The year 2024 has been full of economic and geopolitical risks. The conflicts in Ukraine, the Middle East, as well as uncertainty around US-China relations have been some of the key political risks. The BRICS+ expansion is also considered to be a risk to the US global dominance. Most developed countries’ economies, meanwhile, have showed signs of slowdown. The US Fed has got more dovish. Donald Trump’s victory is also considered to be a piece of good news for the US economy. So, most analysts expect a soft landing for the US economy. Let me explain what to expect for the coming 2025.

INFLATION

One of the key economic risks is broadly considered to be inflation, the gradual rise in the general price level. Even though moderate inflation is considered to be an absolute economic norm, uncontrollable inflation has always been one of the key risks to macroeconomic stability and one of the main causes of the poverty.

Traditionally, there are two types of inflation, namely the cost-push inflation—when prices rises due to rising costs of raw materials—and the demand-pull inflation—when consumer demand exceeds supply. However, another cause of inflation has traditionally been liquidity supply rising due to uncontrolled money printing by central banks.

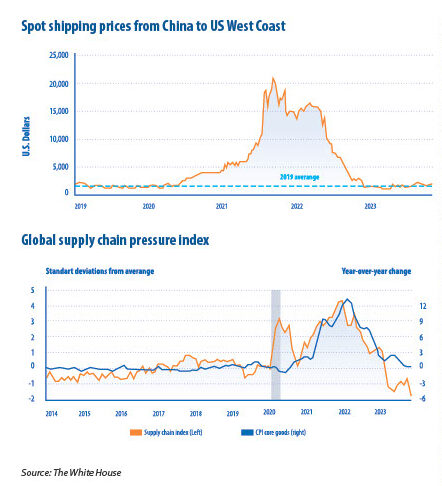

During the recent economic crisis, namely the 2020 coronavirus pandemic there were all three reasons for surging inflation. First of all, in order to prevent the economic crisis from getting out of control, many governments in developed countries organized excessive “helicopter money” to support their companies, banks, stock markets and ordinary households. To start with, the Fed, the ECB and the Bank of England all brought their interest rates to record lows. Moreover, the Fed and the ECB also started their quantitative easing (QE) programs. By this I mean they started buying back government bonds in order to fuel their economies with extra liquidity. Moreover, many businesses were also subsidized for not making their employees redundant. Citizens also got generous unemployment benefits. For example, in the US many households received social welfare checks in order to enable them to spend more. As a result, too much money ended up chasing too few goods, thus making the general price level go up. But it was not the end of the inflation story. As observed by the White House, during the coronavirus crisis, it became clear that global supply chains were turning insignificant shocks into macro-level consequences. For example, individual companies stopped operating due to coronavirus-related lockdowns. This created sectoral supply deficits that made the prices go up. This is especially true of the transportation and logistics industry. Supply chain disruptions and delays at ports led to record high prices for imports to the US during the coronavirus crisis. At their peak, spot shipping prices for containers coming from China to US West Coast ports surged to more than 1000% of their 2019 levels as can be seen from the graph below.

Shipping prices for containers coming from China to US West Coast ports surged to more than 1000% of their 2019 levels

You could see that there is a strong correlation between supply chains and inflation from the Global Supply Chain Pressure Index graph below. The index grew dramatically over the first year of the pandemic, touching its highest-ever level in April 2020, only to reach an even higher peak by December 2021. Since then, the index has decreased. Recent research estimates that sectoral supply chain bottlenecks were responsible for a substantial share of total observed US inflation from 2021 to 2022 (Comin et al. 2023, Giovanni et al. 2022). According to Santacreu and LaBelle (2022), supply chain disruptions during the lockdowns were a large component of cross-industry inflation for producers.

But what did higher inflation readings lead to? Well, they led to extra expenses for consumers, companies and the government. In order to cope with the rising prices, everyone has to spend more. At the same time, the incomes might not rise proportionally with prices. For example, companies selling goods might face higher raw material costs but their customers might be unwilling to pay for the extra expenses. T he same is true of employees. They might face higher living costs but might not necessarily start receiving higher salaries from their employers. Uncontrolled inflation makes planning more difficult. When this happens, not just companies but also governments do not know exactly how to plan their budgets. For example, the government does not know by how much to raise taxes and by how much to increase social benefits. Firms cannot accurately plan their expenses and estimate by how much to raise prices.

