- Bull markets are characterised by a continuous and sustained rise in asset prices. These phases are generally fueled by strong demand, investor optimism, and favourable economic conditions. In cryptocurrencies, these periods are often marked by intense media coverage, a massive influx of new investors and valuations reaching all-time highs.

- Bear markets are marked by a prolonged decline in prices. These phases occur when investor confidence wanes, leading to massive sell-offs. In the context of cryptocurrencies, these periods can be exacerbated by unfavourable regulations, exchange platform hacks or corrections following a speculative bubble.

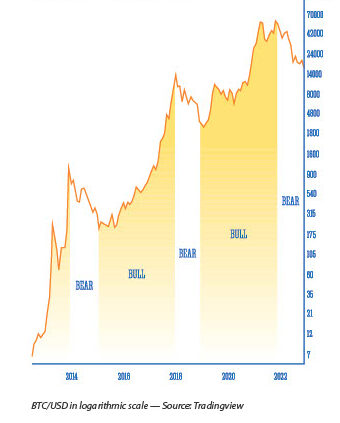

Bitcoin (BTC), as the first and leading cryptocurrency, provides a perfect case study to illustrate these cycles. Since its creation in 2009, Bitcoin has experienced several bull and bear cycles:

- 2013-2014: Bitcoin rose from under $100 at the beginning of 2013 to over $1,100 in December of the same year, before falling to around $200 in 2015. This first cycle was marked by the euphoria surrounding early adopters and the initial acceptance of Bitcoin by companies like Overstock.com.

- 2017-2018: The most iconic cycle, where Bitcoin nearly reached $20,000 in December 2017, followed by a sharp drop in 2018, hitting a low of $3,200 in December of that year. This cycle was marked by widespread enthusiasm for ICOs (Initial Coin Offerings) and the massive entry of new retail investors.

- 2020-2021: After a long accumulation period, Bitcoin began a new bull cycle, reaching an all-time high of around $69,000 in November 2021. This cycle was supported by increased institutional interest, growing recognition of Bitcoin as a reserve asset, and the economic crisis triggered by the COVID-19 pandemic.

- 2022-2023: The last significant bear market in the cryptocurrency market, often referred to as the “crypto winter,” began in late 2021. The market saw a sharp decline of Bitcoin and other cryptocurrencies amid widespread market uncertainty and a decrease in trading volumes. Macroeconomic concerns, regulatory pressures and the collapse of major crypto projects— like Terra (LUNA) and the FTX exchange—contributed to the downturn.

A DISAPPOINTING YEAR?

In late 2023, the bear market phase seemed to have ended, with several indicators pointing towards a potential shift to a bull market:

- Bitcoin price stabilisation: After a prolonged period of declining prices, Bitcoin and other major cryptocurrencies showed signs of price stabilisation, suggesting that the market might have found a bottom.

- Increase in trading volumes: There was a noticeable increase in trading volumes on major cryptocurrency exchanges, indicating renewed investor interest and confidence in the market’s future prospects.

- Positive regulatory developments: Several countries made moves towards clearer and more favourable regulations for cryptocurrencies, which improved the market sentiment and encouraged more participation from both retail and institutional investors.

Historical Bull and Bear cycles in the Bitcoin market (2014-2023)

Several events taking place in the first part of the year actually contributed to fuel optimism. The approval of Bitcoin exchange traded funds (ETFs) by the SEC, in early January 2024, marked a significant step towards mainstream adoption. The growing involvement of institutional investors added credibility to cryptocurrencies as a legitimate asset class, attracting an even wider range of traditional investors.

A Bitcoin halving took place on April 19, reducing the mining reward by half, which created expectations of reduced supply in new coins. By generating scarcity, previous Bitcoin halvings had often led to increased prices, catalysing bull cycles.

Meanwhile, with persistent inflation and accommodative monetary policies from central banks, many saw cryptocurrencies as a potential hedge against inflation. The continuous printing of fiat currencies by central banks to stimulate economies led to concerns about currency devaluation, making cryptocurrencies, particularly Bitcoin, more attractive as a store of value.

