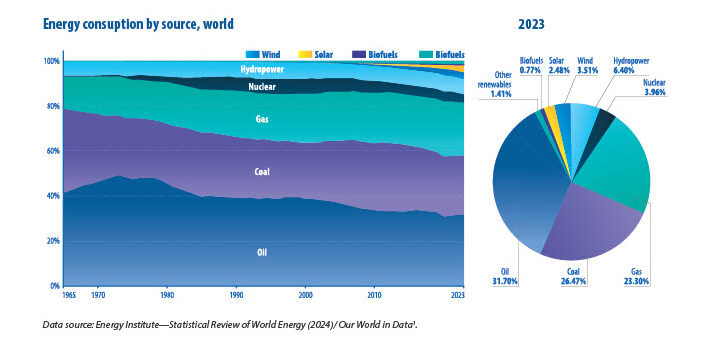

Historically, most countries have relied on fossil fuels like coal, petroleum, and natural gas for energy production. However, fossil fuels release carbon dioxide and other greenhouse gases, causing air pollution and climate change from heat trapped in the atmosphere.

The proven link between fossil fuel usage and climate change has spurred many countries to invest heavily in and create favorable policies for non-polluting, renewable energy. 195 countries, or all United Nations-recognized sovereign states, have signed the Paris Agreement, a legally binding treaty to reduce greenhouse gas emissions and curb global warming.

Transitioning to a carbon-free, renewable energy-based world requires massive investments and policy shifts. Despite exponential growth in the renewable energy sector, coal, oil, and gas currently constitute 81% of global energy consumption (1).

Decarbonizing the global energy industry is feasible but wrought with many financial, technical, and political challenges. Transitioning to wind, solar, and other renewable energy sources requires public support, which can be difficult to build in some countries. It also requires substantial capital from government and private institutions to resolve crucial technical issues, like affordable battery storage.

Fortunately, these challenges are being resolved as time passes, spurring unseen growth in renewable energy production. In 2023, the world added a record-shattering 473 gigawatts (GW) of renewable power capacity, mainly solar and wind (2). This momentum is set to continue in 2024.

According to BloombergNEF (3), solar and onshore wind are the cheapest new electricity sources for at least two-thirds of the world’s population. The record-shattering new solar and wind power plant installations worldwide prove this claim.

Rapid innovations from commercial and government institutions propel global renewable energy growth. This article will examine the key innovations and policies boosting renewable energy production and efficiency.

KEY PROJECTS FOR 2025

2025 will be a crucial year for the renewable energy industry, with many innovations and expectations amid an industry-wide boom. Let’s explore the key projects to note in the solar, wind, and hydrogen energy sectors.

- Wind energy and solar power plants

Solar and wind have taken center stage in the renewable energy transition and will continue to do so in 2025. According to the International Energy Agency (IEA) (4), solar alone will fulfill half of the global growth in electricity demand in 2025.

- The solar boom

The solar boom is driven primarily by decreasing costs and advancements in photovoltaic technology. According to the International Renewable Energy Agency (IRENA), solar module costs have fallen 90% since 2009 (5). Reduced costs lead to rapid growth for both rooftop solar installations and utility-scale solar farms. This benefit is more pronounced in developing countries with significant financial constraints.

Increased efficiency is the core technical advancement driving solar energy growth. Efficiency is the percentage of sunlight converted into usable electricity by photovoltaic panels.

Most solar panels’ efficiency hovers at 15% to 20% (6). An uptick in this efficiency means more energy harvested from solar panels of the same size, translating to more energy to supplant fossil fuel production and reduce greenhouse emissions.

