In January 2025 President Trump’s inauguration took place. This is now Trump’s second term as the US president. Many analysts predicted growing trade tensions between the US and other countries, especially China. The situation has in fact intensified since 2016–2020. Now leading economists are even talking about protectionism as the new norm of international trade. Obviously, the trade tensions we are facing right now are not pure economics. In fact, politics plays a crucial role here as well. In plain terms, tariffs are an instrument of both geopolitical and economic pressure.

TARIFFS IMPOSED BY THE US

The announcements that regularly get published by global media paint a mixed picture: on certain days new trade restrictions get imposed on various nations, while some time later we see the softening of the US administration stance. So, it is sometimes difficult to keep track of the trade situation. But let me start by summarizing the trade restrictions imposed by Trump’s administration by the time I am writing this.

On his first day back in the White House in January, Trump issued an executive order telling his administration to prepare more tariffs.

Quite recently, Trump has announced his most expansive tariffs yet, including a 10% universal tariff on all US imports. The rates for key trading partners were two to three times as high.

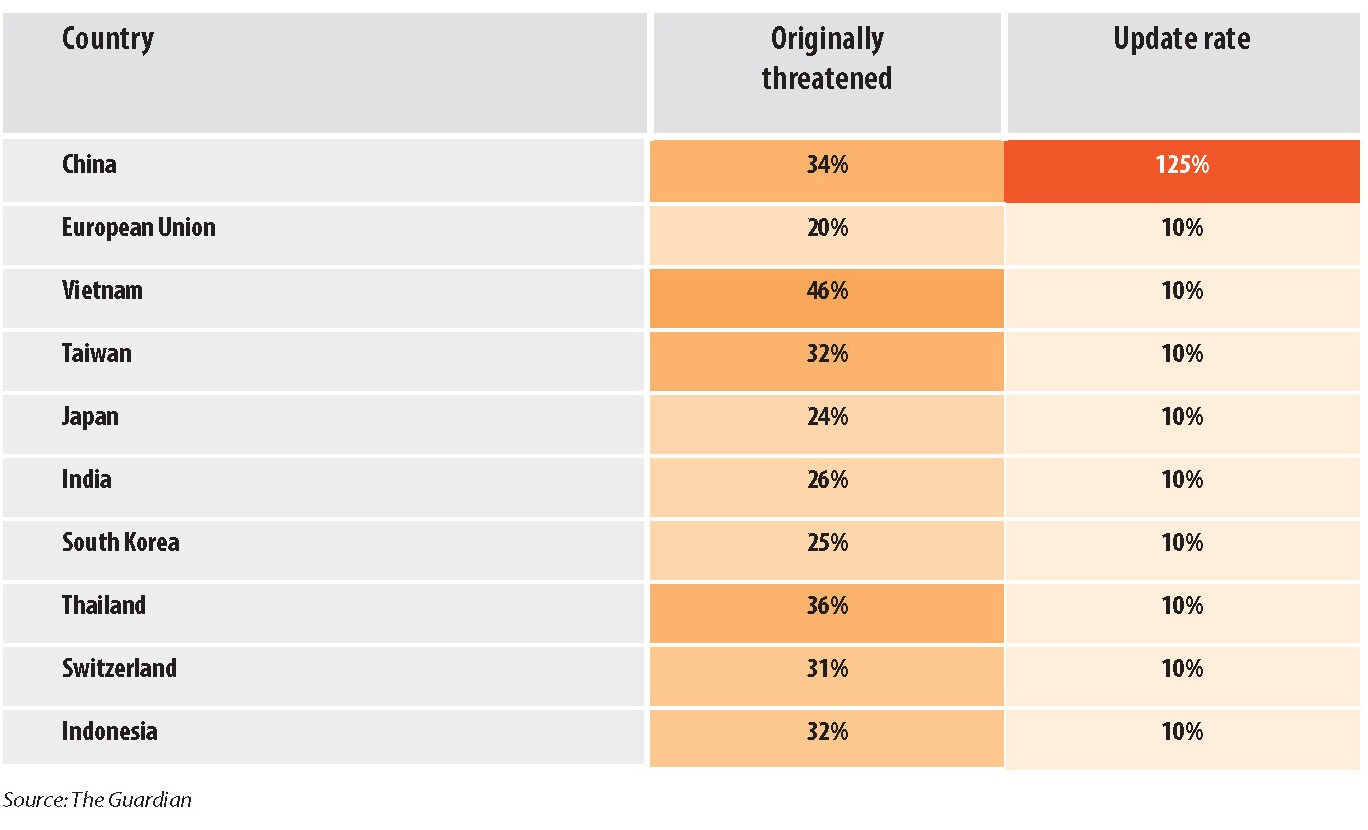

For example, there will be a 20% tariff on imports from the EU, a 26% tariff on India, and China will face a new 34% tariff in addition to the previous levies. The rates are even higher than some economists and policymakers expected.

