AFRICA’S RECENT ECONOMIC OUTLOOK

Africa, a continent as large as China, Europe, India, and the United States, is characterized by immense geographic and demographic scale. The continent is also rich in natural capital, holding nearly 30% of the world’s mineral reserves, 12% of oil reserves, and 8% of natural gas resources. Africa accounts for 40% of global gold reserves and possesses the most prominent cobalt, diamonds, uranium, and platinum reserves. Additionally, 30% of the world’s rare earth elements, essential for semiconductors, batteries, and green energy technologies, are found in Africa, cementing its strategic role in the global value chain.

Many African nations have ratified international agreements like the Kyoto Protocol (1997) and the Paris Agreement (2016). Regional initiatives, including the African Union’s Agenda 2063, the Blue Fund, the Desert to Power project, and the Great Green Wall, reflect a growing commitment to environmental sustainability across the continent.

In 2024, Africa’s GDP growth was expected at 3.4%, rising to 3.8% in 2025, driven by easing inflationary pressures and global economic resilience. However, per capita growth remains modest, at 0.9% in 2024 and 1.3% in 2025, trailing behind the 2.4% annual growth achieved between 2000 and 2014.

AFRICA’S KEY INVESTMENT INDUSTRIES

Agricultural Sector

Addressing poverty in Africa remains one of the most pressing global development challenges, with agriculture playing a pivotal role in driving meaningful change.

According to the World Bank report, agriculture:

• Employs 65-70% of Africa’s workforce and serves as the primary economic activity for over 70% of the continent’s rural poor.

• Contributes 30-40% to Africa’s GDP. Despite its critical importance, food insecurity in sub-Saharan Africa has risen since 2015, driven by global disruptions, regional conflicts, and economic instability.

In addition to global shocks, Africa faces significant structural and productivity challenges:

• Growth Rate: Agriculture grew by 4.1% (2000–2020) compared to:

2.7% worldwide

3.5% in East Asia and the Pacific

2.6% in Latin America

3.0% in South Asia

• Fertilizer Usage: Africa consumes 22 kg/ha of nutrients, compared to 278.6 kg/ha in East Asia and the Pacific.

• Irrigation: Less than 10% of Africa’s agricultural land is irrigated, compared to over 40% in Asia.

• Productivity Gap: Agricultural productivity in Africa is up to one-third lower than in Asia and Latin America.

• Food Insecurity: Nearly 300 million people in Africa are projected to be at risk of famine by 2025 (AfDB).

Regardless of these challenges, Africa has immense potential to become a global leader in agricultural production:

• Abundant Land: Africa accounts for 45% of the world’s land suitable for sustainable agriculture, surpassing Latin America’s 28%. Two-thirds of this land is concentrated in eight countries: Angola, the Democratic Republic of Congo, Madagascar, Mozambique, South Sudan, Sudan, Tanzania, and Zambia.

• Untapped Water Resources: Only 2-3% of Africa’s renewable water resources are utilized, compared to the global average of 5%.

• Competitive Labor Costs: Africa’s labor costs are among the lowest globally. Minimum wages in Thailand are 2-3 times higher than in Ghana and 1.6-2.2 times higher than in Senegal.

TRADITIONAL ENERGY RESOURCES: OIL AND GAS

According to Statista, the continent holds around 12% of global oil reserves and 8% of natural gas resources, with major producers including Nigeria, Angola, Libya, and Algeria.

Oil is essential for transportation and industry, particularly in economies like Nigeria, where it is a primary revenue source. It also plays a key role in global trade, with countries like Nigeria and Angola significant exporters.

Natural gas is increasingly essential for both domestic use and export. Countries such as Algeria, Mozambique, and Egypt use natural gas for power generation and expand export capabilities. Seen as a cleaner alternative to coal, natural gas helps reduce emissions while supporting economic growth.