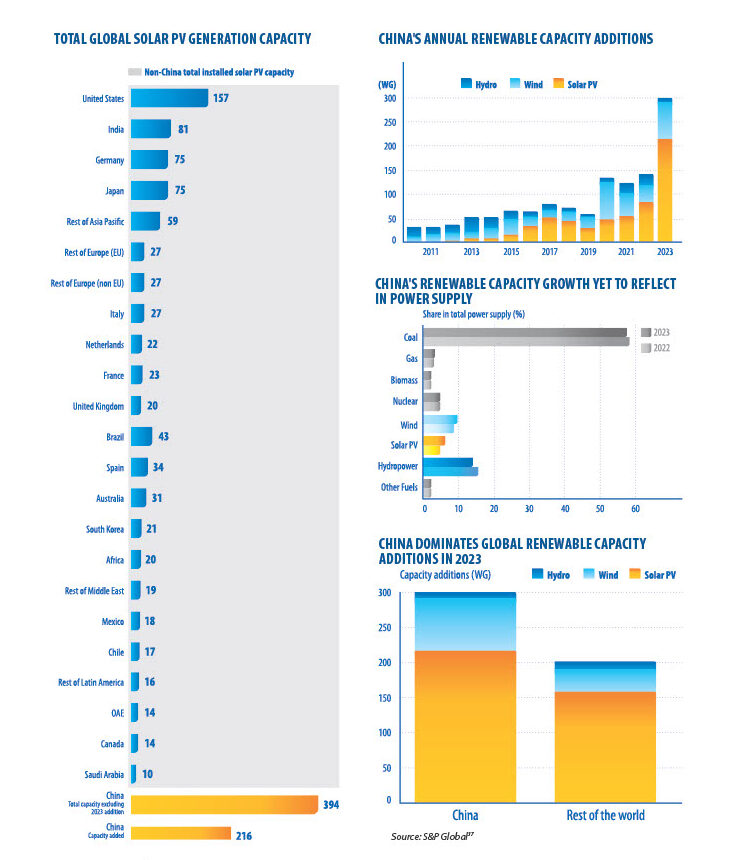

China is the biggest manufacturer of solar panels, and its domestic manufacturers drive the most innovation in this sector. China was helped by economies of scale stemming from its 1.4 billion-strong population and rising energy demand. The government was incentivized to find affordable energy sources to meet growing demand, and solar proved a good bet. Local companies responded to subsidies, tax breaks, and other incentives and catapulted China to the leading solar energy producer.

In June 2024, the world’s largest solar power plant, the Ürumqi Solar Farm with a 3.5 GW capacity (7), went live in China. It beat the previous record holder, India’s Bhadla Solar Farm, with a 2.7 GW capacity (8).

In September 2024, Longi, a Chinese solar panel manufacturer, unveiled a prototype with 34.6% efficiency (9). This prototype used perovskite cells, unlike the silicon most solar cells currently use. It’s far from mass production, but it demonstrates how efficient solar panels could become soon and boost renewable power production.

Though China leads, many other countries contribute to advancing solar energy production. The US. added a record-setting 26.3 gigawatts of solar power capacity in 2023 (10) and 11.8 gigawatts in the first three months of 2024 (11). Solar now accounts for three-quarters of the electric generation capacity added to the US grid.

Other countries across Asia, Europe, North America, the Middle East, and Africa have seen record solar installations. Solar energy’s affordability has made it the go-to option for new power generation capacity, beating long-running sources like coal and natural gas.

- The wind energy rush

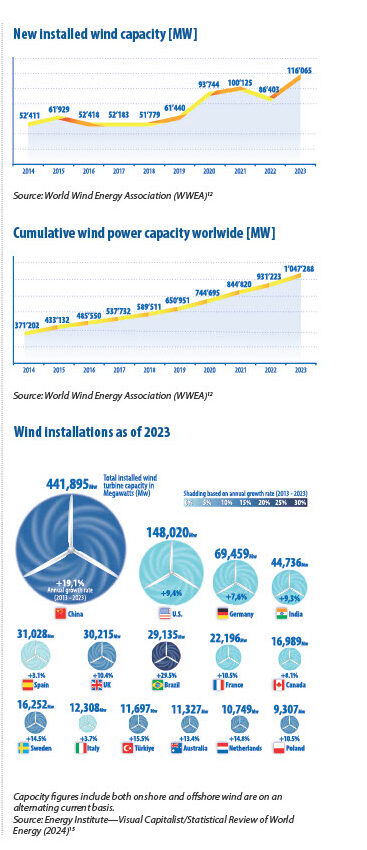

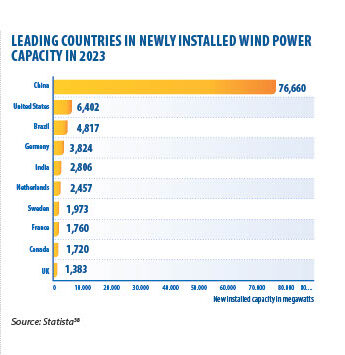

Like solar, wind energy has experienced record-setting installations worldwide. According to the World Wind Energy Association (WWEA), the global wind industry installed 116 GW of generation capacity in 2023, up 34% from the previous year and more than double the capacity installed five years before (12).

