True, China’s economic growth has recently slowed down slightly due to a number of reasons but is still over and bove the rates observed in developed countries. Apart from its economic influence, China is one of the most influential BRICS+ members. BRICS+, Brazil, Russia, India, China South Africa, as well as Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates, are current member states. These countries do not only form an economic alliance but also a political one to act as a counterforce to the West order and international organizations, such as the IMF.

MAIN ECONOMIC TRENDS

As reported by Reuters, economic growth in China has totaled 5.0% in 2024, a decrease compared to last year. Also, according to OECD, the growth rate will gradually weaken in 2025 and 2026. According to the experts, housing starts will keep falling. However, infrastructure and manufacturing investment are rising at a steady pace with public investment increasing thanks to more local government debt issuance. Consumption growth will stay slow, depressed by higher savings. Consumer price inflation will, therefore, remain very low. Export growth will, however, remain quite strong. But tightening of global trade restrictions likely done by Donald Trump could contract Chinese industrial activity. Yet, recent policy measures taken by the Chinese government could raise confidence and consumption higher than many economists expect. One of the key problems of the Chinese economy is the property sector. Credit events could further disrupt its activity, thus affecting growth. Only increased government support could revive investment in the sector.

China is the world’s both largest seller and buyer of goods in 2024 and a major trading partner for more than 150 economies

In July last year there was a meeting organized by the Chinese Communist Party where the main economic priorities and trends were discussed. These included:

• Technological innovations, to reduce Chinese dependence on foreign supplies;

• Using modern technologies to innovate traditional industries, especially in the manufacturing sector;

• Exporting Chinese standards to international customers when they buy Chinese systems or technologies, to increase Chinese influence and create harmonization or plug-and-play challenges for international competitors;

• Allowing foreign companies to access China’s domestic market only if these companies share new technologies and knowledge.

In order to prevent the economy’s growth slowdown, the Chinese central bank is easing monetary policies. There has therefore been a series of cuts of the reserve requirement ratio, the policy and prime interest rates, as well as interest rates on existing mortgages. Housing support measures have been extended. For example, prudential regulations for second houses have been eased. Government fiscal policies are highly supportive of infrastructure projects and now also incomes. Increasing the local government special debt quota and debt swaps will raise funds available for projects. Matching of skills and education to those needed by the market would address skills shortages and also reduce youth unemployment, which has been quite high.

NEW INITIATIVES

China is experiencing high growth of emerging technologies, including 5G, advanced AI, IoT (Internet of Things), and blockchain-based technologies.

China is accountable for almost half of the world’s e-commerce transactions, while advancements by companies like Huawei, Baidu, JD and Tencent are helping the Chinese economy grow at a much higher rate than most developed countries. For example, according to World Bank, the EU’s average GDP growth rate in 2023 totaled only 0.4%.

China’s progress is also very strong in the field of blockchain technologies. As part of its data governance strategy, China has recently published its national blockchain infrastructure plans. These plans are expected to be fully implemented in China by 2029. This project could become one of the world’s largest blockchain-powered data networks and is expected to attract approximately 400 billion yuan or $54.5 billion in annual investments over the next five years.

Blockchain technologies are expected to affect many sectors of the Chinese economy, including supply chain tracking and quality control in industrial manufacturing.

Blockchain technologies improve transaction transparency and facilitate automated compliance processes. Obviously, these benefit the financial services sector. Healthcare providers would also gain access to patients’ data-sharing capabilities. Blockchain technologies are also highly effective in transportation, environmental protection as well as cross-border trade operations.

Also, green energy is an important part of China’s economic agenda. China has “dual carbon” goals—to reach its carbon emissions peak before 2030 and also become carbon neutral before 2060. Green energy is getting a larger proportion of the country’s energy consumption. In 2013, coal was accountable for 67% of Chinese energy consumption. That number decreased to 55.3% in 2023. Over the same period, the significance of oil, hydro and nuclear power have remained almost unchanged. The greening of the energy mix has been influenced mostly by the higher use of wind and solar power as well as natural gas.