Briefly, US consumers are likely to face higher prices on automobiles, electronics, groceries, drinks, lumber and petrol as a result of these new trade restrictions.

But here’s a timeline of Trump’s constantly shifting tariffs so far. The list, however, can be updated every day or even sometimes several times a day.

JANUARY

• On 20 January, hours after he was sworn in, Trump said that he would implement additional 25% tariffs on imports from Canada and Mexico starting on February 1. Both countries were accused of not taking measures to stop the flow of drugs and migrants into the US.

• On 26 January, social media Trump announced 25% tariffs on all imports from Colombia and even promised to increase them to 50% in one week — after Colombia’s government refused to accept planes carrying its immigrants deported by the US. Colombia’s president, Gustavo Petro, however, had “agreed to all of President Trump’s terms”. So, the tariffs and sanctions were quickly canceled by the White House administration.

FEBRUARY

• On 1 February Trump signed an executive order imposing 25% tariffs on nearly all imports from Canada and Mexico, as well as a 10% tariff on China. The US president said the tariffs were imposed due to his concerns about fentanyl smuggling and illegal immigration. The three countries concerned promised “countermeasures.”

• On 2 February Trump admitted the possibility of negative consequences of the tariffs on social media. According to the US President’s post, “WILL THERE BE SOME PAIN? YES, MAYBE (AND MAYBE NOT!)”. In other words, Trump is willing to take on additional risks of his trade policies.

• On 3 February Trump agreed to a 30-day pause of his tariffs on Mexico and Canada while threatening new tariffs against the EU.

• On 4 February Trump’s 10% tariffs on Chinese imports came into effect. China imposed retaliatory tariffs on products from the US.

• On 7 February Trump said he would impose his tariffs on other countries without specifying which countries would be subject to new trade restrictions.

• On 10 February Trump re-imposed 25% tariffs on all imported steel and aluminum. He imposed steel and aluminum tariffs during his first term.

• On 13 February Trump outlined a plan for broad tariffs on US trading partners, which would substantially damage the global trading system. Trump, however, called it a necessary measure to force companies to bring production back to the US.

• On 14 February Trump said he would impose unspecified tariffs on foreign cars on 2 April.

• On 25 February Trump asked his commerce secretary, Howard Lutnick, to carry out an investigation to find out whether foreign production of copper was a risk to national security, increasing the likelihood of tariffs on the commodity. The administration, however, did not publish any details on how high those tariffs would be, or when this investigation would end.

• On 27 February the US president said the tariffs against Canada and Mexico — and an additional 10% tariff on Chinese products — would be valid from 4 March as expected because “drugs are still pouring into our Country from Mexico and Canada at very high and unacceptable levels”.

The trade tensions are not pure economics. Tariffs are an instrument of both geopolitical and economic pressure

MARCH

• On 1 March Trump asked Lutnick to investigate whether lumber imports were a threat to US national security. The positive response to that inquiry would likely lead to more tariffs on Canada because the country is the largest wood exporter to the US.

• On 4 March tariffs on imports from America’s largest trading partners, namely Canada, Mexico and China officially went into effect. Canada’s Prime Minister Justin Trudeau responded with 25% tariffs on $155 billion of US products.

• On 5 March due to pressure from American carmakers, Trump said he would pause tariffs on cars coming into the US from Canada and Mexico for one month. Also, Mexico’s President Claudia Sheinbaum said that if tariffs remained in place, the Mexican government would impose retaliatory tariffs.

• On 6 March many of the tariffs imposed on Canadian and Mexican imports were suspended after the tariff news made the stock market go down. However, Trump said he would still impose 25% tariffs on steel and aluminum imports on 12 March, and that general tariffs on all American trading partners would still be valid from 2 April.