“It is time to look beyond traditional meaning of nutrition in terms of quantity of what is consumed and instead look at nutrition as the quality of what we eat, trade, and general recognition of nutrition and health,” said Dr. Agnes Kalibata, AGRA President

RENEWABLE ENERGY SECTOR

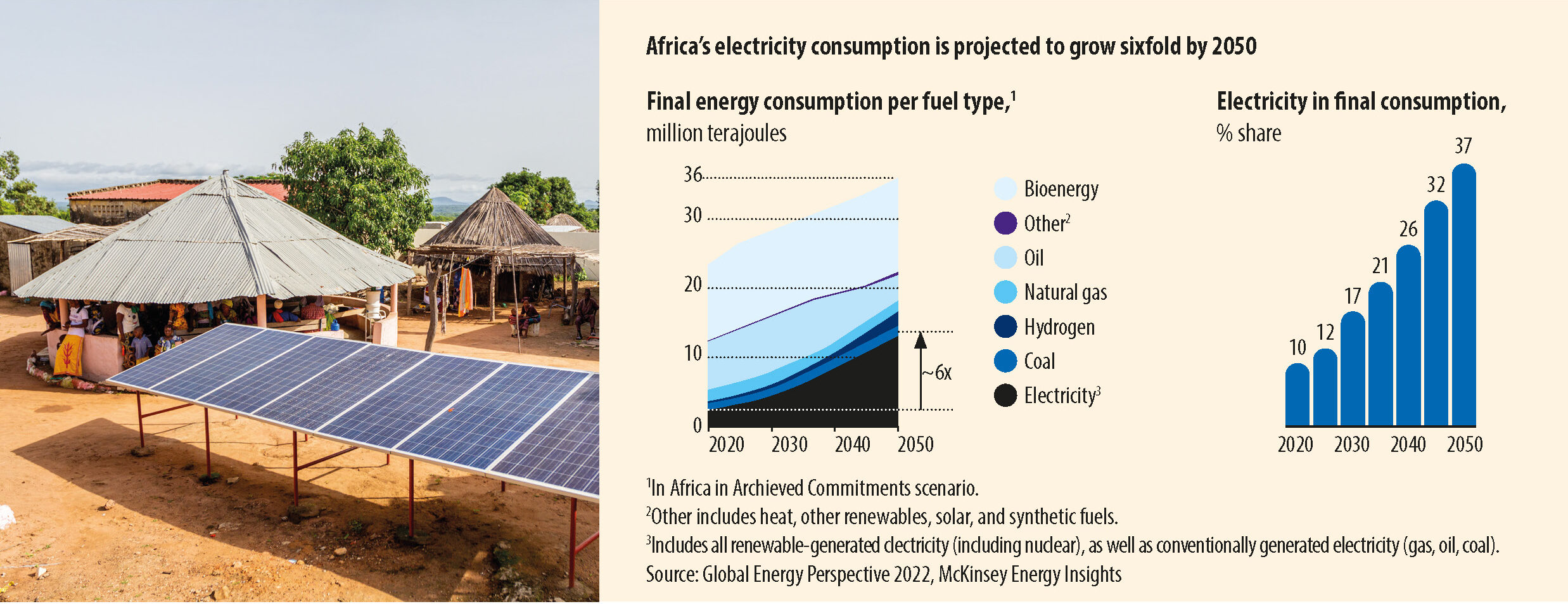

Africa’s energy needs are projected to double by 2050, driven by rapid population growth and industrialization.

Currently:

• 600 million people lack access to electricity, a figure projected to reach 1.2 billion by 2050.

• 920 million people lack clean cooking facilities, with numbers expected to rise to 1.8 billion by the same period.

According to the Africa Energy Review 2024 by PwC, several African nations have made significant progress in renewable energy development:

• Solar Energy: Egypt, Morocco, and Namibia lead large-scale projects such as the Benban Solar Park.

• Wind Energy: Kenya’s Lake Turkana Wind Farm supplies over 75% of regional renewable electricity.

• Hydropower: Ethiopia, the Democratic Republic of Congo (DRC), and Uganda rely heavily on hydropower, with projects like the Grand Ethiopian Renaissance Dam playing a central role.

• Geothermal Energy: Kenya and Ethiopia are pioneering using Rift Valley geothermal resources.

“Africa is entering a period of truly staggering change,” said Edward Paice, the director of the Africa Research Institute in London and the author of “Youthquake: Why African Demography Should Matter to the World.”