But most seriously affected by inflation, in my opinion, are consumers and savers. Consumers are unable to consume as much as they used to because their incomes do not rise proportionately with inflation. Savers’ deposits also do not cover rising inflation numbers. So, their real savings also decrease.

How do governments usually deal with rising inflation readings? Normally central banks play the key role here. They increase the interest rates and in some cases start quantitative tightening (QT) programs. These measures help take extra liquidity of the market, while decreasing consumer demand thanks to the lack of cheap credit. After the Covid-19 pandemic when inflation numbers surged, the Fed first stopped the quantitative easing (QE) program and started raising the interest rates.

Alternatively, governments fight cost-push inflation by imposing price controls and ensuring supply of key raw materials. This was the case in the 1970s after the oil crises, when the US established the Strategic Petroleum Reserve (SPR) of up to one billion barrels of petroleum. The SPR was set when President Ford signed the Energy Policy and Conservation Act (EPCA) on December 22, 1975. Before that wars in the Middle East made the US and many other Western countries experience oil deficits. Poor fuel supplies made the general prices surge in the countries concerned. In order to somehow prevent such situations from happening, the SPR was established. This proved as an effective measure. But in addition to that, the US government also financed additional drilling or fracking to increase the country’s oil production. T his did not only prevent the US from fuel deficits, it also helped decrease inflation readings.

But if we take inflation levels in developed countries and compare these to developing countries, we will see that developing economies have substantially higher inflation numbers. However, in the EU and the US the target inflation rate is fixed at 2%, which is an average reasonable inflation level. However, other countries where inflation is a much bigger issue, For example, the central bank of Türkiye set a target inflation rate of 5%. But its 2023 inflation rate totaled a whopping 64.77%. A higher inflation target is set in Türkiye compared to developed economies due to the structural transformation in Türkiye in the recent years as well as history of high inflation readings.

The EU has traditionally experienced periods of low inflation due to its low economic activity. In other words, the EU’s GDP growth has been low for a while and before the stimulus measures the ECB took during the Covid-19, the EU’s inflation readings have been very moderate and even below the 2% target range.

As concerns the US, due to the fact the US dollar is still the world’s reserve currency and also a medium of exchange, the demand for America’s national currency is high. Therefore, the US avoids a situation when too much liquidity circulates in its economy. That is one of the reasons why inflation readings do not get out of control.

CLIMATE CHANGE

Climate change, sustainability and the “green agenda” are one of the most popular topics discussed during intragovernmental meetings and in international organizations. As the UN’s Secretary-General António Guterres pointed out in September, “the climate emergency is a race we are losing, but it is a race we can win”.

According to the UN, “rising temperatures are fueling environmental degradation, natural disasters, weather extremes, food and water insecurity, economic disruption, conflict, and terrorism. Sea levels are rising, the Arctic is melting, coral reefs are dying, oceans are acidifying, and forests are burning. It is clear that business as usual is not good enough. As the infinite cost of climate change reaches irreversible highs, now is the time for bold collective action.”

- One of the main challenges highlighted by the UN are rising global temperatures.

Glaciers in Northern regions are already melting at a record fast rate, making sea levels rise. Almost two-thirds of the world’s large cities are based in areas at risk of sea level rise and almost 40% of the global population live within 100 km of a coast. If no measures to change the situation are taken, entire districts of New York, Shanghai, Abu Dhabi, Osaka, Rio de Janeiro, and many other cities could sink the next few decades, thus leaving millions of people without a shelter.

The last several years marked with record high temperatures. According to a September 2019 World Meteorological Organization report, we are at least one degree Celsius above preindustrial levels and close to “unacceptable” temperatures. The 2015 Paris Agreement on climate change recommends holding eventual warming below at least two degrees Celsius. But if the world does not slow emissions, temperatures could increase to above 3 degrees Celsius by 2100, causing damage to the environment. The Paris agreement is among the most important international incentives to battle climate change. After years since its entry into force, low-carbon solutions have become more common. More and more countries and companies are setting carbon neutrality targets. Zero-carbon solutions are getting more competitive across economic sectors accounting for 25% of emissions.

We are at least one degree Celsius above preindustrial levels and close to “unacceptable” temperatures

- Another cause for concern is food and water insecurity.

Global warming affects everyone’s food and water security. Climate change is due to soil erosion, which limits the amount of carbon the earth is able to contain. About 500 million people nowadays live in places affected by erosion. Meanwhile almost 30% of food is lost as a result. In addition, climate change limits the availability and quality of water for drinking and agriculture.

Obviously, substantial amounts of crops are lost as a result of water deficits. Global warming is likely to the wealth gap between the world’s richest and poorest countries grow wider.

- New weather extremes are also a cause for concern for the UN.

Natural disasters and weather extremes have recently become more frequent. 90% of disasters are considered to be weather- and climate-related, costing the world economy 520 billion USD each year. As a result, 26 million people are pushed into poverty.

- Also worth noting that climate change is a catalyst for conflict.

It raises competition for resources such as land, food, and water, thus raising social tensions.

Climate is a risk factor that makes already existing problems even worse. For example, poor water supplies in Africa and Latin America lead to political unrest and violence. According to the World Bank, in the absence of action, more than 140 million people in Sub-Saharan Africa, Latin America, and South Asia will have to leave their homes by 2050.

- Among the available solutions the UN proposes changing ways to grow food, use land, transport goods, and power our economies.

Among the proposed solutions are renewable energy, which is in some cases now the cheapest energy source. Also, the UN suggests making electric cars mainstream to decrease pollution.

Nature-based solutions, recommended by the UN to tackle climate change include “improved agricultural practices, land restoration, conservation, and the greening of food supply chains”. These measures would allow the world’s population decrease carbon footprint while also keeping vital ecosystem features, namely biodiversity, access to fresh water, improved livelihoods, healthy diets, and food security.

Among additional measures taken to battle climate change are CO2 emissions taxes. For example, in Germany as of 2021, there is CO2 pricing for the heating and transport sectors. Via the national CO2 emissions trading regulated in the Brennstoff-Emissionshandelsgesetz (BEHG, Fuel Emissions Trading Act), greenhouse gases emitted from heating and transport will have to be paid for. The German government will reinvest the income from CO2 emissions taxes in climate protection measures.

Also, in China the concept of a circular economy is highly popular. It involves encouraging of reducing, re-using and recycling. This means improving efficiency, where the input of resources is reduced, while output levels are raised. This leads to less production and therefore lower CO2 emissions. Obviously, this also leads to battling climate change.

TECHNOLOGICAL REVOLUTION

• Artificial intelligence seems to be the key change of 2024 and beyond. Every business sector has been affected by AI. It seems likely to me that in 2025 the trend will continue. Even more advanced and specialized AI applications will be available to both businesses and individuals. Two types of AI, namely Generative AI and Conversational AI, are expected to see substantial expansion and refinement.

Generative AI is used in many different industries, including healthcare. In medicine it is used to improve patient experiences and analyze large amounts of data. In supply chain optimization, Generative AI identifies patterns and trends and forecasts future insights.

Conversational AI, on the other hand, is significantly affecting the e-commerce, healthcare, and banking sectors. It is starting to properly understand and respond to human speech. In medicine AI can help in transcribing patient experiences and encounters.

Artificial intelligence seems to be the key change of 2024 and beyond

In 2025, we are likely to see even more advancement in natural language processing and machine learning, which will improve organizations’ working processes to make them more productive.

All looks fine so far. But how would AI impact the employment market? As I have mentioned above, AI can understand and respond to human speech and it can generate new content, including texts and images. Even though AI is not quite as creative and intellectually flexible as a human brain just yet, in some working processes it can even now replace human employees. For example, applications like Chat GPT generate reasonable quality content. It can write summaries, rewrite texts in different words and generate translations. However, some editorial work is often needed to improve the content’s quality. But companies do not need to employ as many copywriters and translators as they did before. So, it is likely that many text professionals will face redundancies in the near future, in my opinion. Likewise AI is able to generate attractive and original images. This means that many designers may also lose their jobs. These are just few examples of how different professional can be made redundant. Obviously, lower employment numbers mean higher economic and social risks, including lower consumption and higher levels of social discontent.