In 2023, the total wind power capacity surpassed 1 terawatt, or 1,000 GW, for the first time. 2024 and 2025 are expected to witness more record-breaking wind power installations worldwide.

Several factors drive the wind energy boom. For one, many countries have invested heavily in wind power to meet renewable energy targets. Wind turbine efficiency has increased thanks to lighter materials and larger blade sizes that capture more wind speed.

Streamlined blades reduce drag to capture and convert more wind energy into electricity, and newer turbines have adjustable blade angles to capture the maximum energy under varying wind conditions. New investments and permitting are driving a boom for offshore wind power plants, where wind is stronger and more consistent than on onshore plants.

China leads the world in total wind energy production, followed by the US and Germany. However, Sweden and Denmark are the biggest producers per capita, generating 24% (13) and 53% (14) of domestic electricity from wind, respectively.

Wind and solar power generation are growing immensely because of their relative affordability. They’re the cheapest new power generation sources, prompting government and commercial institutions to invest in them rationally. The solar energy boom and wind energy rush aren’t stopping, but the situation isn’t all rosy.

Wind and solar have major challenges because they’re intermittent. The wind doesn’t blow every time, and sunshine is limited to daytime hours. This intermittency means wind and solar must be paired with large-scale battery storage or other baseload sources to provide energy when they aren’t capable. Clean-energy-produced hydrogen is a potential baseload source that’s gaining steam.

HYDROGEN ENERGY

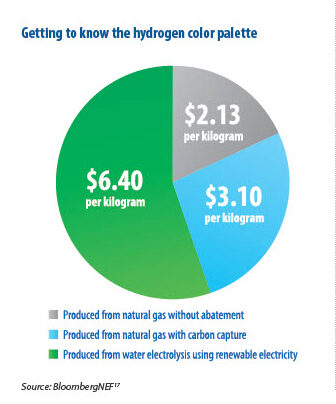

Hydrogen is a clean fuel for baseload electricity generation because it can be burned without releasing carbon dioxide. However, its clean tag depends on being produced from renewable energy electricity sources like solar and wind. Producing hydrogen from natural gas releases carbon dioxide, which countries want to avoid.

Hydrogen is a tricky element. It’s the third-most abundant element on earth but hardly obtainable in its pure form. Instead, it can be obtained by electrolysis, i.e., using electricity to split water into hydrogen and oxygen.

Solar and wind electricity generation can be paired with hydrogen production for baseload capacity. During peak solar and wind hours, excess clean electricity can be used to produce hydrogen. Then, the hydrogen fuel can be burned when solar isn’t available or wind power is low. The hydrogen is produced and burned without greenhouse gas emissions, a win-win.

Yet, producing hydrogen isn’t as simple as it sounds. The process is currently too costly for most large-scale projects. Electricity costs constitute 45–60% of hydrogen production costs16, and obtaining cheap, clean energy can be difficult.

According to BloombergNEF (17), the cost of green hydrogen (produced without carbon emissions) is currently $4.5 to $12 per kilogram, compared to $1.8 to $4.7 for blue hydrogen produced from fossil fuels in carbon-emitting processes. Green hydrogen production costs must be reduced to spur mass adoption, and some innovations are making this gradually happen.

For instance, green hydrogen production relies on an industrial electrolyzer powered by clean electricity. Commercializing new types of industrial electrolyzers, such as the anion exchange membrane water electrolyzer (AEMWE), can reduce production costs. Existing electrolyzers can also be made more efficient to reduce production costs, i.e., to convert more of their electricity input into hydrogen.

“The more electrolyzers are deployed, the cheaper they’ll become,” says Adithya Bhashyam, a BloombergNEF hydrogen analyst. “In Brazil, China, India, Spain, and Sweden, green hydrogen from new plants is going to start undercutting gray hydrogen from existing plants by the end of the decade,” he says. “Remarkably, this holds true even for green hydrogen plants built without subsidies.”

In 2022, Australian startup Hysata claimed it developed an electrolyzer with a 98% efficiency under lab conditions18. This efficiency is far above the average 70% of existing electrolyzers19. It implies generating much more hydrogen from the same electricity input, reducing production costs. However, translating this higher efficiency from lab conditions to largescale production will take some time.