• Bioenergy and Ocean Energy: These remain untapped resources with substantial potential for sustainable energy production.

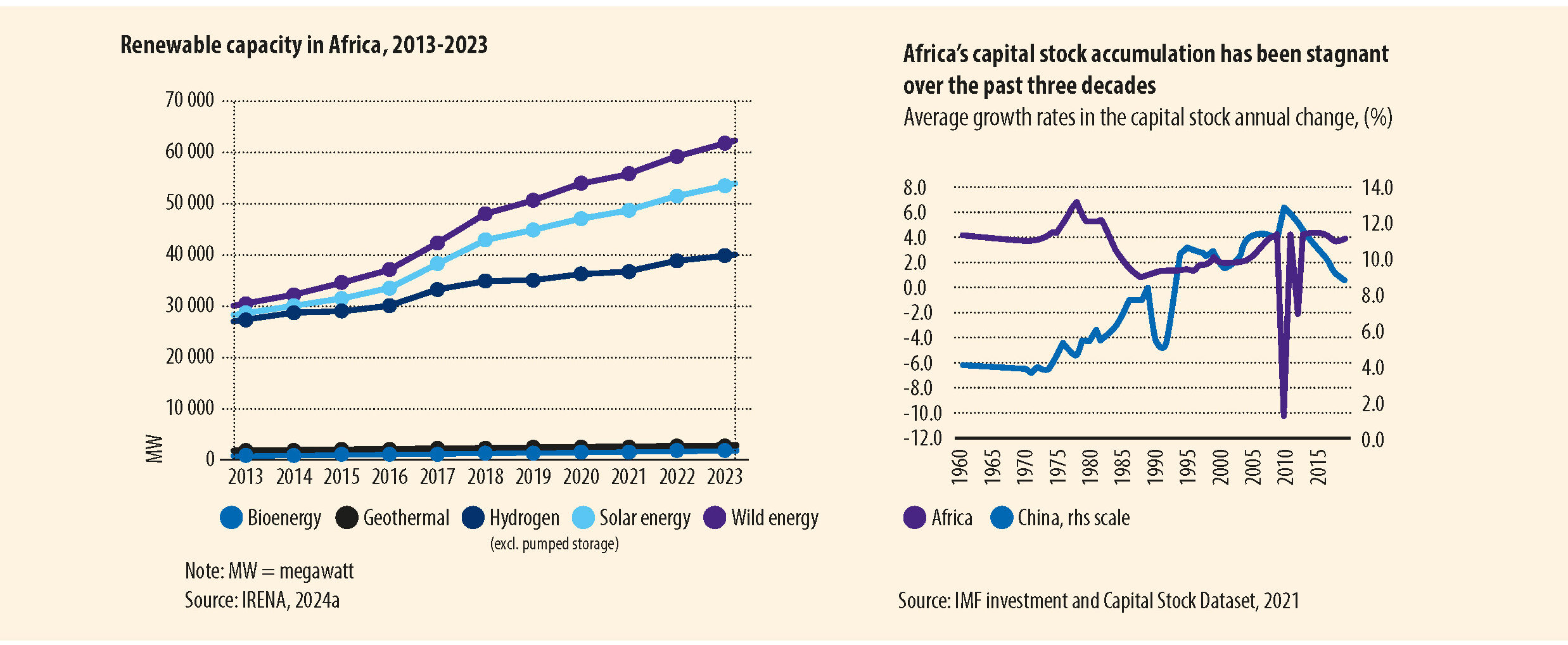

As of 2023, Africa’s electricity generation capacity reached 256 GW. However, despite accounting for 20% of the global population, the continent represents just 4-5% of global electricity capacity. Renewable energy contributes 23% of Africa’s total power capacity, with hydropower dominating due to its historical importance.

Over the past decade, renewable energy growth has surged:

• Solar photovoltaic (PV) energy grew by an average of 44% annually.

• Onshore wind energy achieved an average annual growth rate of 21%.

These gains have been primarily driven by large-scale solar and wind installations, which have doubled Africa’s renewable power capacity in the last ten years.

INFRASTRUCTURE AND TRANSPORT

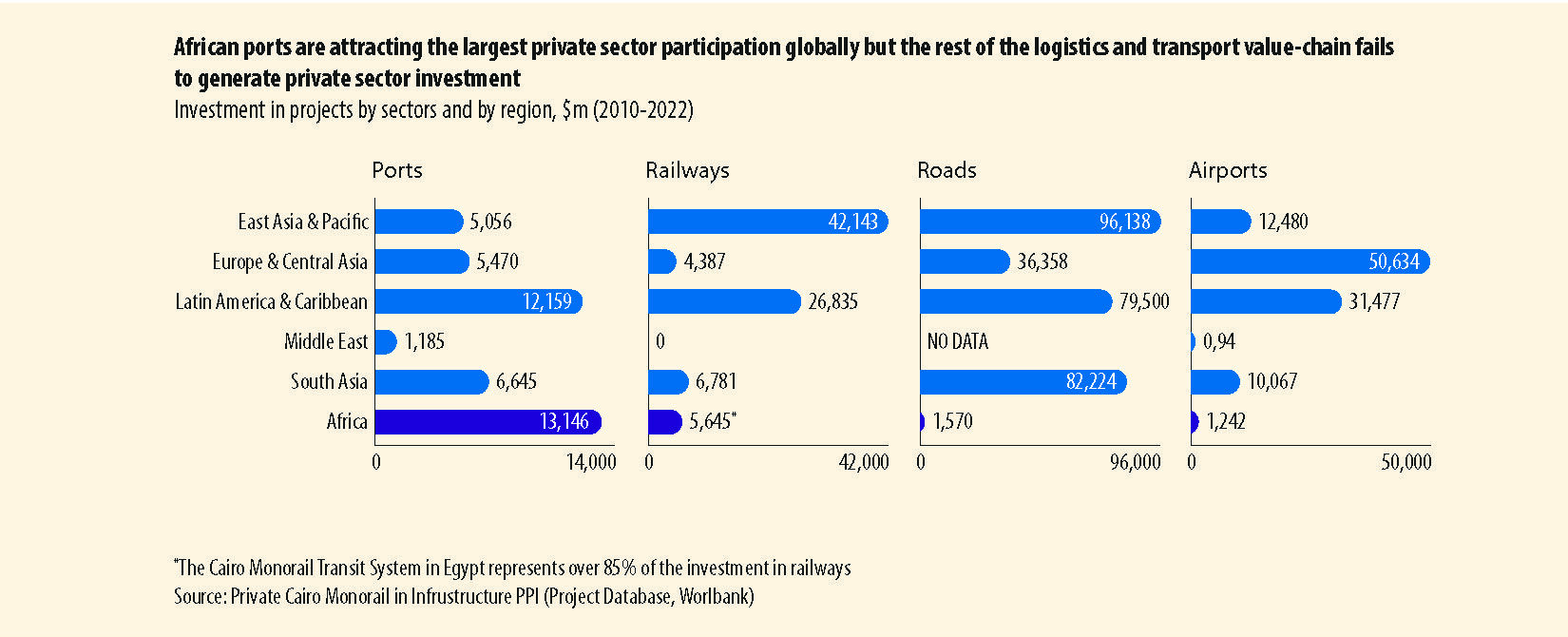

Despite these sectors’ critical role in driving economic growth and poverty reduction, Africa faces significant infrastructure deficits in sectors like energy, transportation, communication, sanitation, and housing.

Over the past three decades, capital stock growth has stagnated, with annual investment rates averaging 1–2% in the 1990s, rising modestly to 2–4% post-2000. In comparison, China maintained a 10% yearly growth rate, resulting in its infrastructure capital stock reaching $64 billion by 2019, far surpassing Africa’s $10.5 billion.

While ports have seen significant activity, railways, roads, and airports have struggled to attract even distribution, sufficient investment, and adequate maintenance. Roads, in particular, are vital for Africa’s economic and social development, carrying:

• 80% of the continent’s goods traffic

• 90% of passenger traffic

Moreover, research by the Africa Finance Corporation (AFC) highlights:

• Despite similar population sizes, Africa’s paved road network spans 680,000 km, six times smaller than India’s.

