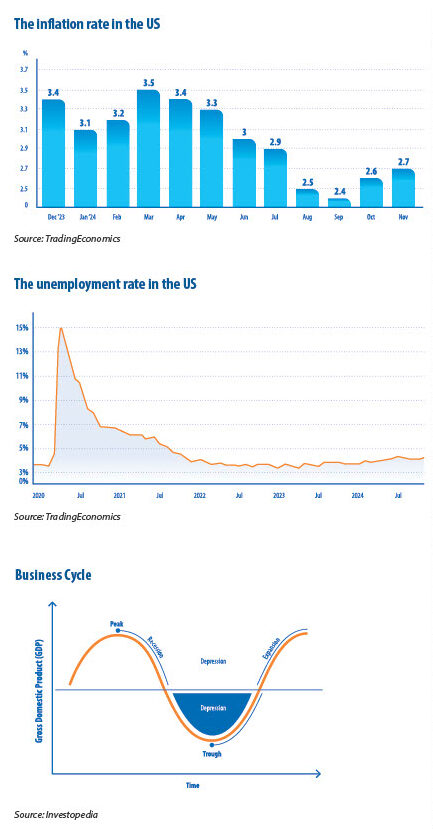

The key stock indices of the US are trading near all-time highs. The US interest rates are high as well. But many analysts expect the Fed to carry on easing its monetary policies. After all, the inflation rate is reasonably low, while the unemployment rate though not high, is not decreasing further. Some of the optimism, however, can also be attributed to Donald Trump’s election victory. What are the market’s expectations in relation to Trump’s presidential term? It is widely expected that Trump would bring jobs and industries that were relocated to China in the 2000s back to the US to create more jobs for US citizens. Trump also promises to increase US oil production, cancel some regulations, and decrease US budget deficits. He plans to do so by creating more jobs and therefore increasing tax revenues.

US ATTRACTIVENESS FOR INVESTORS

The US currency, the USD, is the world’s reserve currency. In other words, most countries’ foreign reserves are nominated in US dollars.

Why is that? During World War II the US the Treaty of Bretton Woods was signed. Under the Bretton Woods agreement, gold was the basis for the USD. Meanwhile, other currencies were pegged to the USD. Even though the Bretton Woods system came to an end in the early 1970s under President Nixon who announced that the US would no longer exchange gold for the dollar, the USD is still considered as a good store of value and also as a medium of exchange in international trade.

This means that the demand for the US national currency is high and therefore its debt, the so-called US Treasuries, are bought by foreign investors. Moreover, the Fed is able to print more money to finance the US mounting national debt by issuing more dollars, while avoiding to make the US experience hyperinflation. This is due to the fact the USDs are exported abroad. In other words, many governments and foreign investors buy dollars in order to invest in US assets, to trade with other countries and to use the USDs to save money. In fact, residents of some developing countries where high inflation is recorded only keep their savings in foreign currencies, especially the USD, in order to protect their money from devaluation. That is why the dollar’s value does not depreciate as much despite mounting US government’s budget deficits and the Federal Reserve’s money printing. That is one of the main reasons why the US still has very high credit ratings issued by major credit rating agencies. Moody’s still maintains a top rating, AAA, for the US government. Fitch, however, changed its rating from triple-A to AA+, also a very strong one, in August 2023, joining S&P, which has had an AA+ rating since 2011.

But what are other fundamental indicators of the US economy and its leading sectors?

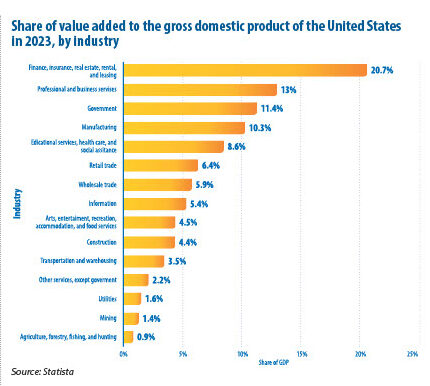

Most of the US GDP is due to the services sector. The top three industries powering the US economy are finance, insurance, real estate, rental, and leasing; professional and business services as well as the services provided by the government. Other industries, including manufacturing, construction and mining are not as important as the services sector for the US economy.

As concerns investors’ opportunities and what sectors of the US economy look particularly attractive, MSCI has defined 11 sectors (as can be seen from the table on the previous page) capturing different parts of the economy and equity market.

The sectors highlighted in green are considered to be good investment opportunities by MSCI’s analysts.

Four of them (energy, consumer staples, health care, and utilities) are defensive sectors, which means that they are less responsive to changes in the economic cycles (changes in economic growth). So which industries offer the most attractive long-term gains?

As the table shows, the four most attractive industries are health care, IT, financials, and energy. Health care is the most attractive industry thanks to the highest expected real earnings growth which even exceeds the IT sector. A lot of growth has recently been due to Eli Lilly (LLY) and Novo Nordisk (NVO), companies selling obesity drugs.

According to experts, utilities and real estate, meanwhile, are the two worst sectors that do not offer longterm returns. Despite their dividend yield that is about 4%, these two sectors have rather poor balance sheets. T hese two sectors heavily use debt to f inance their operations. Moreover, higher bond yields on their debt puts f inancial pressure on them.

Only five sectors have positive real earnings growth estimates. So, to summarize, analysts think that intangibles offer better returns than old and capital intensive sectors.

The four most attractive industries for investment are health care, IT, f inancial and energy

The US economy is also famous for its high-tech sector. Information technologies and artificial intelligence seem to be investors’ top picks among all the industries included in the S&P 500.

However, we should also mention that the most popular sectors and companies are also the most overvalued ones.

For example, the Magnificent 7, consisting of Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA (NVDA), Alphabet (GOOGL), and Tesla (TSLA) has been accountable for 43.5% of the S&P 500’s growth in 2024.

The key risks investors, both domestic and foreign face are the following. First, the US interest rates are high and it is uncertain whether the Fed would ease fast enough to prevent recession in the country. The inflation numbers are reasonable but above the Fed’s 2% target, while the unemployment rate suggests the economy is sound.

So, the Fed may ease too slowly, thus provoking a recession soon.

When, unemployment is low, inflation is above the Fed’s target rate, it means the economy is overheated. When a country’s economy is overheated or is at the boom stage of the business cycle, it normally means that a recession may be close because after the peak stage there is traditionally a recession.

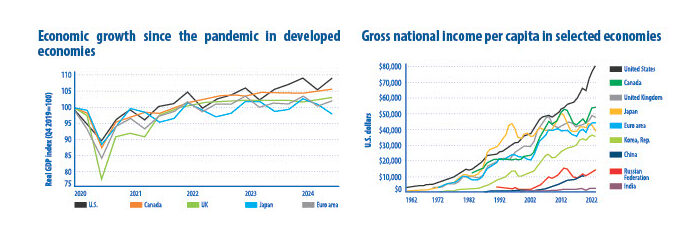

The US economic growth since the pandemic is somewhat higher than most developed economies’.

Gross national income per capita post-pandemic, meanwhile, is substantially above all the developed countries’.

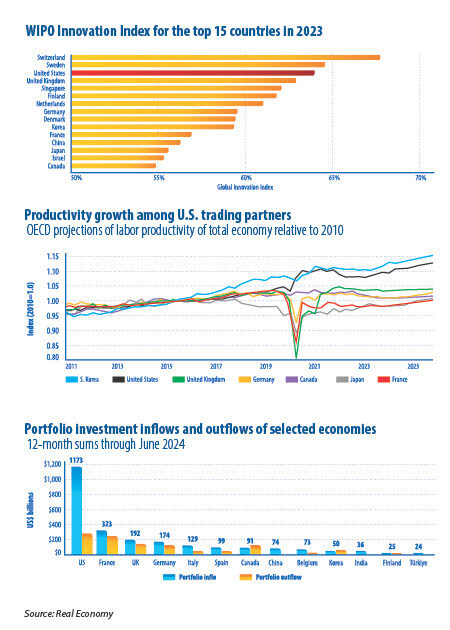

Also, the US was the third most innovative country after Switzerland and Sweden from the top 15 countries.

Moreover, the US is the second most productive country after South Korea.

Also, the US is the most attractive to invest capital in.

For 2025, the IMF expects the US economy to grow 1.9%, versus 1.7% for all developed economies.

China, meanwhile, is expected to post 4.5% growth this year and 4.7% in 2025, after expanding 5.4% last year. The euro area’s economy is only forecasted to expand by 1.2% this year and 1.3% next year, compared to 0.2% growth last year.