An innovative US-based startup, Koloma, wants to sidestep the electrolysis process to obtain pure hydrogen. Its approach is to drill naturally occurring hydrogen from underground deposits, helped by existing oil and gas industry drilling technologies.

Koloma was born from extensive academic research by Ohio State University geologist Tom Darrah, the company’s chief technology officer. It has secured over $300 million in venture funding20, including from Bill Gates and United Airlines. It also won a $900,000 research grant from the US Energy Department (20) to explore geologic hydrogen production.

If Koloma’s approach succeeds, the costs of obtaining hydrogen could drastically reduce, spurring a clean energy future based on solar and wind plus hydrogen for baseload generation. Innovation has brought hydrogen production costs down from historical levels, but more must be done to make largescale production feasible. Companies like Koloma and Hysata are leading these innovations.

THE ROLE OF TECHNOLOGY IN A RENEWABLE ENERGY FUTURE

Technology will play a major role in the global transition from fossil fuel to renewable energy production. Let’s explore the key technologies powering this transition and their key challenges.

- Artificial intelligence and energy grid management

Transitioning towards a clean energy future requires innovations in more than just the generation aspect. Smart grid management is also crucial to integrating renewable energy into existing consumption patterns. The rise of artificial intelligence (AI) will help speed up this integration.

The power grid is fondly called the most complex machine ever built. Clean electricity travels many complex steps from power generation plants to the population centers where it’s consumed. Computers are crucial to managing these steps, and AI has already begun making it more efficient.

For instance, AI makes it easier for assets within the electricity grid to communicate, knowing when to spin up or reduce power output to keep the grid balanced. Sensors can detect risks early and redistribute or reroute power to prevent outages.

AI models can analyze historical weather and grid demand patterns to forecast future energy consumption. This predictive analytics guides electricity producers in delivering ample power during peak consumption periods. During peak periods, solar and wind often produce significantly more energy than the required consumption. Battery storage remains a pressing issue, so much of this power is wasted instead of stored. AI can analyze the grid to detect peak wind and solar generation, telling residential and industrial consumers when to run the highest loads at the lowest costs. Demand management is vital, as demonstrated by the US Federal Energy Regulatory Commission, whose study indicates 150 GW can reduce peak loads through smart grid management (21). 150 GW is equivalent to the output of 2,000 peaker power plants, and reducing this load saves tons of carbon emissions. In November 2024, Singapore signed a deal to build its first district-level AI-based smart grid (22). Danish power companies have begun leveraging AI to inspect grid components and minimize unnecessary physical grid inspections (23). In 2023, the US government announced $3.9 billion in grants for smart grid solutions, including AI-based advancements (24).

Artificial intelligence is in its relative infancy, so the best is yet to come. The next decade will likely witness exceptional AIbased advancements for energy optimization, helping usher in a clean, energy-powered future.

- Battery technologies and energy storage

With sufficient battery storage, excess capacity from wind and solar power plants can be stored for future usage. However, affordable battery storage is a core challenge in transitioning to renewable energy.

Batteries store energy by converting electrical power into chemical energy. Later, the chemical energy can be released to produce electrical power. Lithium-ion batteries are most commonly used for utility-scale storage. They work by moving lithium ions between a battery’s cathode (positive side) and anode (negative side) to release electrical current.

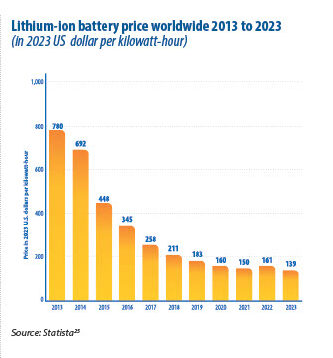

Lithium-ion batteries currently need to be cheaper for most commercial power suppliers despite hitting a record low of $139 per kilowatt-hour (KWh) in 202325. Prices must be reduced substantially to spur large-scale battery storage projects, which will provide electricity during low-output periods of wind and solar power plants.

The good news is that battery manufacturers are innovating rapidly to reduce costs. The cost of raw lithium, the main ingredient in lithium-ion batteries, also dropped substantially from $80,000 a ton in December 2022 to $10,000 a ton in December 202426, a 90% reduction within two years. This sharp drop translates to lower production costs for lithium-ion battery manufacturers.

