Central Asia is rapidly gaining strategic importance for international investors. From a geopolitical perspective, the region plays a key role in global initiatives like China’s “Belt and Road.” Such frameworks open new opportunities for trade and transport infrastructure. Meanwhile, ongoing economic reforms and vast natural resources across the region create favorable conditions for foreign capital.

The region is rich in oil, gas, rare earth metals, and hydroelectric potential. At the same time, Central Asian countries are gradually embracing more sustainable economic models. This opens up new avenues for investment in renewable energy, green technologies, and eco-tourism.

Another strength is the region’s young and growing population — over 75 million people, with youth comprising the majority. This demographic trend presents clear advantages for labor markets, industrial development, and consumer-driven sectors.

ECONOMIC SNAPSHOT: FIVE CENTRAL ASIAN ECONOMIES

Kazakhstan

Kazakhstan is the region’s largest and most diversified economy. With substantial oil and gas reserves and a stable macroeconomic policy, the country remains a key destination for foreign capital. In 2023, inflation dropped by 8.3%, thanks to a national strategy focused on non-resource sectors like logistics, agriculture, and IT.

The Asian Development Bank approved over $6 billion in funding to support industrial development, infrastructure, and extractive industries.

Uzbekistan

Uzbekistan continues to demonstrate robust growth, driven by wide-ranging reforms and investor-friendly policies. In 2024, the economy is projected to grow by 6% — the highest rate in the region.

The country received $12.4 billion from ADB and €5.1 million from the European Bank for Reconstruction and Development in the form of loans, grants, and technical support. Efforts to privatize state-owned enterprises and expand special economic zones (SEZs) have positioned Uzbekistan as a regional investment leader.

Kyrgyzstan

Kyrgyzstan’s economy is built around mining, hydropower, and agriculture. Despite persistent political instability and infrastructure challenges, the country remains attractive for investors operating within the Eurasian Economic Union (EAEU).

By the end of 2023, the ADB had approved 217 financing packages for the Kyrgyz public sector, totaling $2.6 billion. The EBRD has also committed €998 million to boost trade and expand the Trans-Caspian corridor.

Tajikistan

Tajikistan is heavily dependent on remittances but is taking steps to improve its investment environment. The country is focusing on hydropower agriculture, and human capital development.

By late 2023, ADB commitments to Tajikistan reached $2.4 billion across 158 projects. These initiatives aim to boost labor productivity, improve living standards, and foster structural reforms.

Turkmenistan

Turkmenistan remains one of the region’s most closed economies. While limited in openness to foreign investors, the country’s vast natural gas reserves and involvement in energy projects continue to draw attention.

In 2023, GDP growth reached 6.3%. ADB partnered with the government on new initiatives in healthcare, finance, and transport, and provided technical assistance to support public-private partnerships.

Kazakhstan, Turkmenistan, and Uzbekistan are among the region’s top producers of oil and gas. At the same time, countries are shifting toward renewables

KEY SECTORS FOR INVESTMENT IN CENTRAL ASIA

Energy: Traditional Resources and Renewables

Central Asia remains a magnet for energy investments. Kazakhstan, Turkmenistan, and Uzbekistan are among the region’s top producers of oil and gas.

At the same time, countries are shifting toward renewables. Kazakhstan aims to raise its share of renewable energy to 15% by 2030. As of 2020, renewable capacity reached 1,634 MW, or just 3.5% of the national target.

In Kyrgyzstan, the national development strategy through 2040 focuses on green energy, with plans to modernize 132 hydropower stations by 2025. UNDP estimates production costs at $0.19–0.24 per kWh depending on the source (hydro, solar, geothermal).

Tajikistan and Turkmenistan have also set long-term goals to expand clean energy, though implementation remains uneven.

Transport and Logistics: Building New Trade Corridors

Strategically located between major global markets, Central Asia is central to new trade routes, including China’s Belt and Road Initiative.

Kazakhstan has emerged as a regional logistics hub, with freight volumes increasing ninefold in the last five years. Dry ports and international rail corridors — such as the Western Europe-Western China route — are in active development.

Uzbekistan is also modernizing rail and road networks. By 2030, the country aims to increase freight volume by 80% and improve its ranking in the World Bank’s Logistics Performance Index (LPI) to at least 55th globally.

Tajikistan’s logistics strategy includes upgrading border roads and terminals. The government expects logistics GDP contribution to rise from 8% to 10% by 2025.

Agriculture: Export Growth and Technological Modernization

Agriculture is a strategic sector for Uzbekistan, Kyrgyzstan, and Tajikistan. Fertile land and water access support diverse production.

Uzbekistan is expanding irrigation infrastructure and embracing agritech. The country aims to attract $100 million in green investment through the EU-AGRIN project.

Kazakhstan was the first in the region to adopt a national program for organic farming. Over 200,000 hectares are now under organic cultivation, with $35 million in export revenue recorded last year.

In Kyrgyzstan, the UN’s FAO has launched a program to strengthen smallholder farms through both funding and training.