According to the International Monetary Fund, US gross fixed capital formation—a broad measure of investment—will increase by 4.5% this year compared to 2023, more than three times the rate for all developed economies. For the 2016-2025 period, the IMF forecasts that US investment growth will total 3.3% a year on average, versus 2.3% for other developed economies.

Germany’s investment spending, meanwhile, is projected to decrease by 2.7% this year, after dropping by 1.2% last year.

Interestingly, from 2006-2015, US investment spending was rising 1.2% a year, roughly just like the rest of the developed economies.

Another reason for the US greater economic potential is the US energy independence

The main reason for such a gap between the US and Europe is due to the US increased investment in software equipment and intellectual property, which has caused a divergence in the growth rates. But another reason for the US greater economic potential is the US energy independence. So, the money EU firms spend on energy is money that could otherwise have been spent on repairing factories and investing in software to boost productivity. According to the IMF September blog post, productivity rises by big US companies are the main reason why the US and Europe growth rates have diverged in recent years.

Now, let me talk to you about the US both public and foreign debts. The difference between the two is that public debt is the general debt which is obtained by the US government, and foreign debts are only those debts which the US owes to all the foreign countries and institutions.

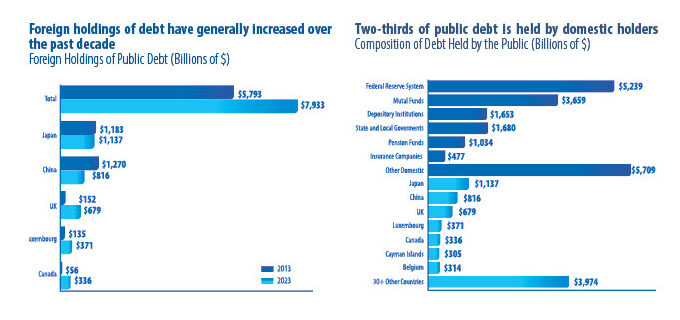

Both of these debts, as you can see from the graphs below are surging fast. T he US debt held by foreigners has increased from $5.793 trillion in 2013 to $7.933 trillion in 2023, while the country’s total public debt is above $36 trillion as of the time of writing. The US public debt is rising at a fast pace.

US FOREIGN DEBT

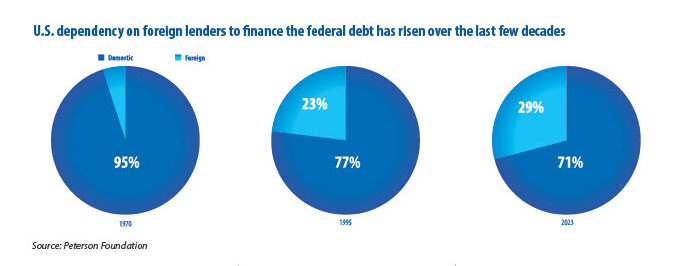

In 2023 two thirds of the US debt was held by the US companies, institutions and individuals, and one third was held by foreign residents and organizations.

But just over fifty years ago in 1970, just 5% of US-issued debt was held by foreigners. This means that the US government is more dependent on foreign capital.

US TOTAL PUBLIC DEBT

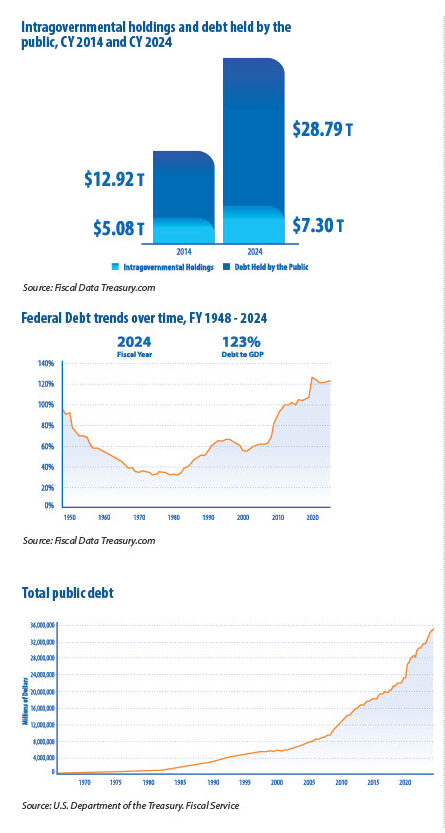

The reason why the US has such a high debt is due to its rising budget deficits. As I have mentioned in the beginning of this article, the gold standard under which the USD was tied to the price of gold was canceled by President Nixon in the 1970s. This allowed the US Fed to print more money to finance the US government’s surging expenditures. So, as can be seen from the diagram below, the US debt was negligible in the 1970s but has been mounting since then. It surged two times particularly dramatically, namely during the Great Recession in 2008 and in 2020 during the pandemic. This is due to the “helicopter money” that was made available by the US government to support the shattered economy during difficult times.

The diagram on page 28 compares calendar years 2014 and 2024, and displays the difference in growth between public debt and intragovernmental debt. Both debt types combine to make up the national debt. They have risen by different amounts in the past few years. One of the main causes of the public debt surge is increased funding of government programs and services during the coronavirus pandemic. Intragovernmental debt has not risen by much because it is mostly composed of debt owed on agencies’ excess revenue invested with the Treasury. The revenue of the largest investor in Treasury securities, the Social Security Administration, has not increased substantially in recent years, leading to this slower intragovernmental holding increase.

There are two major categories for federal debt: debt held by the public and intragovernmental holdings.

The debt held by the public has increased by 123% since 2014. Intragovernmental holdings have risen by 44% since 2014.

The US debt-to-GDP ratio is at the record highs since 1950 and is currently standing at 123%.

This debt rise is due to mounting government expenditures. The four main spending categories of the US government are Medicare (medicine, that is), social security (unemployment benefits, etc.), defense and interest on its debt.

The US has always been famous for its new technologies. The Silicon Valley, the country’s most important innovation place, has been house to startups, many of which have grown to become international corporations. The most active venture capital companies of Silicon Valley are Andreessen Horowitz, Accel Partners and Kleiner Perkins. These three companies have financed some of the most successful startups in the US, including Airbnb, Lyft and Twitter (X). Apart from financing, these firms provide their portfolio companies with mentorship that can support them in a rapidly changing high-tech world.

Venture capital is a form of private equity and a common source of financing for startup firms with high growth potential. Venture capital companies provide support through financing or mentorship. As their name suggests, venture capitalists are not conservative investors and are not interested in large sound corporations with long operational histories. Instead, its business involves investing in high-risk businesses in the hope to generate high returns. For example, one of the best US investments so far has been Amazon. Amazon raised $8 million from Kleiner Perkins Caufield & Byers, one of the VC firms I have just mentioned, in 1995. In 1997, Amazon went public to raise additional money. By 1999, the value of the Kleiner Perkins Caufield & Byers $8 million investment in Amazon created returns of over 55,000%. But not all high-tech companies so far have been as successful as Amazon. Investing in high-tech is very risky. T his was especially true during times of the Dot.com bubble. It was the time in the 1990s when both professional and amateur investors rushed to panic buy high-tech companies’ shares. Needless to say that most of these stocks were issued by highly mediocre companies and their stock prices did not match the companies’ fundamentals. In some cases, some of the shares were ridiculously overvalued. So, investing in companies just because they deal with innovations does not guarantee high returns.

Nowadays the most popular hightech giants are the Magnificent 7, namely Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. Their total market caps make a substantial proportion of S&P 500. According to Nasdaq, their proportion of S&P 500’s capitalization is about a third.

Many analysts forecast that generative artificial intelligence (AI), 5G expansion, internet of things, autonomous vehicles and green energy are just some fields that are predicted to grow in the next 5 years. High-tech giants, namely the whole Magnificent 7 but especially Nvidia, is subject to AI technologies growth. In fact, Nvidia has risen to the top of AI investments because it has become the building block on which AI models are built and trained. Its graphics processing units and the software that controls them, CUDA, are considered to be best of class. Big tech companies, including Amazon, Meta, Microsoft, and Alphabet are among Nvidia’s biggest clients, making up roughly 40% of its revenue. Also, autonomous vehicle companies, like Tesla, are significant customers of Nvidia too. Most of the Magnificent 7 firms are also linked with the internet of things sector. Tesla, meanwhile, produces EVs and solar batteries and aims to develop a fully autonomous vehicle. So, it has exposure to green energy and in the future could have exposure to autonomous vehicles.

TRUMP’S ELECTION

Trump’s key election promises included tax cuts for businesses, deportation of undocumented migrants and building a wall on the border with Mexico, sweeping tax cuts, making tips tax-free, abolishing tax on social security payments and shaving corporation tax.

Investing in companies just because they deal with innovations does not guarantee high returns

Mr. Trump has also proposed new tariffs of at least 10% on most imported goods, to cut the US trade deficit. Imports from China could be subject to additional 60% tariff. The newly elected President also promised to cut climate regulations and end the war in Ukraine.

In my view, even if these promises are kept, the effect of these measures on the US economy will rather be indirect but serious. To start with, the US-China relations will likely deteriorate following the tariff rise. However, the US-China confrontation will not only amount to only a new trade war escalation. In addition to rising tariffs on US goods in China and rising tariffs on Chinese goods in the US, the tensions around Taiwan would also rise. This is problematic for the US economy because a lion’s share of semiconductors is made in Taiwan. Semiconductors are a key component in electronics. They are used in televisions, computers, tablets, and smartphones. However, there is also demand for semiconductors in other industries, such as healthcare, transportation, communications, and military systems. 60% of the world’s semiconductors are due to Taiwan. This means that many industries in the US and other countries, including, military systems, transportation, healthcare and electronics will suffer from semiconductor shortages, which will lead to underproduction and higher consumer prices in these industries. So, the seriousness of the problem cannot be underestimated. Levying tariffs on Chinese goods will lead to higher US inflation numbers because many Western companies produce their goods in China. And if these imported goods still get imported to the US, they will be sold at much higher prices, thus leading to higher inflation numbers.

Deteriorating US-Mexico relations would likely also lead to higher tariffs between Mexico and the US.

If the US cuts its taxes, it would lead to even higher budget deficits that would in turn cause galloping inflation. As I have mentioned above, budget deficits lead to surging national debt. In order to service it, the Fed prints more money, thus pushing the USD supply and therefore inflation upwards. Obviously, higher inflation numbers will make the Federal Reserve tighten monetary policies soon. In turn, this may provoke a recession, thus negatively affecting consumers, investors and businesses. In addition, a trade war can add to poor investors’ and business expectations as well as stock market selloffs.

Mr. Trump also intends to bring US oil supply even further upwards. In order to achieve that, he plans to cut some of the climate regulations. However, I do not personally think that oil majors would automatically raise the oil production after that. Instead of raising output, it is the best for oil companies to strengthen their balance sheets and pay higher dividends to their shareholders.

As concerns Mr. Trump’s desire to stop the war in Ukraine, he has to somehow make Russia and Ukraine reaches a compromise and signs a peace agreement. This may not happen if any of the sides disagrees with the peace conditions. However, even if the peace talks fail, there is chance the US might supply fewer arms to Ukraine. Mr. Trump has recently told NBC News that Ukraine will likely receive less US aid once he officially starts serving as the US President. T his will lead to some form of agreement and therefore peace. Moreover, if the two sides reach a peace agreement, the collective West-Russia relations might get less tense than they are now. I do not personally think the sanctions will be canceled but the situation would not be as dangerous as it is now. At the very least, the risk of the World War III will not be as evident as it is now.

Another key issue under Donald Trump’s presidency will be de-dollarization of BRICS+ countries. Recently, Trump said he would require from BRICS countries to cancel their plans to create a new common currency. If they do not fulfill this requirement, they will face 100% tariffs during Mr. Trump’s presidential term. This simply means that BRICS’ countries goods will get two times more expensive for US consumers, which obviously means the demand for goods from these countries will substantially drop.

But still tariffs are not the only measure Trump’s administration can take to make the lives of BRICS+ members more difficult. Quotas, limits on the supply of imported goods, and an embargo on certain products, complete prohibition to import some goods, can also be applied to limit trade from BRICS+ countries, most notably China. The US has a very high trade deficit with this country and China can be substantially affected by these measures because it is the largest importing country to the US, even Mexico and Canada import fewer products to the US than China.

According to Trump, the BRICS+ members are trying to stop using the USD in international trade. Obviously, this is a threat to the USD as the world’s reserve currency. If many countries start trading in their national currencies or using a new common currency, other than the USD, the demand for the USD will fall substantially. That is why the US government will be unable to sell its debt abroad, while investors will be less willing to buy the USDs and invest them in American assets. That is why the US government will be unable to keep raising its debt to the extent it is doing now, while the Fed will not be able to print that much money without making inflation get out of control.

If the US cuts its taxes, it would lead to even higher budget deficits that would in turn cause galloping inflation

As concerns the global markets, they might not use the USD as often as they used to, following the BRICS+ de-dollarization. The BRICS+ members currently account for 35% of the global economy, based on the purchasing power parity indicator. Also, India and China are the biggest buyers of commodities, especially oil. So, commodities markets might slowly move away from the USD and non-BRICS countries might slowly switch to other currencies to hold in foreign reserves. Other currencies, including the Chinese yuan, might get more important for the global markets. Alternatively, a common BRICS+ currency can be created. It can be a digital currency or a cryptocurrency backed by gold.

BUT HERE IS WHAT SOME OF THE KEY EXPERTS SAY ABOUT THE FUTURE OF THE US ECONOMY UNDER DONALD TRUMP:

E&Y’s US economic forecast following Donald Trump’s victory

• “Solid income growth, pro-cyclical productivity growth and strong labor force participation remain the key pillars to the US economic outperformance. Selective consumer prudence in the face of high prices continues to drive disinflation, allowing the Fed to recalibrate monetary policy toward a more neutral stance. What appears to be unfolding before our eyes is a soft-landing scenario only the most optimistic dream of.

• Looking ahead to the next six months, we foresee consumers and businesses still spending but doing so more prudently amid still-elevated costs and rates. We continue to expect a bifurcated consumer spending outlook with lower-income households with larger debt burdens exercising more spending restraint while families at the higher end of the income spectrum still spending, albeit with more discretion.

• Factoring the changes to immigration, regulatory, trade and tax policy, we foresee minimal changes to the GDP growth, inflation and Fed outlook in 2025, but more pronounced changes to the 2026-27 outlook.

• In short, we foresee real GDP growth at 2.7% in 2024, easing toward trend growth at 2.0% in 2025 (marginally lower than previously), and 1.7% in 2026 (about 0.3 percentage points (ppt) lower than previously). In 2027, we foresee growth picking up modestly to 1.8% (about 0.2ppt lower than previously).

• We foresee headline CPI inflation closing the year around 2.4%, easing to 2.3% in Q4 2025 (marginally higher than previously) and 2.3% in Q4 2026 (about 0.3ppt higher than previously).

• We continue to expect a 25bps cut to 4.25-4.50% in December. T hereafter, we believe the Fed may decide to slow the recalibration process as policymakers more carefully feel their way to a neutral policy stance. Considering the elections results, we now assume a rate cut at every other meeting in 2025, for a total of 100bps of easing in 2025, down from 150bps previously. This would leave the federal funds rate at 3.4% at the end of 2025.”

Capital Economics’ forecast following Trump’s win:

• “For the US economy, a consensus is now forming that Trump’s re-election will result in stronger GDP growth fuelled by lower taxes and fiscal expansion. We’re not so sure. If nothing else, the absence of a f ilibuster-proof majority in Congress will make it harder for Trump to pass a very large package of tax cuts. More fundamentally, the US economy is now in a very different place to where it was during his first administration in 2016. The federal budget deficit is larger and the government debt burden is higher, meaning a major fiscal expansion would risk a strong backlash in the bond market. What’s more, even if Trump pressed on regardless, with the economy at close to full employment this would be more likely to generate faster inf lation than it would higher output.

• Indeed, while there remains enormous uncertainty about the policies that a Trump administration would enact (as well as when they might take effect), the common thread running through the president-elect’s campaign pledges is that they would be inflationary. Curbs on immigration, substantially higher tariffs and tax cuts (if they materialise) would all stoke price pressures. Accordingly, we are minded to add around 1% to our US inflation forecast between mid-2025 and mid-2026. We have also revised up our forecast for US interest rates by 50bps, and now anticipate that they will trough at 3.50-3.75% in this cycle. That means we now expect higher US government bond yields and a stronger dollar.”

In conclusion, Trump’s victory can have a substantial effect on the international relations, including global trade. However, the US might experience a recession due to too high interest rates, and the Fed not reacting to the economist slowdown fast enough. The key question regarding the US economic well-being remains the de-dollarization threat. If many countries move away from the US dollar, it will be a substantial problem for the surging US debt and the Fed’s inability to print more money without causing hyperinflation.

By Anna Sokolidou

PHOTO: DRAGOS CONDREA / ADOBE STOCK; PHOTO: DENNIS SCHROEDER / NATIONAL RENEWABLE ENERGY LABORATORY; PHOTO: MICHAEL PROBST / AP.

Stay informed anytime! Download the World Economic Journal app on the App Store and Google Play.

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal

https://www.magzter.com/publishers/World-Economic-Journal