The actual performance of the cryptocurrency market in 2024 did not turn out to be uniformly positive

However, the actual performance of the cryptocurrency market in 2024 did not turn out to be uniformly positive. A comparative chart of Bitcoin prices since the beginning of 2024 shows significant fluctuations, with several attempts at bullish breakouts that failed to hold above key resistance levels. Rather than the typical dynamics of a bull run, this year’s evolutions have been those of a consolidating market, with support levels being repeatedly tested.

According to CoinGecko, Bitcoin ended Q2 2024 at around $62,734, down 11.9% from the beginning of the year. Meanwhile, trading volume on centralised exchanges reached $3.40 trillion in Q2 2024, down 12.2% from the previous quarter.

Institutional adoption of cryptocurrencies did strengthen in 2024, largely thanks to the approval of Bitcoin spot ETFs. However, these effects were offset by macroeconomic volatility and the ongoing hesitation of some institutional investors to significantly increase their exposure to cryptocurrencies.

Bitcoin price fluctuations from Jan. 1 to Aug. 15, 2024

ARE CYCLES STILL THERE?

Despite the volatility observed in 2024, most industry experts continue to support the validity of the market cycle theory for cryptocurrencies.

- Impact of halving: The key argument remains that the April 2024 Bitcoin halving will have a delayed but significant positive effect on prices, as in previous cycles.

- Supportive regulations and increased institutional adoption are expected to attract new types of investors to the market, leading to a gradual rise in prices.

- Technological enhancements will have beneficial effects on the infrastructure, such as the Lightning Network for Bitcoin.

Some analysts, though in the minority, point to factors that could delay or alter the expected bull cycle. Cryptocurrency market cycles could lengthen as the market matures, they argue, with less spectacular but more sustained long-term growth. Bitcoin growth could be more gradual, far from the explosive peaks of previous cycles.

In addition, macroeconomic uncertainty, with risks of a global recession and geopolitical tensions, could keep volatility high and delay the formation of a sustainable bull market.

SCENARIOS FOR THE FUTURE

Fueled by the aforementioned positive factors, the cryptocurrency market could experience a substantial recovery this year. In this optimistic scenario, Bitcoin could surpass $100,000 by the end of 2024, leading to a price increase for major altcoins (Ethereum, Solana, etc.).

In a conservative scenario, the market could remain volatile, with regular ups and downs, without reaching the expected highs. Bitcoin could stabilise between $60,000 and $70,000 by the end of 2024. This scenario assumes that macroeconomic uncertainty persists, but cryptocurrency adoption continues to grow—slowly, but surely.

Pessimists point out several external factors that could lead to a significant drop in cryptocurrency prices. A prolonged global economic recession, major geopolitical tensions or unexpected regulatory tightening, in particular, could lead to such an outcome. In this context, investors might flee risky assets, including cryptocurrencies, in favour of safer havens like gold or government bonds.

Under this scenario, Bitcoin could fall below $30,000 before finding solid support. Altcoins, often more volatile, could see even steeper declines, with a reduction in their total market capitalization. Though not the most probable, this remains a plausible scenario, especially in a context where global markets are highly interconnected and sensitive to external shocks.

CONCLUSION

In my opinion, the fundamentals supporting crypto assets remain strong, despite the mixed performance of the cryptocurrency market in 2024. Bitcoin, along with other major cryptocurrencies, continues to benefit from growing adoption by both institutions and individuals.

Market cycles remain an essential feature of the sector, and while 2024 may have defied the expectations of some investors, it would be premature to conclude that this year’s evolutions have ended or even seriously challenged the cycle theory.

Most industry professionals continue to believe in the potential for a future bull run, even if its timing might differ from initial expectations. The scenarios described above highlight the need for investors to stay vigilant and well-informed, ready to adapt to the rapid changes that characterise this market. Cryptocurrencies still represent an emerging asset class with considerable growth potential, but they require an informed and cautious investment approach.

By Maxime Duhommet

Stay informed anytime! Download the World Economic Journal app on the App Store and Google Play.

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal

https://www.magzter.com/publishers/World-Economic-Journal