• On 10 March the Chinese government started introducing tariffs on many US farm products. These included an extra 15% on US farm products like chicken and corn, and a 10% on goods like soybeans and fruit. Additionally, Ontario, Canada’s province, introduced its own tariffs, including a 25% charge on the electricity exported to Michigan, Minnesota and New York.

• On 11 March in response to the electricity surcharge, Trump threatens to raise tariffs twofold on Canadian steel and aluminum imports. However, the two sides reached a compromise. Doug Ford, Ontario’s premier, said he would cancel the surcharge, while Trump said he would “probably” decrease the tariff on Canadian metals.

• On 12 March the EU and Canada announced billions of dollars in countertariffs on US goods, but the EU said they would not introduce their tariffs until 1 April. They would clearly prefer not to impose them, but would like to negotiate with Trump’s administration instead.

• On 13 March Trump threatened one of his largest tariffs to date: a 200% levy on all EU wines, Champagnes and alcoholic beverages. These tariffs are set to kick in on 1 April. This was in response to the EU’s plans for 50% tariffs on US whiskey and similar products.

• On 24 March 25% tariffs on exports to the US valid from 2 April were announced on all countries buying oil from Venezuela — either directly or from a third party.

• On 26 March Trump promised 25% tariffs on all cars and car parts exported to the US, including US brands whose automobiles are assembled abroad.

APRIL

• On 2 April a 10% tariff was applied to all countries importing goods to the US. That basic 10% will in some cases be supplemented by additional tariffs varying by country. These additional tariffs would also affect many US allies.

• On 4 April China announced a 34% tariff on US imports, in response to Trump’s plans to introduce 34% tariffs on Chinese exports. In addition, the Chinese government prohibited a group of 11 US companies from doing business in China.

• On 5 April Vietnam asked President Trump to delay tariffs for at least 45 days. The US is Vietnam’s largest export market, while the 46% tariffs the US planned to impose on Vietnam’s goods is among the highest any nation faces.

• On 7 April Bangladesh also asked the US for a three-month pause before imposing any tariffs on its exports. Trump threatened to respond to China’s trade restrictions with an extra 50% tariff. So, in total China could face 104% taxes on all exports.

• On 9 April Trump’s tariffs on some American biggest trading partners took effect. Chinese goods were subject to a 104% tariff, EU goods faced a 20% import tax, Japanese goods were taxed 24% and Vietnamese products 46%. In response China imposed a supplemental 50% tariff on US imports. So, all American products transported to China became subject to an additional 84% import tax. The EU also approved new tariffs against the US. On the very same day Trump announced a pause on his tariffs for the next 90 days, bringing tariff levels to a universal 10%. China, however, would not be included in that pause. Instead, he increased tariffs on Chinese exports to 125% after China’s countermeasures announcement.

• On 10 April the President’s administration said that the 125% tariff on Chinese products was in addition to a 20% tariff that Trump had already imposed on China, bringing the total tariffs on China imposed by the Trump administration to a whopping 145%.