Tourism: Infrastructure and Eco-Tourism

Tourism is rapidly growing in the region. Uzbekistan’s historic cities like Samarkand and Bukhara welcome over 2 million tourists annually. The country has built 11 international airports and supports a network of 600+ tour operators.

Kazakhstan’s national tourism plan emphasizes eco-tourism. Legislation supports regulated access to nature reserves and investment in low-impact infrastructure. A one-stop window has been launched for foreign tourism investors.

Kyrgyzstan is prioritizing tourism as a strategic sector, with investments in digital border controls, airport upgrades, and soft loans for small tourism businesses.

CASE STUDIES, REFORMS, AND INCENTIVES

Investment Success Stories

Danone has built a successful dairy processing business in Central Asia by partnering with local farmers. Its products are now distributed across the region. Total investment: approximately €21 million.

NALCA, an agribusiness firm, has committed €500 million over 10 years to beef production in Kazakhstan. The company established full-cycle operations — from farming to logistics and exports — to serve both domestic and international markets, including China and the Middle East.

Economic Reforms and Investment Climate

Countries across Central Asia are pursuing active economic modernization to attract global investors. Kazakhstan continues to lead in reform efforts. Under its 2021–2025 development plan, the government targets over $1.35 billion in new investments by 2025.

“Kazakhstan strikes a smart balance between state support and market competition,” says James Freeman of the EBRD. “Investments exceeding $1 billion are fully realistic.”

Uzbekistan has implemented major reforms: relaxed visa regimes for business travelers, expanded SEZs, and privatized state-owned enterprises.

“Uzbekistan is now a regional transformation leader,” says ADB’s Li Sung. “It offers both market access and favorable export terms.”

Kyrgyzstan focuses on supporting SMEs in agriculture and hydropower. However, political uncertainty remains a key challenge.

“Institutional capacity must be strengthened to build investor trust,” notes IMF’s Sara Thompson.

Role of Special Economic Zones

SEZs are a core policy tool for attracting foreign investment across the region.

• Kazakhstan operates over 10 SEZs, including Astana — New City and Khorgos — Eastern Gate, offering tax and customs incentives, plus streamlined administration.

• Uzbekistan grants tax holidays of up to 10 years, depending on investment volume, within its SEZ network.

• Turkmenistan, though restrictive in access, offers preferential terms for energy-sector investors.

“SEZs hold enormous potential,” says World Bank expert Anna Carter, “but success depends on transparent procedures and access to financing.”

RISKS AND BARRIERS TO INVESTMENT

Political Instability and Regional Tensions

Political risk remains a top concern for investors in Central Asia.

• Kyrgyzstan has faced repeated political crises in recent years, undermining long-term investor confidence.

• Tajikistan continues to experience border tensions, particularly along the Afghan frontier.

• Turkmenistan maintains a highly closed political system, limiting transparency and risk assessment.

“Investors must be prepared for abrupt legislative changes and potential contract revisions,” warns David Holmes of the Global Markets Research Center.

Legal Uncertainty and Weak Investor Protections

Legal frameworks vary widely across the region and often lack harmonization, complicating cross-border investment and trade.

• Customs, sanitary, and veterinary standards differ between countries, limiting regional integration.

• Turkmenistan remains particularly restrictive outside the energy sector due to opaque regulations.

• According to ADB’s ease-of-doing-business metrics: Kazakhstan ranks 28th globally, while Tajikistan ranks 126th — highlighting wide gaps in investment environments.

“Rule of law and investor protections must become top priorities,” says UNDP legal advisor Maria Reynolds. “Progress in this area is essential to unlock long-term capital inflows.”

Environmental Challenges and Skills Gap

The region also faces growing environmental pressures and human capital limitations:

• Water scarcity is a major issue in Kyrgyzstan, Tajikistan, and Uzbekistan — causing tensions and slowing transnational projects.

• Climate change threatens agriculture and food security, with increased drought risk and declining yields, especially in Turkmenistan.

• Pollution from unchecked industrialization is degrading soil and water quality, affecting agriculture and tourism alike.

OUTLOOK AND STRATEGIC RECOMMENDATIONS

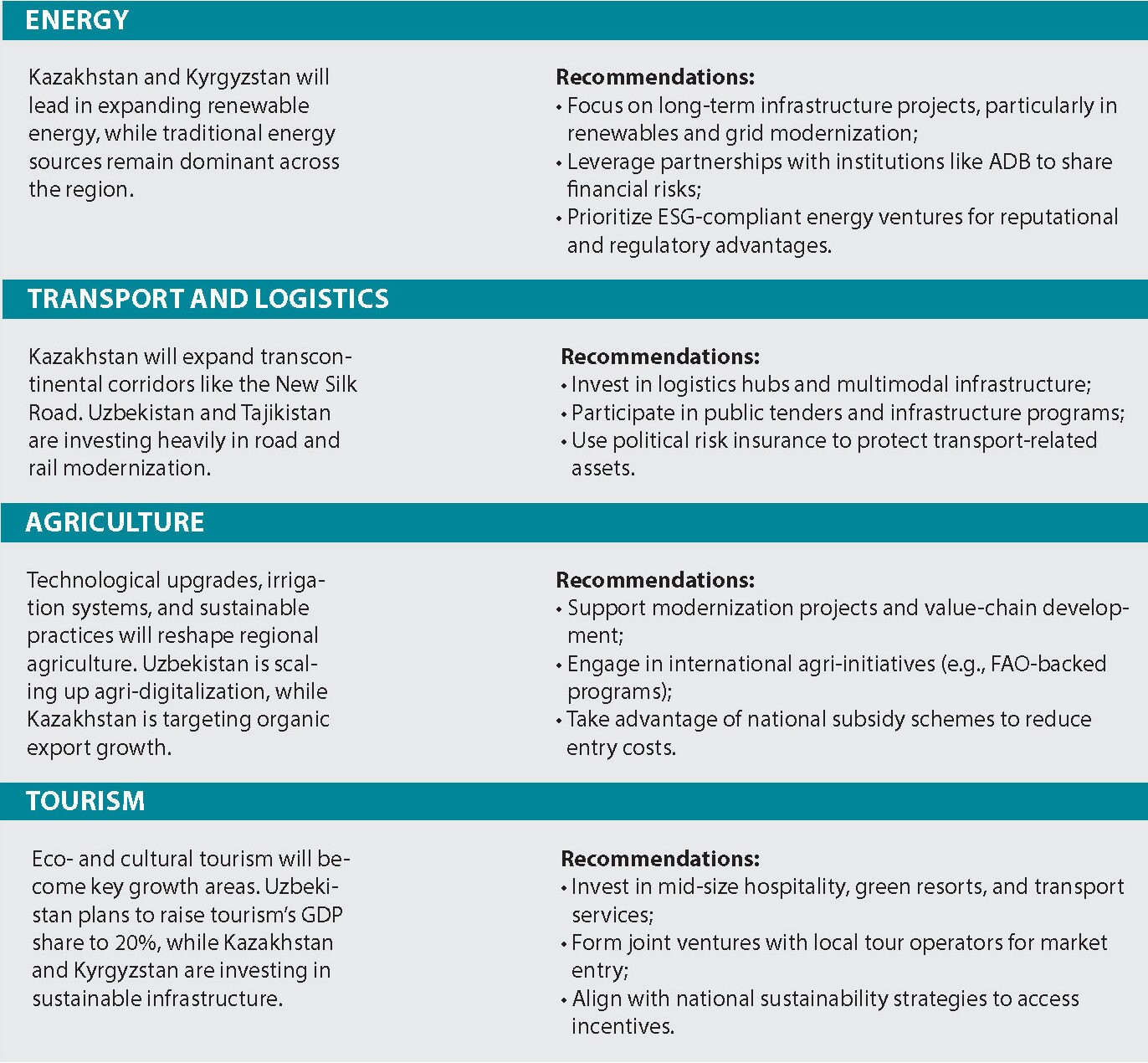

Central Asia is set to maintain its appeal as a long-term investment destination, supported by its natural resource base, strategic location, and multilateral institutional support. Four sectors are expected to drive regional growth in 2025 and beyond:

FINAL OUTLOOK

In 2025, Central Asia will continue strengthening its role as a strategic region for international capital. Energy, logistics, agriculture, and tourism will serve as the primary growth engines.

Kazakhstan and Uzbekistan are expected to attract the bulk of new investment thanks to ongoing reforms and logistical connectivity. Kyrgyzstan and Tajikistan will focus on infrastructure modernization and sustainable development. Political instability and ecological risks will remain key challenges, but with a well-planned risk strategy, the region offers significant long-term potential.

By Robert Gubernatorov

___________________________________________________________________________________________

PHOTO: VELIRINA / SHUTTERSTOCK, PHOTO: MATYAS REHAK / SHUTTERSTOCK, PHOTO: WORAWIT_J / SHUTTERSTOCK.

WEJ MEDIAKIT- ENG

Stay Ahead with World Economic Journal — Anytime, Anywhere

Get full access to expert insights, global analysis, and exclusive features from every issue of World Economic Journal.

Download the journal on your preferred platform:

Google Play: WEJ on Magzter

Magzter Web: World Economic Journal on Magzter

- Apple App Store: World Economic Journal Magazine

Subscribe now and never miss an issue. Knowledge. Insight. Impact.

Available in Leading Digital Libraries Worldwide

World Economic Journal is not only available through major digital platforms — it is also part of hundreds of public, academic, and institutional digital libraries across the globe.

You can access the journal through:

London Public Library, Toronto Public Library, ZINIO-powered U.S. and Canadian networks

British Council Libraries, Universities such as Southampton, Leeds, and DuPage

Major city libraries in Washington, Chicago, Philadelphia, Houston, Los Angeles, Berlin, Tokyo, Illinois, Switzerland, Malta, Johannesburg — and many more.

We are proud to be present in the global knowledge ecosystem — from government research centers to digital reading networks in over 70 countries.

If your institution has a digital library, World Economic Journal is likely already there.