CHINA’S TRADE

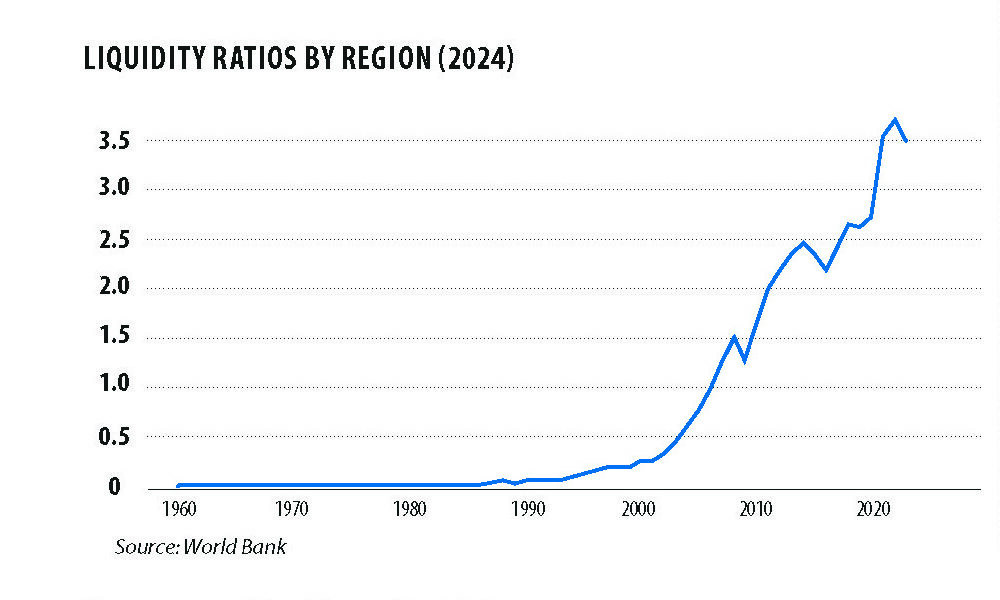

In the recent several decades China has been considered to be the world’s strongest export economy. Since 2000, Chinese exports have been rising at a very fast pace.

According to data released by the General Administration of Customs (GAC), China’s imports and exports increased by 5% year-on-year in 2024 to reach 43.85 trillion yuan ($5.98 trillion), while the total foreign trade volume set a new record high.

As the customs show, in 2024, China’s total exports, meanwhile, rose by 7.1% year-on-year to reach 25.45 trillion yuan. Imports, in turn, increased by 2.3% to hit 18.39 trillion yuan.

So, China is the world’s both largest seller and buyer of goods in 2024. China has become a major trading partner for more than 150 economies. Meanwhile, its circle of foreign trade partners is expanding.

China’s trade volumes under the BRICS cooperation increased by 5.5% with member and partner countries. Moreover, China and the EU maintained close economic and trade ties—bilateral trade increased by 1.6% in 2024.

Even US-China trade increased by 4.9%, closely matching China’s overall trade growth.