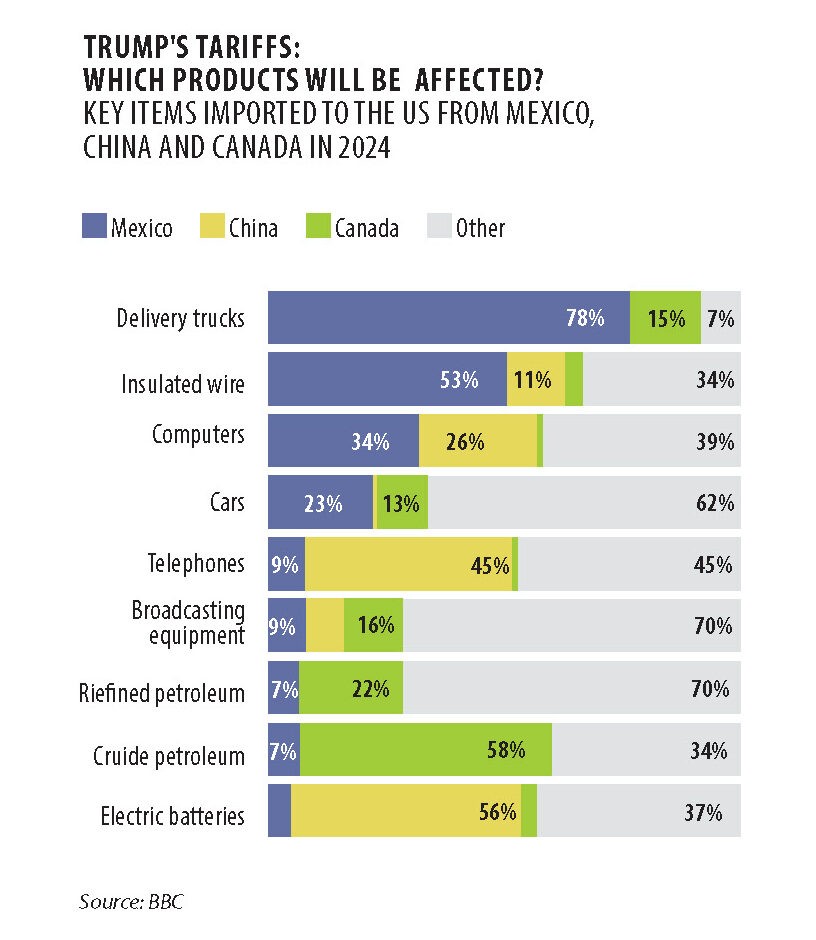

So far, from all the relevant goods affected by tariffs, delivery trucks from Mexico, electric batteries from China and crude petroleum from Canada would be most affected by tariffs.

Global reaction

But let us break down the individual responses to the new trade restrictions by country.

CHINA: As we have seen above, China has been particularly affected by the new tariffs. China asked the US to “immediately cancel” the tariffs, saying they “endanger global economic development” and would be against US interests because there is no winner in a trade war.

The US will introduce 34% tariffs on Chinese goods, in addition to the 20% that had already been imposed earlier this year. According to Wang Wen, dean of Renmin University’s Chongyang Institute for Financial Studies, the trade war between the US and China and the resulting “high tariffs have not reduced the US-China bilateral trade volume as well as China’s trade surplus with the US … most Chinese people believe that the US tariff war against China is ineffective.”

According to Wang, potential Chinese countermeasures could include tariffs, devaluing China’s currency, and also some prohibitions to export certain rare earth materials to the US. The latter would also be highly significant for the US economy because these materials are used in the production of glass, lights, magnets, batteries, and catalytic converters. They are used in virtually everything from cell phones to cars.

UK: The UK government had been expecting a 20% tariff rate to be imposed. But Trump has charged the UK with 10% tariffs thanks to the UK’s prime minister Keir Starmer’s more diplomatic approach to the Trump administration. However, the UK’s growth forecasts will likely be downgraded as a result of even 10%.

SOUTH KOREA: In response to the US 25% tariffs, South Korea’s acting president, Han Duck-soo, said “as the situation is very grave with the approach of the reality of a global tariff war, the government must pour out all of its capabilities at its disposal to overcome this trade crisis”.

Particularly hard will be hit South Korea’s leading carmakers Hyundai and GM Korea because they will see a substantial decline in US exports. The country exported cars worth $34.74bn to the US last year, which is a whopping 49% of South Korea’s global car exports. No counter-tariffs on US goods have been imposed by South Korea just yet. Instead, the country has tried to negotiate more favorable conditions on its exports with the US.

JAPAN: Japan’s trade and industry minister Yoji Muto called the tariffs “extremely regrettable”. However, Tokyo did not take any countermeasures but instead started attempting to persuade the Trump administration to think again. The country’s prime minister Shigeru Ishiba said: “Japan is a country that is making the largest amount of investment to the United States, so we wonder if it makes sense for [Washington] to apply uniform tariffs to all countries.”

Just like South Korea’s carmakers, Japanese automakers will also face a slump in exports. According to Goldman Sachs, the tariffs would have a substantial impact on Japanese car manufacturers, as cars are responsible for more than 30% of all Japanese exports to the US.

INDIA: Trump said the 26% was a “discounted reciprocal tariff” for the 52% tariffs imposed by India. The Indian government, meanwhile, has been working hard in recent weeks to negotiate tariff discounts. Almost $14 billion worth of electronics and over $9 billion of jewelry, textile and IT sectors are among the top industries to be affected by the new tariffs. However, pharmaceuticals, one of India’s biggest export industries, is exempt from Trump’s tariffs. The US trade deficit with India is currently at $46 billion. According to Trump these tariffs will remain in place till the deficit decreases. There have been reports that in order to please Trump and decrease US tariffs, India is considering cutting tariffs on $23 billion worth of US imports, including jewelry, pharmaceuticals, and car parts. However, no trade deal has been signed just yet.

AUSTRALIA: Australia’s products were only charged with 10% tariffs. Some critical minerals Australia exports and not available in the US, will be exempt from the new levies. According to Australian Prime Minister Anthony Albanese the White House administration’s tariffs have no basis in logic and they go against the basis of the two nations’ partnership. Albanese said his government would not impose retaliatory tariffs against America and said that, ultimately, the US consumers would face the consequences of Trump’s tariffs.

NEW ZEALAND: Just as was the case with Australia, a 10% levy was imposed on New Zealand’s goods imported to the US. Prime minister Luxon said “there’s about $900 million worth of tariff being levelled at New Zealand exporters, and that will be passed on to US consumers sadly”.

Just like Australia’s government, Luxon said he would be seeking negotiations with US representatives after the White House administration said New Zealand was charging 20% tariffs on US imports. Luxon said, “We don’t understand how that figure has been calculated.” New Zealand’s exports to the US exceeded USD 5 billion in 2024, driven by meat, dairy and wine, thus making the US New Zealand’s fastest growing export market. In fact, the US is its second largest market in 2024, ahead of Australia and after China, New Zealand’s main trading partners. The new US tariffs could mean a NZ$900 million charge for New Zealand’s exporters.

CANADA: Canada has been freed from the latest round of tariffs but is still subject to 25% levies on aluminum and steel, as well as on cars. The country’s prime minister Mark Carney promised to “fight these tariffs with countermeasures”.

According to Carney, despite the fact that Trump had “preserved a number of important elements” of US-Canada relations, the previous tariffs of 25% remains in place. Trump claimed these tariffs are a punishment for not doing enough to stop the flow of fentanyl into the US.

MEXICO: Just like Canada, Mexico has been freed from the latest round of tariffs but still faces previous levies announced by Trump. Mexico’s president Claudia Sheinbaum said that the country would not pursue a “titfor- tat on tariffs” strategy but would rather seek a diplomatic agreement on the matter.

TAIWAN: Taiwan’s government has called the tariffs “very unreasonable” and said it would negotiate more favorable trade conditions with the US government. The 32% tariffs Trump announced against Taiwan would have a substantial effect on the island’s economy. More than 60% of the country’s economy is due to exports. Taiwan had a trade surplus of about $74 billion last year. Bloomberg economists even predicted a possible 3.8% GDP decrease due to a substantial decrease in exports to the US because of these levies.

Taiwanese officials had been preparing a response to these new tariffs for several months. However, the island’s government is not planning countertariffs but is rather seeking ways to appease the White House administration. For example, Taiwan’s officials consider increasing the island’s energy imports and decreasing Taiwan’s own tariffs to reach a more reasonable trade balance that Trump mentioned. Earlier, a $100 billion investment was made by TSMC, a Taiwanese company, in the US. Trump said TSMC would be exempt thanks to its decision to invest.

THAILAND: The country’s government said that the tariffs will undoubtedly impact all trading partners, especially US consumers’ purchasing power. The government also encourages Thailand’s exporting companies “to look for new markets to stop relying on a single market. Thailand’s government is also taking measures to support exporters. However, Thailand has expressed its willingness to continue negotiations with the US as early as possible to reach a fair trade balance for the two economies.

It is argued that there is a trend for both “friendshoring” and “nearshoring” as trade tensions between the US and other countries are getting out of control

LOSERS AND WINNERS

The key question, however, is who will win from the US trade war against most of the countries in the world. The brief answer is that there are not any winners from economic and geopolitical tensions. Apart from higher inflation numbers resulting from imposed tariffs, there are also unemployment and recession threats. First, higher tariffs make products more expensive for US consumers. Meanwhile, local US producers will not be able to replace Chinese manufacturers immediately in all the industries affected. Even if some alternatives to Chinese products appear in the US, they are highly likely to be much more expensive compared to the “made in China” goods. That is because production expenses in China, especially the labor costs are substantially lower compared to the ones in the US. As a result, the general price level in the US is likely to rise, thus affecting consumers’ real incomes.

Let us also bear in mind that US producers that have tight business contacts with Chinese businesses might face higher costs due to tariffs. These higher costs will also likely be passed on to consumers in the form of higher product prices. Moreover, China has also imposed reciprocal tariffs on US production. This means that US firms would also end up losing the Chinese markets, thus decreasing their revenues. As a result, fewer US workers would be needed to produce goods targeted at Chinese consumers. Not to mention that some companies specialize in exporting B2B goods and services. So, their trade partners located in China are likely to be lost forever. Obviously, this raises unemployment risks. Consequently, higher unemployment numbers and higher inflation create stagflation risks. This is a situation when the Fed is stuck between a “rock and a hard place”. In other words, central bankers can lose big if they ease their monetary policies too fast because they are likely to raise inflation numbers further. Yet, if they increase the interest rates, they can raise the country’s unemployment and decrease consumer activity levels further, thus provoking a recession.

Not to mention that trade wars tend to completely distract logistics chains and also create the atmosphere of economic uncertainty. This means investors unwillingness to buy either American or Chinese assets. This is particularly obvious in the case of stock markets. American companies’ capitalizations are likely to decrease even further just the way it can happen to Chinese companies listed in the US. Moreover, there is a threat that Chinese companies would be delisted from US stock exchanges.

Noteworthy is that smaller and medium-sized businesses will be affected. Larger corporations tend to be heavily diversified and exposed to different international markets. So, they are not strongly focused on China but can replace their revenues by relocating their production facilities to other countries. Not to mention large corporations tend to be more financially stable, which means they can more easily survive “hard times”.

But let me do a more detailed analysis of the industries involved that can be affected more than others and if there are any US economic sectors that are here to gain.

NEW SUPPLY CHAINS

The growing trade tensions are also harmful for supply chains. In many countries it now does not make sense to prefer just-in-time production. This manufacturing method involves focusing on producing exactly the quantity the company needs at exactly the time its customers need it. It is argued that there is a trend for both “friendshoring” and “nearshoring” as trade tensions between the US and other countries are getting out of control.

‘Friendshoring’ refers to a growing trade practice when supply chains are focused on economies regarded as political and economic allies. However, friendshoring leads to further ‘deglobalization’. After all friendshoring is the rerouting of supply chains to countries considered to be politically and economically safe or low-risk. But it does not seem to be the case with the US, given the fact that Trump has even imposed tariffs on its closest allies, including the EU, Japan, Taiwan and Australia. However, countries most affected by US tariffs as well as other economic and political measures have the interest to become closer to each other, while building trade alliances to fight US restrictive policies. This trend, however, has started long before the trade war initiated by Donald Trump.

The most notable anti-Western alliance seems to be the BRICS+. It is both a political and an economic organization seeking to encourage trade and other forms of co-operation between its members. The idea of BRICS has first appeared in 2006, while in 2011 South Africa officially became part of the group to justify the acronym BRICS (Brazil, Russia, India, China and South Africa). Due to the trade war the trend can only become stronger, most notably affecting countries that have never been strong allies of the US, most notably Russia and China.

“Nearshoring” is the process of a company relocating its production facilities to a nearby country in order to ensure faster speed to market and quicker transit from manufacturers to customers. This is not massively happening right now simply because many developed countries, including the US and Europe have located their production facilities to Asian countries, especially China and India. However, due to Trump’s tariffs it is in the best interests of companies based in China and actively exporting their products to the US to relocate their production facilities elsewhere. This does not even have to be the US. It might be cheaper to relocate their factories to China’s neighboring countries like Vietnam. So, the trade war can stimulate the nearshoring trend.

AMERICA’S SOVEREIGNTY

However, Trump’s tariffs are not only “bad news” for the US economy. It is possible that in the long term US companies with production facilities located in China would relocate them back to the US, thus raising American employment and generating extra tax revenues for the US national budget that has long been in a deficit. Moreover, the US can become more self-sufficient, less reliant of foreign supplies of various goods, that is. This would lead to America’s reindustrialization, thus decreasing US reliance on its services sector, which is responsible for almost 80% of the country’s GDP.

As I have mentioned above, medium-sized and smaller companies focused on international supplies will be most affected. Nevertheless, larger corporations with strong financial reserves will likely gain in the long run because they would be free from smaller businesses’ competition.

Larger corporations with strong financial reserves will likely gain in the long run because they would be free from smaller businesses’ competition

As less reliable businesses go bankrupt, larger companies take their niches. Moreover, in my opinion, trade wars would also pass. Do not take me wrong. Complicated US-China relations would not improve dramatically overnight. But the tariff war would eventually pause. So, large companies that have strong business ties with China and other US trading partners are likely to take the place of smaller businesses that have gone bankrupt during the tariff shock.

But how can large corporations with dependence on China, like Apple (AAPL), Tesla (TSLA) and Boeing (BA) adapt to the current situation? To start with, Trump has signed an exemption to electronics imports from China. When Trump administration announced the US 145% tariffs on Chinese imports, there was one critical exception, namely consumer electronics, including iPhones, laptops and semiconductors. These product categories were reassigned to a separate 20% tariff category. The reason why the White House administration decided to free iPhones from too high tariffs is due to structural impossibility of organizing advanced electronics production in the US. Bank of America’s analysts estimate that producing iPhones in the US would raise costs by 25% just from labor, without taking account of the logistical problems arising from importing Chinese components under very high tariffs. Even if we assume that Apple accepts these expenses, the resulting $3,500 retail price would crash demand. In the long term Chinese brands and South Korea’s Samsung would take Apple’s market niche in America.

CONCLUSION AND FORECASTS

It is likely that under Trump the US would stop being WTO’s member because the country does not seem to want to be part of free trade blocs. Given the table I have quoted at the beginning of this article, Trump has imposed tariffs on most of the countries in existence. This, in my opinion, means that given the current trade policies, the US is highly unlikely to become part of new trade alliances.

As I have mentioned before, the US economy is likely to substantially be affected by the trade wars. The country will likely face a recession, high inflation and lower standards of living due to the fact the US is not self-sufficient but exports a substantial part of physical goods from other countries. The US closest trading partners, namely Mexico, Canada and China would also likely face slowing GDP growth and higher unemployment numbers.

Now that Trump’s second president term has only started, we should not expect all the relevant trade restrictions to be over, in my view. Only two scenarios are possible here, namely trade escalation and stabilization. The former, however, is more likely because some countries, possibly not American closest allies are likely to eventually adequately respond to Trump’s actions. This is particularly true of China because it is the country most affected by the new trade restrictions. This would lead to further action from the White House administration, thus making trade tensions escalate further.

By Anna Sokolova

__________________________________________________________________________________

PHOTO: RAWF8 / SHUTTERSTOCK, PHOTO: OFFICIAL WHITE HOUSE PHOTO BY DANIEL TOROK, PHOTO: RANGSARIT CHAIYAKUN / SHUTTERSTOCK, PHOTO: PX MEDIA, ANYVIDSTUDIO, SVEN HANSCHE / SHUTTERSTOCK, PHOTO: LIGHTSPRING / SHUTTERSTOCK; SIMON DAWSON / NO 10 DOWNING STREET; MINISTRY OF ECONOMY, TRADE AND INDUSTRY, JAPAN / CC BY 4.0, PHOTO: AUSTRALIAN GOVERNMENT UNDER / CC-BY-4.0; ÄIVI PAASIKOSKI, VALTIONEUVOSTON KANSLIA, FINNISHGOVERNMENT / CC BY 2.0; CARLETONU, FACULTY OF PUBLIC AND GLOBAL AFFAIRS / CC BY-SA 3.0; ENEAS DE TROYA / CC BY 2.0, PHOTO: IVAN MARC / SHUTTERSTOCK, PHOTO: NIROWORLD / SHUTTERSTOCK

WEJ MEDIAKIT- ENG

Stay Ahead with World Economic Journal — Anytime, Anywhere

Get full access to expert insights, global analysis, and exclusive features from every issue of World Economic Journal.

Download the journal on your preferred platform:

Google Play: WEJ on Magzter

Magzter Web: World Economic Journal on Magzter

- Apple App Store: World Economic Journal Magazine

Subscribe now and never miss an issue. Knowledge. Insight. Impact.

Available in Leading Digital Libraries Worldwide

World Economic Journal is not only available through major digital platforms — it is also part of hundreds of public, academic, and institutional digital libraries across the globe.

You can access the journal through:

London Public Library, Toronto Public Library, ZINIO-powered U.S. and Canadian networks

British Council Libraries, Universities such as Southampton, Leeds, and DuPage

Major city libraries in Washington, Chicago, Philadelphia, Houston, Los Angeles, Berlin, Tokyo, Illinois, Switzerland, Malta, Johannesburg — and many more.

We are proud to be present in the global knowledge ecosystem — from government research centers to digital reading networks in over 70 countries.

If your institution has a digital library, World Economic Journal is likely already there.