At the same time, AI can also create new jobs. Professionals able to operate AI apps will become more employable. But overall, in my view, there will be fewer intellectual jobs available on the market.

• Another key trend of 2025 will likely be cybersecurity growth.

The importance of Internet of Things (IoT) security, particularly due to the expanding network of connected devices has risen greatly in 2024 and will only grow in 2025 and beyond. T here will be growth and development of more sound, standardized security protocols for the Internet of Things devices.

With this technology trend, companies would strengthen their cybersecurity investments and enforce effective strategies. But in order for them to be able to do so, they will have to employ more personnel to keep up.

• Software development in 2025 will only continue.

The year 2024 was significant for the growth of software development, driven by several key factors. Advanced technologies such as AI, machine learning, and cloud computing have already created new opportunities in software development. This trend allows developers to consistently innovate and improve their skills.

Many companies now employ expert machine learning and artificial intelligence engineers with knowledge and understanding of the industry who can quickly deliver high value. The demand for ML/AI engineers is set to increase by 40% from 2023 to 2027. Besides ML/ AI engineers, more software developers and DevOps engineers will be employed. In fact, the US Bureau of Labor Statistics says there will be a 26% growth in the demand for software developers in the next decade. So, more jobs opportunities for high-tech experts will become available.

• Industry Cloud Platforms.

In 2024, industry cloud platforms grew rapidly, marking a milestone in how businesses deal with cloud computing. These platforms are indeed different from traditional cloud services. They offer solutions tailored to specific industries, including but not limited to healthcare, finance, manufacturing, and retail. This growth trend is fueled by the necessity to address industry challenges and requirements, including regulatory compliance and operational efficiencies. The industry’s growth trend will also attract more cloud engineers.

Overall, these new high-tech job opportunities will make more young people get information technology and similar high-tech degrees or take additional courses in artificial intelligence to improve their employability.

• Green energy.

Green energy is another big topic, which is getting popular even in developing countries. For example, China is working to decrease air pollution and also invests heavily to facilitate the circular economy concept to reduce emissions and increase sustainability. However, in the past the green energy agenda was typical of developed countries such as the EU and the US. As the concept gains popularity, it seems likely that the demand for green energy sources will only rise.

As a result, more jobs opportunities will be created. For example, the production of wind turbines and solar batteries will rise. So, more factory workers to produce them will be needed. At the same time, the world will move slowly from fossil fuels, thus making employees working in this area redundant.

SOCIAL INEQUALITY

Here is the IMF’s outlook regarding economic growth and growing social inequality: “The global economy is stuck in low gear, which could deal a major blow to the fight against poverty and inequality”.

Group of Twenty finance ministers and central-bank governors gathering this week in Rio de Janeiro face a sobering outlook. As the IMF’s latest World Economic Outlook update shows, global growth is expected to reach 3.2 percent this year and 3.3 percent in 2025, well below the 3.8 percent average from the turn of the century until the pandemic. Meanwhile, our medium-term growth projections continue to languish at their lowest in decades.

To be sure, the global economy has shown encouraging resilience to a succession of shocks. The world didn’t slip into recession, as some predicted when central banks around the world raised interest rates to contain inflation.

Yet, as we move beyond the crisis years of the pandemic, we need to prevent the world from falling into a prolonged period of anemic growth that entrenches poverty and inequality.

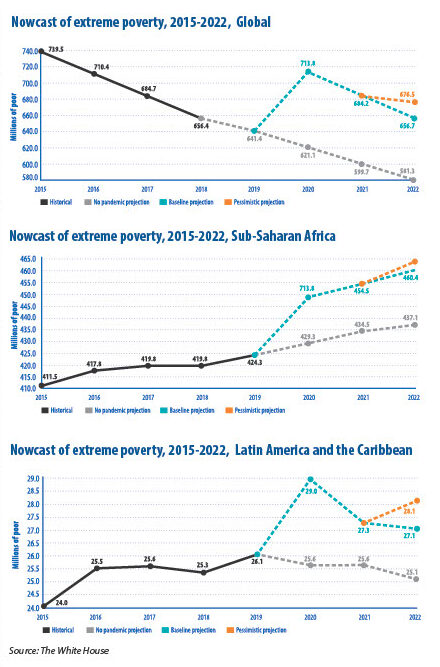

The pandemic already set back the fight. Extreme poverty increased after decades of decline, while global hunger surged and the long-term decline in inequality across countries stalled.