China-based CATL is the world’s leading lithium-ion battery manufacturer. Other top manufacturers include China-based BYD, South Korea’s LG Chem, and Japan’s Panasonic. These companies have invested heavily in research and development to reduce production costs and increase battery efficiency, with good results.

2024 CATL unveiled Tener, a 6.25 MWh storage system stacked in a 20-foot equivalent unit (TEU) container27. This battery system’s defining feature is increased energy density, enabling more energy to be stored in less space. It makes building utility-scale storage facilities in populated areas technically and financially easier.

The chart on page 51 demonstrates lithium-ion battery prices falling from $780 per kilowatt-hour in 2013 to $139 in 2023. This reduction will keep pace in 2024, 2025, and beyond. With reduced prices, expect more massive utility-scale storage projects to usher in a renewable energy future.

For instance, the US Energy Information Administration (EIA) forecasts domestic battery storage capacity to double in 202428. This doubling is driven by new utility-scale storage projects in California and Texas, the two biggest renewable energy-producing states in the US.

Australia, a major solar and wind energy producer, added 3.9 GWh of battery storage capacity from July to September 202429, a 95% year-on-year growth rate. If this growth in the US, Australia, and other countries persists, global battery storage capacity could soar to 1,000 GW by 203030, compared to 126 GW in 202431, helping humanity edge closer to clean power generation.

ENERGY TRANSFORMATION IN NATIONS

The global transition from fossil fuels to renewable energy is spearheaded by public-private partnerships. Governments kickstarted the renewable energy industry with incentives, and private companies followed suit. Let’s examine key transformation energy initiatives across Europe, the US, and China, the three biggest energy consumers.

The European Green Deal

• The European Green Deal is a set of policy agreements aimed at making all 27 European Union (EU) countries climate-neutral by 2050. Launched in 2020, this policy inked a deal to make European Union countries net zero emitters of greenhouse gases by 2025. In 2021, the Green Deal became legally binding after the passage of the European Climate Law.

• The Green Deal centers on transitioning the EU from fossil fuel energy consumption towards renewable sources. EU countries are investing heavily in boosting renewable energy production with effective results.

• In the first six months of 2024, EU countries generated more electricity from solar and wind (30%) than from fossil fuels (27%)32. It marked the first time wind and solar surpassed fossil fuel generation in the EU.

“Following two record years for renewables installations, in the first half of 2024 wind and solar have risen to new highs, overtaking for the first time fossil fuels in our electricity mix,” EU Energy Commissioner Kadri Simson confirmed. “The EU is now well equipped to meet its climate neutrality goal while ensuring that industry stays competitive.”

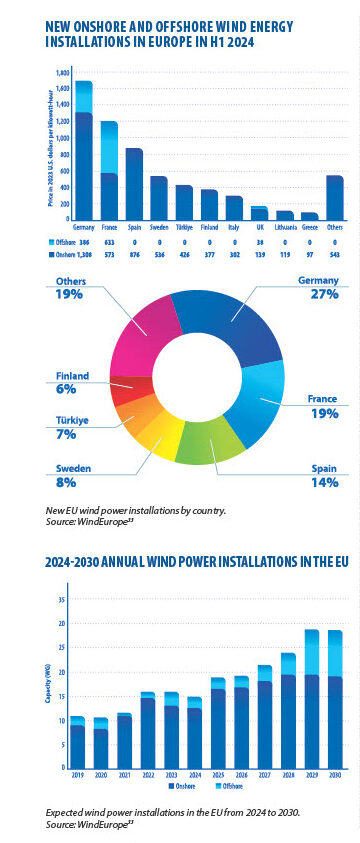

As of 2024, EU countries have 225 GW of wind capacity, accounting for most of Europe’s 278 GW capacity. In the first half of 2024, the EU installed 6.4 GW of new wind power capacity, with offshore wind plants constituting 83% of this new capacity. Germany, France, and Spain account for most of the new wind power capacity (33).

From 2024 to 2030, the EU is expected to add 22 GW of wind farms annually, although the Green Deal aims to increase it to 33 GW. By 2030, the EU targets 425 GW of wind power capacity.

Solar is also booming in the EU, which installed a record 55.9 GW of new capacity in 2023. Germany, Spain, and Italy contributed the most to new solar power installations. The EU’s total solar power capacity reached 263 GW in 2023, up 27% from the previous year (34). Double-digit growth is expected from 2024 to 2027, implying the solar boom is still ongoing.

The European Green Deal has spurred EU members to create favorable policies and monetary incentives for clean energy production, primarily wind and solar. Many opportunities abound for investors to profit from renewable energy production and reduce carbon emissions to create a safer world, making a two-bird killing with one stone.

Innovative projects in China and the USA

China leads the world in renewable energy production. According to the Chinese National Energy Agency, it added a record 216 GW (35) of solar capacity in 2023, or as much as the rest of the world combined. In 2024, it is projected to install 230 to 260 GW (36) solar panels, besting its previous record.

China added 77 GW of wind power in 2023, beating all other countries by a wide margin. The second-highest addition came from the US. with 6.4 GW of capacity (38).

Like the EU, the Chinese government has committed to transitioning towards renewable energy-based consumption. It pledged to reach 1,200 GW of renewable capacity by 2030 and has already surpassed that pledge, with 1,450 GW installed as of 2023 (39).

The US, the second-largest energy consumer after China, has similarly bet big on renewables. It deployed 32 GW of new solar capacity in 2023, up 52% from the previous year. For the f irst time, solar accounted for over half of the new electricity-generating capacity added to the US grid. In 2023, the US nearly doubled its solar module manufacturing capacity from 8.5 GW to 16.1 GW (40).

New wind power capacity in the US hit a record 6.4 GW in 2023. These record-shattering additions were helped by the Inflation Reduction Act passed by the US government in 2022. This Act, the most significant climate law passed in US history., allocated over $100 billion in grants (41) for clean energy development.

A sample US government loan recipient is Redwood Materials, a company developing innovative ways to recycle lithium-ion batteries. It breaks down old batteries to provide raw materials for new batteries, reducing manufacturers’ costs. To scale its recycling capacity, it received a $2 billion loan from the US Energy Department (42).

As solar panels and wind turbine blades reduce in price and increase efficiency, expect more record-shattering additions from Europe, the US, China, and many other countries in 2025 and beyond. Manufacturers are improving existing processes to harness as much clean energy power as possible, encouraged by favorable government policies and incentives.

PROSPECTS AND RISKS

The renewable energy sector has good prospects yet has its risks. Let’s explore what lies ahead for this booming industry.

• Forecast for 2025 and beyond

Renewable energy is currently on a tear and isn’t projected to stop anytime soon. By 2030, a landmark year of climate pledges, the International Energy Agency expects renewable energy to fulfill 46% of the world’s electricity demand, compared to 30% currently (43).

The renewable energy sector continues to supplant fossil fuels in the biggest energy-consuming regions, including the US, China, and the EU. As time goes on, we expect this trend to spread to other countries attracted by the low costs of renewable energy.

For example, Texas, the largest oil and gas-producing state in the US, has become the largest producer of renewable energy despite little government incentives. Since 2014, the state has seen a 70-fold increase in solar generation (44). It demonstrates the resilience of the renewable energy industry, spurred by rapid innovations and falling production costs.

• Investment opportunities

The shrinking costs of solar modules, wind turbines, and battery storage have opened more lucrative opportunities for investors to build renewable power capacity. Investors can make long-term profits from renewable energy power plants.

The cost of renewable energy production is mostly a onetime investment, unlike carbon-emitting power plants, which require a constant fuel input, and prices are subject to changing economic conditions.

Solar and wind power plants receive free energy inputs from the sun and natural wind, respectively, which reduces their maintenance costs. Government incentives also lower production costs and increase potential profits for commercial power producers. Ample opportunities abound in the rapidly growing renewable energy industry.

_________________________________________________________________________________________________________________

(1) Energy consumption by source. Our World in Data. (n.d.). (2) Systemic Changes Needed to Triple Renewables by 2030. IRENA (n.d.). (3) Bloomberg —Solar and Wind Cheapest Sources of Power in Most of the World (2020, April 28). (4) Global Electricity Demand Set to Rise Strongly This Year and Next, Reflecting Its Expanding Role in Energy Systems Around the World – News – IEA, 2024. (5) Power generation costs. IRENA (n.d.) (6) Staff, A. (2024, November 15). A guide to solar panel efficiency. Aurora Solar. (7) Shaw, V. (2024, June 6). World’s largest solar plant goes online in China. Pv Magazine International. (8) Largest solar PV power plants worldwide 2023 | Statista. (2024, May 22). Statista. (9) Bellini, V. S. a. E. (2024, September 12). Longi achieves 34.6% efficiency for two-terminal tandem perovskite solar cell prototype. PV Magazine International. (10) National Survey Report of PV Power Applications in the USA 2023 – IEA-PVPS. (2024, October 24). IEA-PVPS. (11) Yuen, S. (2024, June 6). US breaks Q1 record to add 11.8GWdc solar capacity in previous quarter. PV Tech. (12) WWEA Annual Report 2023: Record year for Windpower. (13) Sweden. (n.d.). IEA Wind TCP. (14) Denmark. (n.d.). IEA Wind TCP. (15) Energy Institute. (n.d.). Home. Statistical Review of World Energy. (16) Reducing low-carbon hydrogen investment and operating costs – Capgemini. (2024, July 5). Capgemini. (17) BloombergNEF. (2023, August 9). Green hydrogen to undercut gray sibling by end of decade | BloombergNEF. BloombergNEF. (18) Hysata’s electrolyser breaks efficiency records – Hysata. (2022, March 15). (19) Hydrogen science and Engineering. (n.d.). Google Books. (20) Ohnsman, A. (2024, February 12). Bill Gates-Backed clean fuel startup raises $246 million to aid plans to drill for hydrogen. Forbes. (21) National Assessment & Action Plan on Demand Response – 2009 National Assessment. (n.d.). Federal Energy Regulatory Commission. (22) Singapore to build its first district-level smart grid. govinsider.asia (n.d.). (23) De Marie, O., & De Marie, O. (2023, September 23). Artificial intelligence revolutionizes power grid management in Denmark. Microgrid Media. (24) Battery price per kwh 2023 | Statista. (2024, October 1). Statista. (25) TRADING ECONOMICS. (n.d.). Lithium – price – chart – historical data – news. (26) Maisch, M. (2024, April 12). CATL unveils first mass-producible battery storage with zero degradation. Pv Magazine International. (27) US battery storage capacity expected to nearly double in 2024 – US Energy Information Administration (EIA). (n.d.). (28) Maxhall. (2024, November 11). Australia closed on a record 3.9 GWh of battery storage capacity in July-to-September – Energy Storage. Energy Storage. (29) BloombergNEF. (2021, November 10). Global energy storage market set to hit one Terawatt-Hour by 2030 | BloombergNEF. BloombergNEF. (30) Statista. (2024, June 28). Forecast battery storage capacity 2024, by global leader. (31) Frost, R. (2024, September 12). Wind and solar have risen to ‘new highs’ in the EU overtaking fossil fuels for the first time ever. Euronews. (32) WindEurope asbl/ vzw. (2022, April 2). Product | WindEurope. WindEurope. (33) EU market Outlook for solar Power 2023-2027 – SolarPower Europe. (n.d.). (34) Shaw, V. (2024a, February 2). China’s new PV installations hit 216.88 GW in 2023. Pv Magazine International. (35) Bloomberg. (2024, December 5). China to set another solar record even as industry struggles. Energy Connects. (36) Infographic: China’s solar capacity growth in 2023 sets new record. (2024, February 8). S&P Global. (37) Global installed wind power capacity additions 2023 | Statista. (2024, April 26). Statista. (38) Statista. (2024b, July 19). Renewable energy capacity in China 2009-2023. (39) DiGangi, D. (2024, March 6). US deployed a record 32 GW of solar generating capacity in 2023: SEIA. Utility Dive. (40) Volcovici, V. (2024, December 3). Biden pushes out over $100 billion in clean energy grants as term winds down. Reuters. (41) LPO offers conditional commitment to Redwood Materials to produce critical electric vehicle battery components from recycled materials. (n.d.). Energy.gov. (42) Global overview – Renewables 2024 – Analysis – IEA. (n.d.). (43) New analysis: Texas continues dominance in wind and solar power generation. (2024, October 23).

By Chisom Maduonuorah

PHOTO: TOPE007 / STOCK.ADOBE.COM; PHOTO: ES SARAWUTH / SHUTTERSTOCK; PHOTO: FOTOGRIN / SHUTTERSTOCK;

Stay informed anytime! Download the World Economic Journal app on the App Store and Google Play.

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal