Brazil is one of the world’s top agricultural exporters. In 2023, it exported a record $166 billion worth of farm products, including coffee, soybeans, beef, and sugar. As a top exporter of many agricultural commodities, Brazil has fostered economic growth and boosted its standing in the global trade echelons. Yet, with the right investments and regulations, there’s still more to be achieved. “Agriculture productivity growth in recent decades in Brazil has been mainly driven by investments in agriculture innovation, facilitation of sector financing, and trade liberalization,” World Bank expert Diego Arias concurs.

Brazil’s agricultural industry has grown rapidly and broken records over the past two decades. Its 2023 exports stood at $166 billion, nearly double the $85 billion exported in 2013. The agriculture sector’s share of gross domestic product (GDP) rose from 4.6% in 2017 to 6.2% in 2023. These figures indicate a robust, fast-growing agricultural industry with many investment opportunities.

Despite its robust performance, Brazil’s agricultural sector still has ample space for more productivity, even while paying attention to sustainability. For instance, research by the Brazilian Agricultural Research Corporation suggests the country could convert an additional 70 million acres of existing pastureland to crop production without deforestation.

Technology innovations can help Brazil maximize its agricultural output and build a more resilient economy. Let’s explore what makes Brazil suited for this growth and how investors can profit from these opportunities.

KEY AREAS IN THE AGRICULTURAL SECTOR

Brazil specializes in agricultural commodities like soybeans, coffee, and beef. It also has a burgeoning timber export business that presents opportunities for investors. Sustainability is a major investment theme, as Brazil’s agricultural industry has received significant criticism for environmentally harmful practices like deforestation.

The key areas in Brazil’s agricultural sector include:

• Soy and meat production

Brazil is the world’s largest soybean exporter, accounting for 57% of global exports in 2023. Soybean is a crop in high demand for food and industrial products. It’s an ingredient for everything from cooking oil to animal feed and paints. Brazil’s dominance of soybean exports gives it considerable economic and political clout.

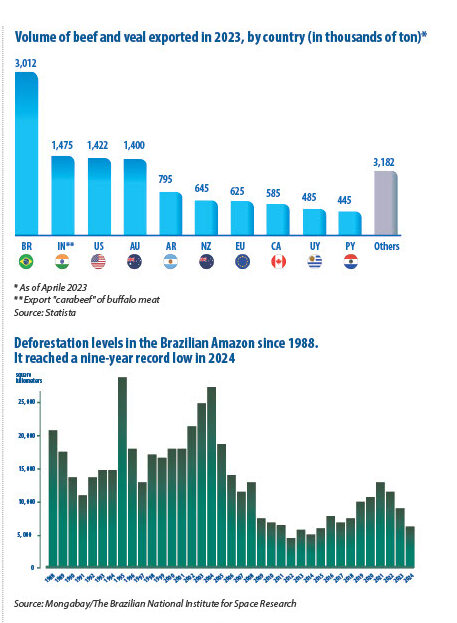

Beef is another area in which Brazil dominates the international market. It’s the world’s largest beef exporter, shipping 3 million tons in 2023, far ahead of the runner-up, India, which shipped 1.48 million tons.

Brazil is expected to set a new record for soybean shipments in 2024, beating the 22.4 million tons it shipped in 2023. The same applies to beef exports. Brazil’s beef production is expected to grow by 7% in 2024, and exports are projected to grow by 4.2%. These statistics indicate a lucrative soy and beef market from which domestic and foreign investors can benefit.

• Development of organic farming

Organic farming prioritizes sustainability and maximizing the use of natural inputs. It’s a fast-growing agricultural segment in Brazil, driven by the global shift towards climate change mitigation and Brazil’s environmental challenges. Organic farmland in Brazil is over 1.5 million acres as of 2024, compared to around 950,000 acres in 2015. The country had nearly 26,000 organic producers as of 2023, a 123% increase from 2015.

Brazil’s organic farming shift is crucial because of its vulnerability to climate change effects. 90% of Brazilian agriculture relies on rainfall, making production vulnerable to droughts. Organic farming includes shifting to drip irrigation (tubes laid on the ground to trickle water across soil), which is more efficient than rainfed agriculture.

Globally, rainfed agriculture produces 50% less output than irrigated agriculture. Hence, a simple shift towards irrigated systems can significantly boost Brazil’s agricultural output. This illustrates how the right investments can boost profits for agricultural producers and investors.

• Forestry and timber export

Brazil accounts for 55% of timber product exports from South America and 2.7% of global exports. Major timber products include wood pulp, wooden frames, plywood, and furniture. With the world’s second-largest forested area, Brazil has numerous resources to grow its forestry and timber exports.

Brazil’s forestry industry faces notable environmental challenges, mainly illegal logging. However, the government has implemented fruitful efforts to tackle this challenge and permit logging only in suitable areas. In 2024, deforestation dropped by 31% compared to 2023 and plunged to its lowest nine-year level. These efforts pave the way for domestic and foreign investors to profit from sustainable timber harvests, unlike illegal loggers, who pay little attention to environmental practices.

INVESTMENT OPPORTUNITIES

Brazil’s robust and fast-growing agricultural sector presents investment opportunities in three core areas: crop yield enhancements, logistics, and sustainability. Let’s explore these opportunities further.

• Technologies to enhance crop yields

Despite its robustness, the Brazilian agricultural sector requires considerable work regarding mechanization and technological adoption. We’ve mentioned that 90% of Brazil’s agricultural output is rainfed, which yields less than irrigated agriculture. Another example is indoor farming, which increases crop yield in limited spaces.

We can then consider more advanced solutions, such as satellite imagery, to guide decision-making and remote sensing to monitor weather, soil moisture, weed locations, pest infestations, and other crucial farming conditions. Brazil’s agricultural sector is ripe for advanced technology solutions to boost crop yields, and investors can make money by providing these solutions.

• Building logistics infrastructure for exports

Brazil’s agricultural industry relies on seaports, airports, roads, rail networks, and other logistics infrastructure to export massive volumes of goods. However, the country faces significant logistical challenges, such as overstretched ports and inadequate road and rail networks.

Many agricultural regions lack adequate transport networks, which causes higher transport costs that reduce farmers’ profits. Investments to tackle this inadequacy can substantially improve Brazil’s agricultural productivity.

For example, the Port of Santos, Latin America’s busiest container port, is being expanded to improve capacity from 6 million TEU containers annually to 9 million. This expansion will open more space for Brazil’s agricultural producers to ship products to global customers. It’s spearheaded by a partnership between a state-owned logistics company and private investors, demonstrating how businesses can help boost agricultural productivity and profits.

Brazil issued its f irst $2 billion green bond in November 2023 and another $2 billion in June 2024

• Financing sustainable agricultural projects

Brazil needs considerable investment to speed up sustainable agricultural practices. The transition towards sustainability requires massive investments to revamp existing production processes, and domestic companies often lack access to this capital. Foreign investors can help close this gap, and local investors can also contribute.

For example, Brazil participates in the Climate Bonds Initiative, which helps countries mobilize financing based on sustainability milestones. The country issued its first $2 billion green bond in November 2023 and another $2 billion in June 2024. Green bonds often have lower interest rates than traditional bonds, giving Brazil more capital to fund sustainable investments and boost agricultural exports.

RISKS AND CHALLENGES

The Brazilian agricultural sector faces notable risks and challenges, mainly climate change, political headwinds, and global macroeconomic changes.

• Climate change effects

Brazil’s vast agricultural sector is vulnerable to climate change effects like drought, f looding, deforestation, and sea-level rise. The adverse effects are already being seen, such as a flood disrupting road and rail links to a major grain port in May 2024 and a drought halting river grain transport in September 2024.

Environmental disasters significantly affect agricultural output and transport, making them core investment risks. Fortunately, Brazil’s government and commercial entities have made efforts to reduce disaster risks, including building resilient transport infrastructure and investing heavily in renewable energy to reduce greenhouse gas emissions.

In 2023, Brazil commissioned its largest solar power plant with 1.2 GW capacity. The plant was built by a private company, demonstrating how investors can profit from sustainable investments, in line with Brazil’s pledge to reduce greenhouse gas emissions by 59%-67% by 2035, relative to 2005 levels.

• Deforestation

Deforestation, mainly caused by illegal logging, reduces arable land and increases soil erosion, harming longterm agricultural output. Brazil faces considerable deforestation, which risks agricultural productivity for farmers and investors. However, as mentioned earlier, Brazil has made progress in tackling this issue, with deforestation currently at a nine-year low.

• Political and economic risks

The agricultural sector is greatly affected by business and environmental regulations, which change depending on political leadership. Polarization and institutional conflicts challenge Brazil’s political landscape, often leading to inconsistent regulations that discourage long-term planning. The country is progressing in this area, but more work is needed to mitigate political risks.

Brazil’s agricultural sector is also vulnerable to global macroeconomic headwinds, such as the 2020 COVID-19 pandemic, which disrupted supply chains and workforce productivity.

Remarkably, Brazil’s agricultural industry outshined other domestic sectors in 2020, growing 2% even as others contracted. “The rapid devaluation of the Brazilian real made the country’s agricultural exports attractive on the international market. Weak real also discouraged dollar-denominated imports and fueled internal demand for domestically produced agricultural products.

Brazilian agriculture, working in tandem with government decision-makers, overcame early transportation hurdles to boost exports, while also maintaining internal supply,” said US Agriculture Department specialists Evgenia Ustinova and Katherine Woody during the COVID era. This resilience demonstrates Brazil’s readiness for profitable agricultural investments.

DEVELOPMENT OF THE AGRICULTURAL SECTOR BY 2025

Brazil’s agricultural sector is expected to increase by 5% in 2025, continuing the growth trends seen in previous years. This sector is a beacon in Brazil’s developing, industrialized economy.

With the right technology investments to boost crop yields, organic farming growth, and increasing timber production, Brazil’s agricultural sector is poised to grow further over the next decade. “Owing to its incredible natural endowment, its advanced agribusiness and research sectors, its stability within an unstable world, and its well-developed integration into global agriculture and food markets, Brazil is now and will remain a leading agricultural powerhouse and a critical partner in addressing the global food crisis,” notes Atlantic Council experts Valentina Sader and Peter Engelke. Global investors can capitalize on this growth to earn profits.

OPPORTUNITIES FOR INTERNATIONAL INVESTORS

Foreign investors should target infrastructural and sustainable investments in Brazil’s agriculture sector. The Brazilian government has spearheaded several public-private partnerships, demonstrating its intention to create a favorable climate for foreign investments.

Brazil’s agricultural sector presents endless investment opportunities, from fertilizer production to renewable energy, port upgrades, road construction, machinery production, and yield-boosting technologies. Global trends point towards sustainable growth in this sector, enabling investors to earn substantial long-term profits.

By Chisom Maduonuorah

___________________________________________________________________________________________________________

PHOTO: BRASTOCK IMAGES / ADOBE STOCK; PHPTO: LOURENCOLF / SHUTTERSTOCK; PHOTO: LEONIDAS / ADOBE STOCK.

Stay informed anytime! Download the World Economic Journal app on the App Store and Google Play.

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal

https://www.magzter.com/publishers/World-Economic-Journal