CHINESE POSITION IN THE WORLD’S SUPPLY CHAINS

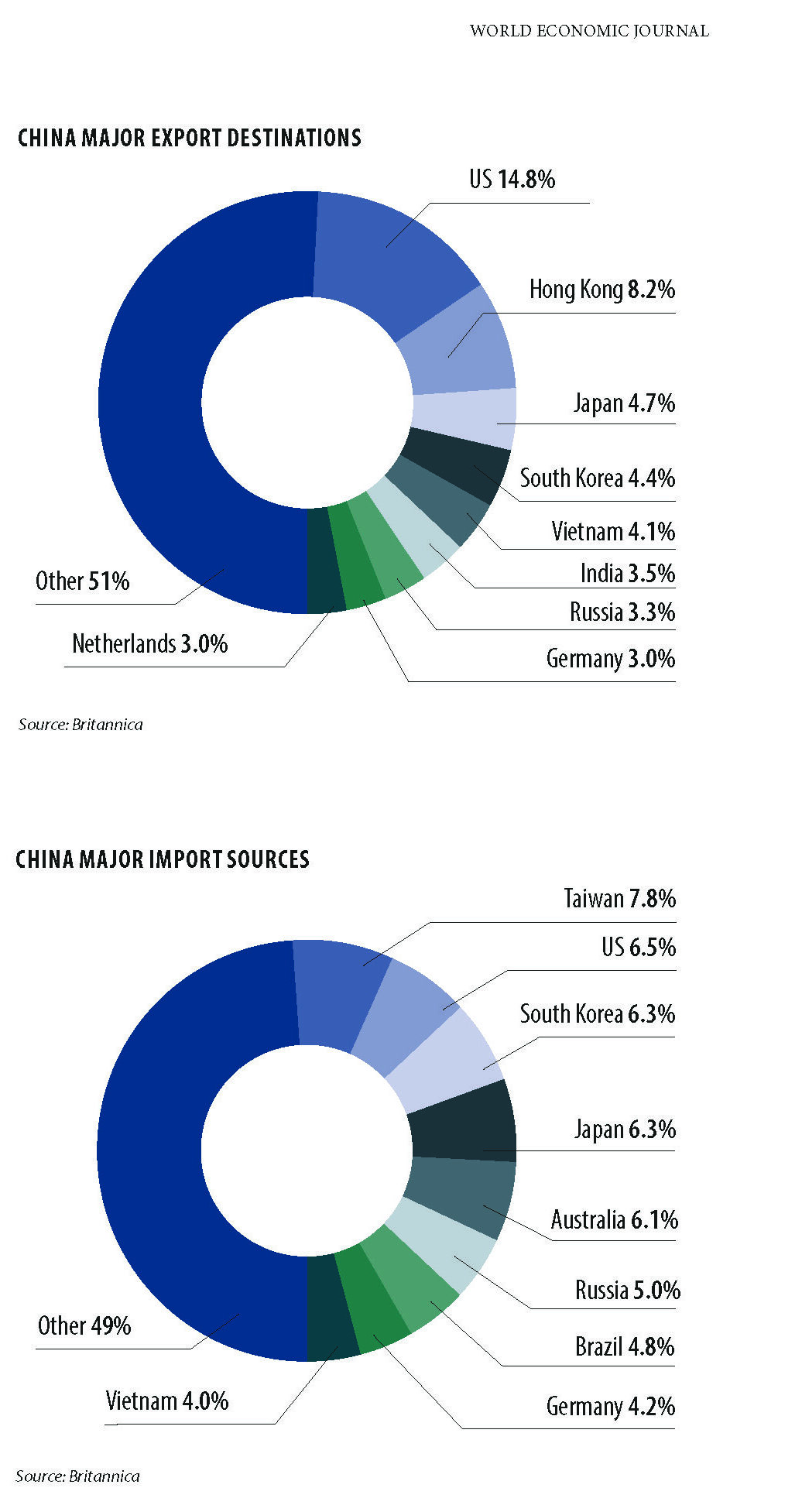

As I have mentioned above, China is the world’s leading exporting economy. Most of the country’s exports consist of manufactured products, such as electrical and electronic machinery, equipment, clothing and footwear. China also sells agricultural products, chemicals, and fuels. Its major export destinations are the US, Hong Kong, Japan, EU countries, and South Korea.

China mostly imports machinery and apparatus (including semiconductors, computers, and office machines), chemicals, as well as fuels. The main countries China imports products from are Taiwan, South Korea, Japan, the US, Aus- tralia, and the EU. Regionally, almost half of China’s imports are due to East and South- east Asia, and some a quarter of its exports go to the same trading partners.

GEOPOLITICAL CHALLENGES

One of the key geopolitical challenges for China, in my view, is centered on its relations with the US. Both economic and political relations between the US and China have been quite tense for several reasons. First of all, the US sees the rise of China as a direct threat to its global dominance. It is for exactly the same reason that the collective West is rather opposed to the BRICS’ expansion. In other words, China is seen as a strong rival to the US. One of the ways the US wants to control China is by imposing trade restrictions. The trade balance between the US and China is not in favor of the US, indeed. So, the newly elected president Donald Trump is highly likely to continue its trade policies the way it did during his 2016-2020 term. This means that Mr. Trump will raise tariffs of Chinese products.

But the sources of conflict do not only limit to trade. One of the recent misunder-standings between the US and China has been Taiwan. Moreover, the US administration has criticized China for its human rights violations. One of these has been the rights of Uighur-based Muslims.

SANCTIONS

Obviously, sanctions and trade measures against China only raise tensions be- tween the US and China and add more uncertainty around the world. To start with, it decreases international investors’ confidence. This is especially true of stock- holders investing in Chinese companies and corporations actively co-operating with China. That is because both Chinese companies exporting products to the US and US producers selling goods to China or having their production facilities in this country can face very serious losses. Obviously, people employed by these companies can be made redundant, thus raising unemployment numbers both in the US and China. Moreover, tariffs (taxes that governments place on imported goods), quotas (import limits that prevent more than a

set amount of a specific good from being imported into a country) and embargos (bans on the trade of a particu- lar good, category of good, or with a spe- cific country) increase prices of the goods affected. But due to rising prices of the goods affected the overall inflation levels in the US and China can rise, thus forcing the two countries central banks raise the interest rates. Tightening monetary con- ditions raises recession chances. So, if the trade war between the two countries goes too far, we are likely to see an economic crisis soon enough.