The pandemic already set back the fight. Extreme poverty increased after decades of decline

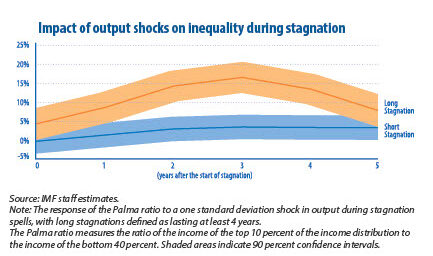

New IMF analysis suggests periods of stagnation lasting four years or more tend to push up income inequality within countries by almost 20 percent— considerably higher than the increase due to outright recession.

During periods of stagnation, sluggish job creation and wage growth increase structural unemployment and reduce the share of a country’s income f lowing to workers. Together with limited fiscal space, these forces tend to widen the gap between those at the top and bottom of the income ladder.

In other words, the longer we’re stuck in a world of low growth, the more unequal that world would become. That in itself would be a setback to the progress we’ve made in recent decades. And as we have seen, rising inequality can foster discontent with economic integration and technological advancements.”

So, based on the IMF’s outlook, we will face slower economic growth, and more social inequality. But more affected will be developing countries. During the pandemic these countries’ poverty only got more stunning.

Most heavily affected was the Sub-Saharan Africa region. The numbers of the poor were surging during the pandemic and post-pandemic.

Also, in Latin America the number of the poor surged substantially.

At the same time, the number of the rich surged substantially during the coronavirus crisis.

About $42 trillion in new wealth was created in the first two years of the pandemic. Two-thirds of that amount has made even wealthier the richest 1% of the world’s people, according to a report out Monday from the nonprofit organization Oxfam. In the US, billionaires are a third richer now than they used to be before the coronavirus lockdowns.

According to Elise Gould at the Economic Policy Institute, “So much of what typical people in the US have is based on their income and what they make in the labor market,” said. “But that’s not the case for the superwealthy”, she said.

That is because those at the very top of the wealth hierarchy are making successful investments in real estate, in companies, in the stock market, all of which have gone up in value during the pandemic simply because they have the money.

As mentioned by Molly Kinder at the Brookings Institution, “the stock market boomed through 2021”… “Companies did extremely well. They benefited from [Federal Reserve] policy, from low interest rates, from big government spending.” Obviously, when large businesses did extremely well, so did the very rich who had their money invested in them.

“And that’s because the bulk of stock in this country, of shares, are owned by the wealthiest households. Upwards of 70% of all stock is owned by just the top 5% of richest households,” she said.

So, to conclude, if there is a serious economic crisis in 2025, the rich will only get richer and the poor will only get poorer. Stagnation expected by IMF in the next few years will not decrease social inequality. As a result, social discontent will intensify. Most affected countries will be more likely to face social unrest. International organizations, including the UN, do not play such a crucial role in fighting social inequality due to their inability to intervene too much in sovereign countries’ internal affairs. However, the UN aims to encourage “equal opportunities and reduce inequalities of outcome, including by eliminating discriminatory laws, policies and practices and promoting appropriate legislation, policies and action in this regard.” At the same time, the UN can only recommend such measures but cannot take them instead of local governments. Local governments and businesses can do much more to eliminate extreme poverty. Businesses can create more jobs, while governments can pay social security benef its, improve medicine and access to education. Moreover, governments can pass new laws ensuring fair labor conditions.

By Anna Sokolidou

HOTO: DRAGUN3D / SHUTTERSTOCK; PHOTO: NIRUT SANGKEAW / ADOBE STOCK; PHOTO: RONNIE CHUA / SHUTTERSTOCK; PHOTO: CATALIN LAZAR / SHUTTERSTOCK; PHOTO: SUMMIT ART CREATIONS / ADOBE STOCK.

Stay informed anytime! Download the World Economic Journal app on the App Store and Google Play.

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal