory compliance, improved investment attractiveness, and enhanced operational efficiency

THE ROLE OF ARTIFICIAL INTELLIGENCE IN ESG

As ESG regulations tighten and investors demand higher transparency, businesses face an urgent need to streamline ESG reporting, enhance predictive analytics, and prevent greenwashing. Artificial intelligence (AI) has emerged as a transformational force in ESG, offering automated solutions that reduce reporting costs, improve data accuracy, and drive sustainability strategies.

1. AI-Driven ESG Risk Prediction

Traditional ESG risk assessments rely on manual data collection and static historical analysis, which often fails to identify emerging sustainability risks in real time. AI changes this paradigm by:

• Analyzing thousands of ESG indicators to predict potential compliance violations, environmental fines, and supply chain disruptions.

• Detecting early warning signals by monitoring news, financial disclosures, and market sentiment, flagging ESG risks before they escalate.

• Modeling long-term sustainability scenarios, helping businesses adjust their ESG strategies in response to regulatory changes and investor expectations.

For example, AI-powered climate risk models enable companies to forecast carbon footprint trends and proactively adapt their operations to upcoming emissions regulations.

2. Automating ESG Reporting and Compliance

One of the most resource-intensive aspects of ESG management is regulatory compliance. AI-driven platforms like SustainaNet AITE reduce ESG reporting efforts by up to 75%, enabling:

• Automated data integration – AI collects ESG data from corporate ERP systems, regulatory databases, and real-time environmental monitoring tools, eliminating manual entry errors.

• Real-time compliance tracking – AI ensures that reports adhere to evolving frameworks such as GRI, SASB, TCFD, and CSRD, reducing the risk of non-compliance.

• Multi-standard report generation – AI systems can instantly generate customized sustainability reports tailored for different investors, regulators, and industry requirements.

This automation allows companies to shift focus from compliance management to proactive ESG strategy execution.

3. AI-Powered Fraud Detection: Combating Greenwashing

Greenwashing – the practice of misleading stakeholders about a company’s environmental impact – has become a major concern for regulators and investors. AI helps counteract this issue by:

• Cross-checking reported ESG data with independentsources to identify inconsistencies.

• Detecting anomalies in corporate sustainability claims, ensuring that companies do not manipulate emissions or social impact figures.

• Analyzing supply chain data to prevent companies from outsourcing environmental damage to third parties.

AI-powered fraud detection is a game-changer for ensuring that ESG disclosures remain credible, verifiable, and free from manipulation.

4. AI-Driven Personalized ESG Strategies

Beyond compliance, AI enables businesses to proactively enhance their sustainability performance. By analyzing industry trends, competitor benchmarks, and regulatory landscapes, AI can:

• Recommend ESG optimization strategies tailored to a company’s specific industry and geographic location.

• Identify cost-effective sustainability improvements, such as energy efficiency initiatives or carbon offset programs.

• Simulate the financial impact of various ESG initiatives, helping executives prioritize investments in sustainability.

Instead of treating ESG as a regulatory burden, companies that leverage AI-driven insights can turn sustainability into a competitive advantage.

AI IN ESG: FROM DATA COLLECTION TO STRATEGIC DECISION-MAKING

The integration of AI in ESG goes beyond automation – it fundamentally redefines how businesses approach sustainability. Companies that embrace AI-driven ESG solutions can:

• Reduce compliance costs while improving reporting accuracy.

• Strengthen their investment attractiveness by ensuring verifiable ESG claims.

• Gain a competitive edge by proactively identifying and mitigating sustainability risks.

In the final section, we will explore the future of ESG analytics, the role of emerging technologies like IoT and blockchain, and how SustainaNet AITE is shaping the next generation of ESG solutions.

Technological advancements and the increasing regulatory pressure on ESG make process automation inevitable.

Companies that adopt intelligent ESG analytics solutions gain a competitive edge by reducing costs, improving reporting accuracy, and ensuring data transparency. SustainaNet AITE is precisely such a solution – integrating advanced AI technology and automated monitoring to transform the ESG analytics market. Let’s explore how this platform addresses key ESG challenges and what opportunities it unlocks for businesses and government institutions.

THE FUTURE OF ESG ANALYTICS AND THE ROLE OF SUSTAINANET AITE

As ESG reporting evolves, businesses are increasingly turning to cutting-edge technologies to ensure compliance, enhance transparency, and gain strategic insights. The next phase of ESG analytics will be shaped by IoT-powered real-time data collection, blockchain-based transparency, and AI-driven predictive modeling. SustainaNet AITE is at the forefront of this transformation, providing a scalable, AI-powered ESG intelligence platform that aligns with the rapidly changing regulatory and investment landscape.

1. The Future of ESG Analytics: Key Technological Shifts

To meet 2025–2030 sustainability goals, companies will need to integrate advanced data solutions into their ESG strategies.

IoT Integration for ESG Monitoring

• Real-time environmental tracking – IoT sensors collect instantaneous data on emissions, energy usage, and water consumption, reducing reliance on outdated manual reporting.

• Automated compliance monitoring – IoT-enabled systems detect regulatory violations in real time, helping companies stay ahead of tightening ESG policies.

Blockchain for ESG Transparency

• Immutable ESG records – Blockchain-based ledgers store tamper-proof ESG data, preventing corporate greenwashing and ensuring accountability.

• Supply chain sustainability verification – Blockchain enhances traceability of sustainable sourcing, allowing companies to certify ethical labor practices and carbon neutrality claims.

AI-Driven ESG Forecasting

• Predictive risk assessment – AI-powered models analyze global sustainability trends to anticipate emerging ESG risks, allowing businesses to adapt in advance.

• Real-time scenario modeling – AI simulates the longterm impact of sustainability initiatives, helping executives make data-driven investment decisions.

These innovations are rapidly redefining ESG analytics, making sustainability management more efficient, transparent, and actionable.

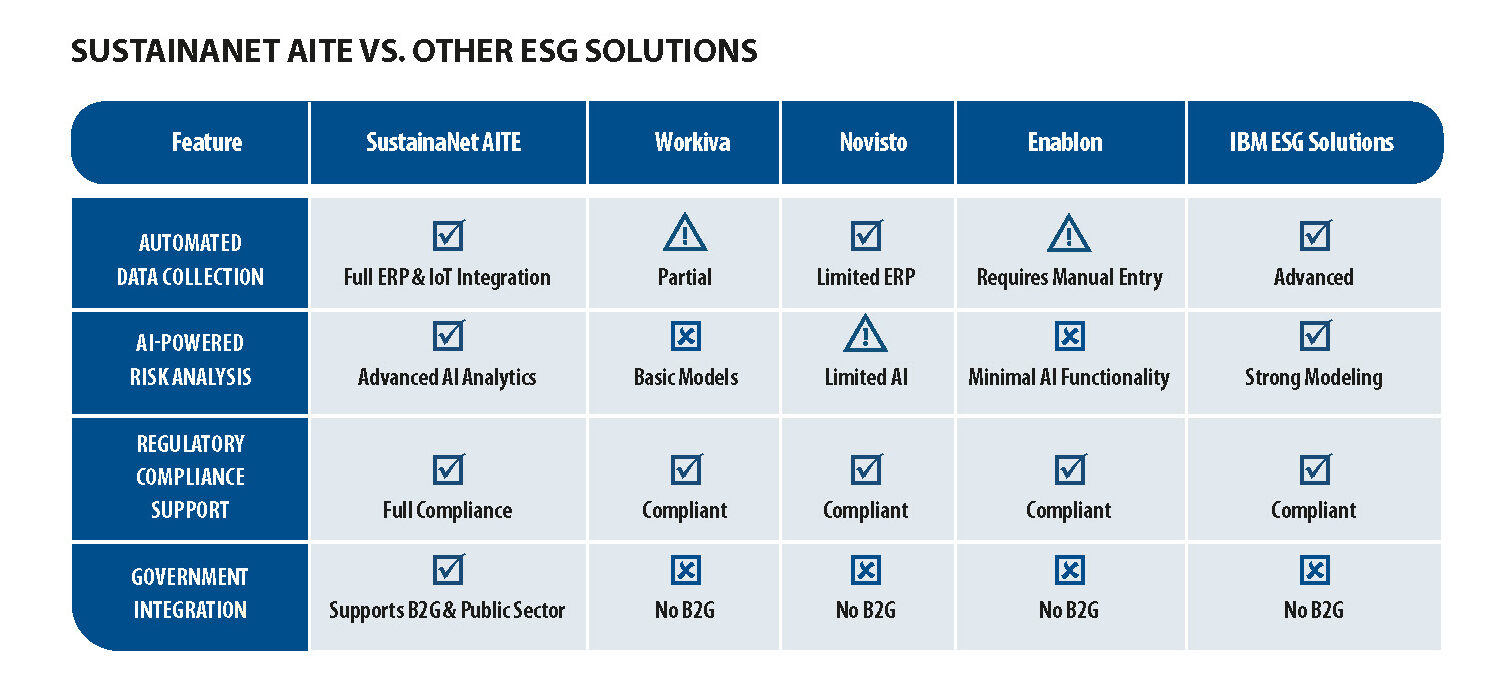

2. SustainaNet AITE: A Next-Generation ESG Intelligence Platform

SustainaNet AITE is designed to revolutionize ESG analytics by integrating AI, IoT, and blockchain into a single, powerful platform. It offers:

• End-to-End ESG Data Automation – AI-driven data integration eliminates manual reporting inefficiencies, ensuring seamless regulatory compliance.

• Deep AI-Driven Insights – The platform analyzes 500+ ESG indicators, offering real-time risk prediction and impact analysis.

• Comprehensive ESG Compliance Management – SustainaNet AITE generates customized reports that meet GRI, SASB, TCFD, and CSRD standards.

Unlike traditional ESG reporting tools, SustainaNet AITE is built for real-time compliance, predictive risk management, and seamless regulatory adaptation.

3. The Growing Demand for AI-Driven ESG Solutions

As ESG disclosure rules become mandatory for most corporations by 2030, the market for AI-powered sustainability analytics is expected to surge.

• According to Verdantix, the ESG analytics market will grow from €1.3 billion in 2023 to €5.6 billion by 2029.

• More than 50,000 companies in the EU alone will be required to implement CSRD-compliant ESG reporting.

• Institutional investors are increasingly prioritizing.

AI-powered ESG analytics, demanding higher data accuracy and real-time risk insights.

4. SustainaNet AITE: Defining the Future of ESG Management

By combining AI, IoT, and blockchain into a unified platform, SustainaNet AITE is setting a new benchmark for ESG analytics. The platform is designed to:

• Ensure full regulatory compliance with evolving ESG standards.

• Eliminate inefficiencies in ESG reporting through AI-driven automation.

• Provide unmatched risk visibility through predictive ESG intelligence.

• Support governments and enterprises in scaling sustainability initiatives.

SustainaNet AITE is at the forefront of this transformation, providing a scalable, AI-powered ESG intelligence platform that aligns with the rapidly changing regulatory and investment landscape

CONCLUSION: A NEW STANDARD IN ESG INTELLIGENCE

SustainaNet AITE is more than just an ESG tool – it is a strategic innovation that transforms sustainability reporting into a competitive advantage. Recognized by the United Nations as an SDG Good Practices, the platform is poised to redefine global ESG compliance, investment analytics, and corporate sustainability strategies.

As AI-driven ESG analytics become the new standard, SustainaNet AITE is leading the charge – helping businesses, governments, and investors shape a more sustainable and resilient global economy.

By World Economic Journal Editor-in-Chief Robert Abdullah

PHOTO: TZIDO SUN / SHUTTERSTOCK; PHOTO: BOY ANTHONY / SHUTTERSTOCK; PHOTO: CHAYANUPHOL / SHUTTERSTOCK; PHOTO: NUTTAPONG PUNNA / SHUTTERSTOCK.

Stay informed anytime! Download the World Economic Journal app on the App Store, Google Play, ZINIO, Magzter and Issuu:

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal

https://www.magzter.com/publishers/World-Economic-Journal

Issue FEBRUARY – MARCH 2025 – World Economic Journal https://www.zinio.com/publications/world-economic-journal/44375