• South Africa and Algeria account for 40% of the continent’s paved road network.

• Although Africa occupies 20% of the world’s landmass, its paved roads comprise just 1.5% of the total global land area.

• Transport costs contribute up to 40% of the final price of goods in Africa.

Currently, Africa aims to improve connectivity between key economic and urban hubs. The Priority Action Plan (PAP) under the Programme for Infrastructure Development in Africa (PIDA) targets building 30,700 highways by 2040, with 16,066 km already completed since the early 2010s. A significant focus is finalizing the Trans-African Highway Network to boost regional connectivity.

AFRICA’S RISING APPEAL FOR GLOBAL INVESTORS

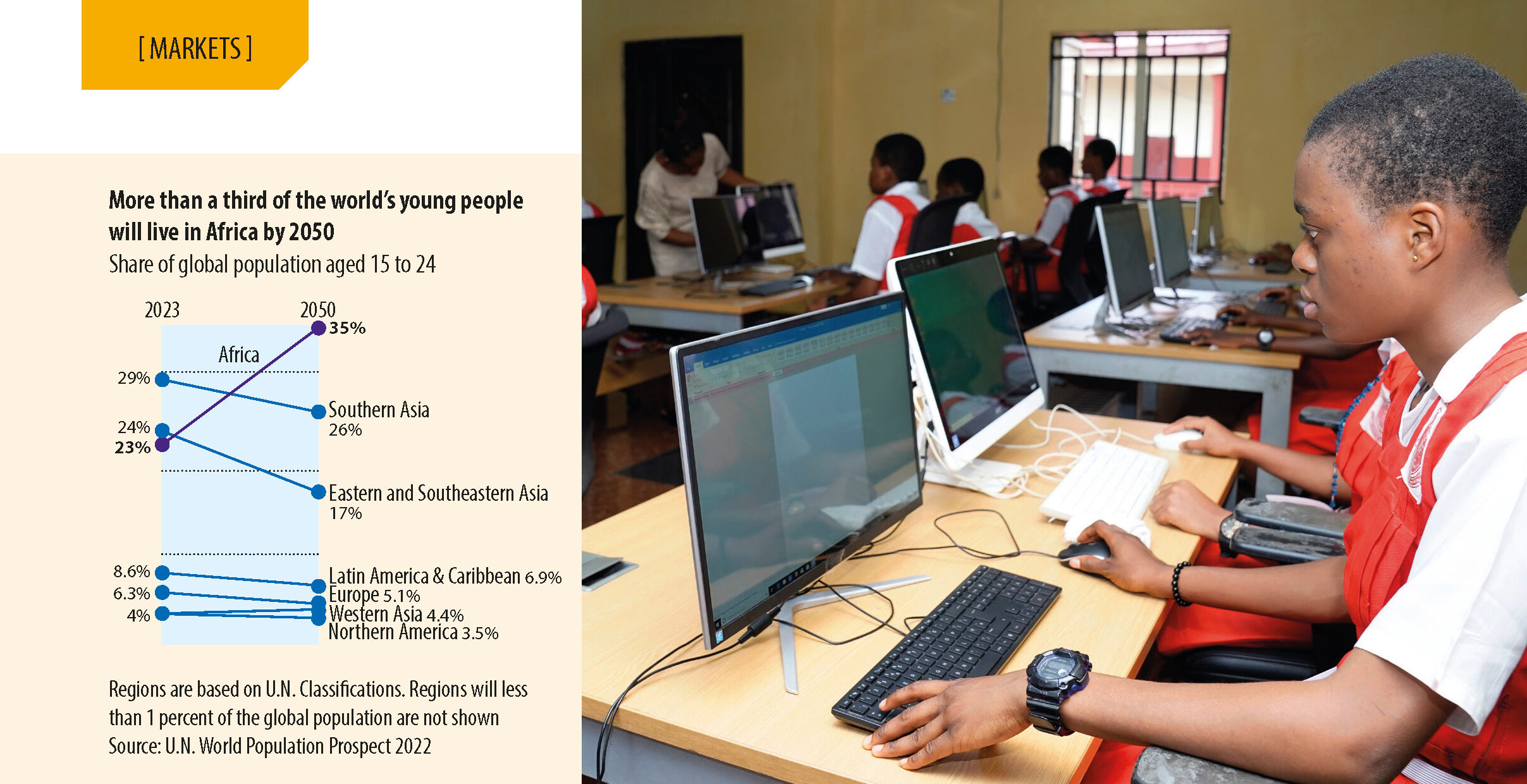

Africa’s Youth

Africa’s population is growing unprecedentedly, shaping the youngest and fastest-expanding demographic globally. According to United Nations forecasts, by 2050, they are projected to represent a quarter of humanity and at least one-third of all people aged 15 to 24. Currently, the median age on the continent remains strikingly young, at just 19.

Young Africans are now better educated and more digitally connected than ever before. In 2020, 44% of young Africans graduated from high school, up from 27% in 2000. Additionally, approximately 570 million Africans use the internet, reflecting the continent’s growing digital presence.

Despite progress in education, employment remains a significant challenge. According to the World Bank, up to 1 million Africans enter the labor market every month, yet fewer than 1 in 4 secure formal jobs.

Faced with limited opportunities, migration has become a standard escape route. Since 2010, over 1 million sub-Saharan Africans have migrated to Europe, according to the Pew Research Center.

Business Programs

Let’s take a look at the different international investment projects in the region.

Boost Africa

A joint initiative by the African Development Bank (AfDB) and the European Investment Bank (EIB), aims to drive Africa’s economic growth by empowering young entrepreneurs and fostering innovation.

The program focuses on:

• Enhancing entrepreneurship and innovation across Africa;

• Creating quality jobs for young Africans;

• Bridging the financing gap at the early and risky stages of enterprise creation.

The program targets sectors with high potential for social and economic impact:

• ICT

• Agribusiness

• Financial services and inclusion

• Healthcare

• Education

• Renewable energy

The initiative aims to leverage €1 billion in investments to support 1,500 SMEs and create 25,000 direct and at least 70,000 indirect jobs, with an estimated overall target size of around €250 million across its various components.

The Regional Network

A project supported by the European Union (EU) will serve as a platform to strengthen business incubation in Angola, Somalia, Ethiopia, and Madagascar. Its key objectives are to:

• Support entrepreneurship and grow micro-, small-, and medium enterprises (MSMEs);

• Create jobs for youth and women;

• Ensure inclusive access to markets and value chains;

• Promote knowledge sharing and collaboration among incubators.

Moringa Partners

Moringa Partners is an investment firm focused on sustainable agroforestry projects in Latin America and Sub-Saharan Africa. The firm targets profitable, large-scale agroforestry projects with high environmental and social impact. Moringa Partners has invested in various projects, including a wind farm in Kenya and solar power installations in South Africa, contributing to both energy access and economic growth.

RISKS AND CHALLENGES

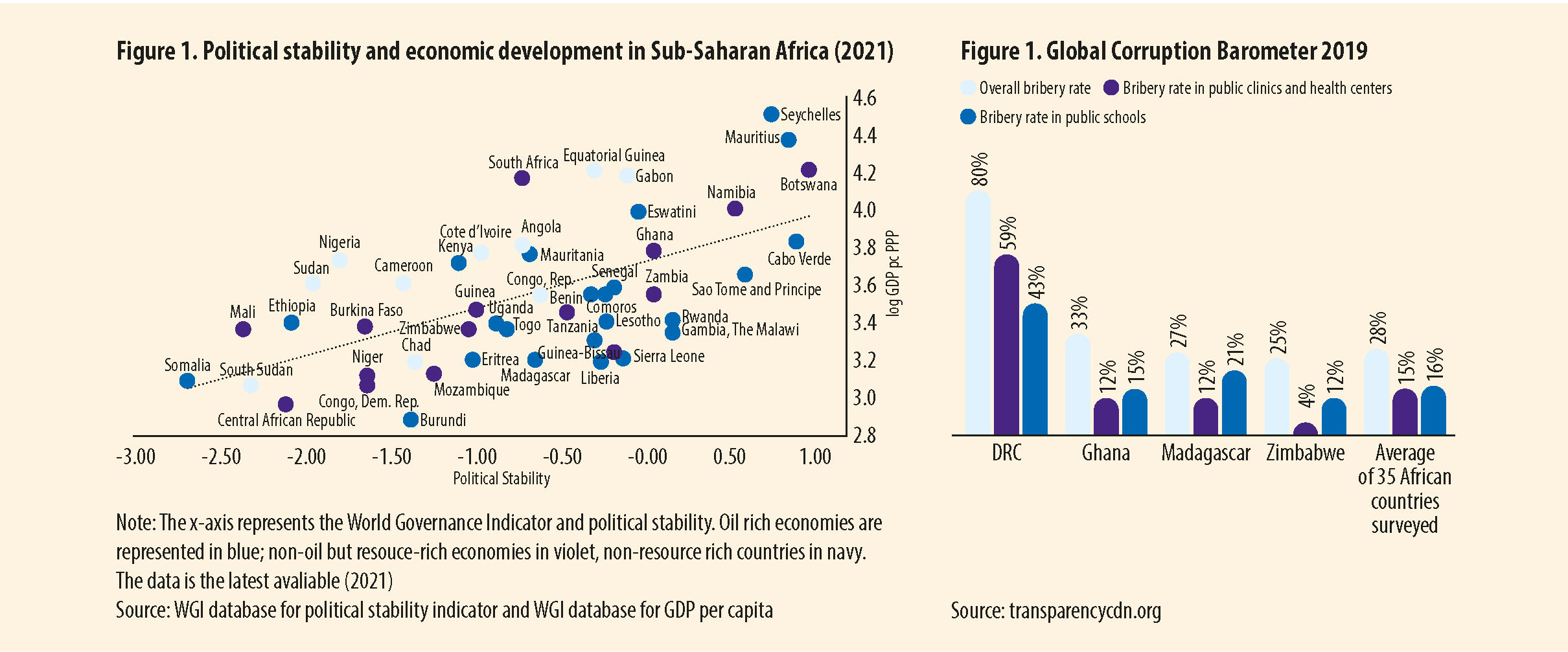

Political Instability in Africa

Political instability remains a persistent challenge across Africa, driven by a mix of democratic dissatisfaction, economic struggles, and military interventions. A wave of recent coups has weakened public confidence in democratic governance.

Since around 2015, a series of crises with primarily external origins—including plunging commodity markets, rising insecurity and extremism, the COVID-19 pandemic, authoritarian populism, and shifting geopolitical alliances—have exposed the fragility of democratic institutions and weak state capacities across much of the continent.

• South Africa: The ruling African National Congress (ANC) lost its parliamentary majority for the first time since 1994, driven by corruption scandals, economic challenges, and power cuts.

• Senegal and Ghana: Both nations are preparing for leadership transitions, with economic concerns and dissatisfaction driving key electoral issues. Border tensions with coup-affected neighbors Mali and Burkina Faso added to regional instability.

• Rwanda: President Paul Kagame secured a fourth term amidst ongoing criticism of his regime’s human rights abuses and suppression of dissent in 2024.

• Sudan: The civil war between the Sudanese Armed Forces and the Rapid Support Forces has displaced over 7 million people and killed around 10,000 despite limited international attention.

• Ethiopia: Prime Minister Abiy Ahmed’s push for an Ethiopian seaport has reignited regional tensions, especially with Somalia after an agreement with Somaliland raised concerns over sovereignty and territorial disputes.

Corruption Issues

Corruption remains a significant barrier to social development and equitable access to essential services in many African countries, particularly education and healthcare. Transparency International’s 2019 Global Corruption Barometer shows that corruption levels vary widely across sectors and countries, highlighting systemic challenges undermining progress.

Corruption in Education

• In some regions, access to schooling is contingent upon school fees, which are meant to cover operational costs, while additional financial barriers, such as payments for school materials, persist.

• Data from Global Findex indicates that 54% of adults in Sub-Saharan Africa are apprehensive about affording their children’s education.

• Among the five ISDA target countries, DRC recorded much higher bribery rates in education, while Madagascar also reported elevated levels.