CHINA’S RESPONSE

In response to the US actions China also imposed tariffs on America’s products. Moreover, the Chinese government also introduced its own Anti-Foreign Sanctions Law in 2021. It also approved regulations very similar to those issued in the US—an export or trade law and an entity list—providing the Chinese government with an opportunity to punish foreign companies for activities seen as being against Beijing’s interests. However, Beijing’s reactions to the sanctions against Huawei as well as the recent technological and financial restric- tions have been quite moderate mostly because tougher countersanctions would have been self-defeating. For example, imposing sanctions against US companies like Apple or General Motors that have major production facilities in China would mean massive job losses for Chinese workers. Also, depriving US from access to Chinese rare earth minerals essential for green technologies would lead to the US finding alternative supplies elsewhere. As concerns Washington’s allegations of unfair trade practices, Beijing’s general reaction to was to ask for continued dia- logue and to highlight that progress had been made on many issues.

KEY ECONOMIC SECTORS

Despite the fact that China is famous for its manufacturing sector, Chinese services accounted for 54.6% of the country’s GDP in 2023. In other words, this is the country’s largest sector of economic activity. The services sector includes expert services, healthcare, and entertainment.

The manufacturing sector is account- able for over 38% of the country’s GDP. So, it is in the second place among the Chinese economy’s largest sectors. Most of the economic decline has been due to the industrial sector over the last couple of years. However, the manufacturing sector is still very important for the domestic economy. Nowadays, Chinese companies are getting more capital-intensive. They are also prioritizing the domestic market, while the government offers tax incentives and other support measures.

China’s agricultural sector contributes 7% to GDP and is the country’s third larg- est sector. China has always produced, ex- ported, and imported agricultural goods. The agricultural market’s gross output value is expected to reach $1,682 billion by 2028, constituting yearly growth of 5.95% between 2024 and 2028.

At the same time, China also imports agricultural products. The agricultural market is expected to import goods worth $218.1 billion in 2024. Between 2024 and 2028 the agricultural import growth rate is expected to total 17.73%.

China has also made substantial in- vestments in technology such as AI, the Internet of Things, and robotics. Such technological advancements have af- fected the services sector via fintech and e-commerce, the manufacturing sector via automation and also the agricultural sector via relevant technologies.

The Chinese government’s 14th Five-Year Plan for Digital Economy Develop- ment prioritizes blockchain technologies, 6G internet, sensors, and semiconductors.

Chinese services accounted for 54.6% of the country’s GDP in 2023—this is the largest sector of economic activity

GROWTH FORECASTS

According to Statista, the manufacturing sector in China is expected to grow by 2.00% between 2025 and 2029, thus resulting in a market volume of $5.2 trillion in 2029. Meanwhile, an annual growth rate of the agricultural sector is expected to be 3.44% between 2025 and 2029. According to the IMF, the services sector is expected to show the strongest performance in China. The projected growth rate will remain constant at about 5% in 2024, despite the property sector’s relatively poor performance.

POSSIBLE SCENARIOS

China, the leading BRICS+ economy, has been suffering from GDP growth slow- down. However, its contribution to the global economy is still very significant. China’s government as well as the People’s Bank of China have reasons to further stimulate the economy because of the country’ GDP growth slowdown and low inflation readings. Further monetary and fiscal incentives will make the economy grow faster. Low economic growth is not as dangerous as the overheated economy because after an economic boom there is traditionally a bust or an economic crisis. This is clearly not the case with China right now. So, it seems likely the Chinese economy is here

to gain. However, one of the largest problems facing China is dete- riorating relations with the US, including the US-China trade war and also tensions against Taiwan. Additionally, there could be a global financial crisis, which will likely affect China due to its reliance on exports to other countries.

RECOMMENDATIONS

China is still an attractive destination to invest money in. However, it is necessary to first analyze which Chinese assets will be most affected by a highly likely trade war ahead as well as the global financial crisis. Obviously, it is the best to choose high-quality assets, for example, stable and large Chinese corporations, and also to avoid investing too much capital in one country.

By Anna Sokolidou

PHOTO: GUI YONG NIAN / ADOBE STOCK

Stay informed anytime! Download the World Economic Journal app on the App Store, Google Play, ZINIO, Magzter and Issuu:

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal

https://www.magzter.com/publishers/World-Economic-Journal

Issue FEBRUARY – MARCH 2025 – World Economic Journal https://www.zinio.com/publications/world-economic-journal/44375