Corruption in Healthcare

• The World Health Organization’s UHC Service Coverage Index highlights disparities in access to essential health services, including maternal care, infectious disease treatment, and non-communicable disease management.

• DRC and Madagascar scored below the African regional average for healthcare service coverage, while the other three ISDA countries performed above but still below the global average.

• The private sector is critical in filling healthcare gaps. In some regions, private providers deliver up to 35% of healthcare services.

“Given the evolving security landscape in Africa, and instances where United Nations peacekeeping missions may not be suitable, it is critical to recognize how African Union-led peace support operations, including enforcement actions, contribute to both regional and global peace and security efforts.”, said Fatima Kyari Mohammed, Permanent Observer of the African Union to the United Nations

PROSPECTS FOR 2025

Africa remains a region of immense economic potential, expected to host three-quarters of the world’s top 20 fastest-growing economies in 2025. Most African nations are expected to experience faster economic growth compared to 2024, underscoring the continent’s dynamism and resilience. These include Niger, Senegal, Libya, Rwanda, Côte d’Ivoire, Djibouti, Ethiopia, The Gambia, and Benin.

• Niger: Despite facing economic sanctions following a coup d’état in July 2023 and its subsequent exit from ECOWAS, Niger is projected to be Africa’s fastest-growing economy and the third-fastest globally. This growth is driven mainly by the oil industry, which, thanks to a 2,000-kilometer pipeline to Benin, is expected to contribute a quarter of the country’s GDP.

• Senegal: Following a period of political unrest—now resolved—Senegal is predicted to be Africa’s second- astest-growing economy. Its expanding hydrocarbons sector underpinned this growth, with over 40 trillion cubic feet of natural gas discovered between 2014 and 2017.

• Democratic Republic of Congo (DRC): Growth is primarily driven by the extractive sector, which is supported by the opening of new oilfields. Other contributors include agriculture, services, and mining.

• Rwanda: Economic expansion is fueled by private consumption and investment, an improving business environment, and ongoing development projects.

• Ivory Coast: Increased infrastructure investment, market-friendly reforms, and improvements in the National Development Plan support growth.

Overall, Sub-Saharan Africa’s projected growth rate of 4.2% in 2025 surpasses the global average of 3.2%, positioning it as the second-fastest-growing region globally after Emerging and Developing Asia (5.2%).

KEY RECOMMENDATIONS FOR AFRICA’S DEVELOPMENT

1. Strengthen governance and political stability:

• Prioritize transparent and accountable governance to build trust and attract investment.

• Address macroeconomic imbalances, including inflation and rising debt levels, to stabilize economies.

2. Invest in infrastructure and digital innovation:

• Accelerate critical infrastructure projects in transportation, energy, and digital connectivity.

• Promote AI policy frameworks and digital skills training to build a tech-savvy workforce.

3. Focus on critical minerals and industrial diversification:

• Shift from raw material exports to domestic processing and refining of critical minerals.

• Establish strategic global partnerships to maximize economic benefits from the clean energy supply chain.

Africa’s young population, abundant natural resources, and renewable energy potential position it as a future leader in global economic growth and sustainability. Strategic investments, governance reforms, and sustainable development initiatives are needed to ensure inclusive, resilient, and transformative growth for both the continent and the world.

By Adneissa Christy Alezy

PHOTO: GEORGINA SMITH / CIAT / CC BY-NC-SA 2.0; SETH CARNILL / CTA ACP-EU / CC BY-SA 2.0; PHOTO: ALEJANDRO MOLINA / SHUTTERSTOCK; UN PHOTO; PHOTO: AFRICA RESEARCH INSTITUTE; PHOTO: GOALLORD-CREATIVITY / SHUTTERSTOCK; PHOTO: MARK GARTEN / UN PHOTO

Stay informed anytime! Download the World Economic Journal app on the App Store, Google Play, ZINIO, Magzter and Issuu:

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal

https://www.magzter.com/publishers/World-Economic-Journal

Issue FEBRUARY – MARCH 2025 – World Economic Journal https://www.zinio.com/publications/world-economic-journal/44375