PREREQUISITES FOR FUTURE CHANGES

According to the International Monetary Fund (IMF), global economic growth slows to 2.5% in 2024, driven by rising rates and high inflation. In this environment, successful strategies will depend on the flexibility of markets and the ability to embrace innovation.

• Rate hikes and their consequences

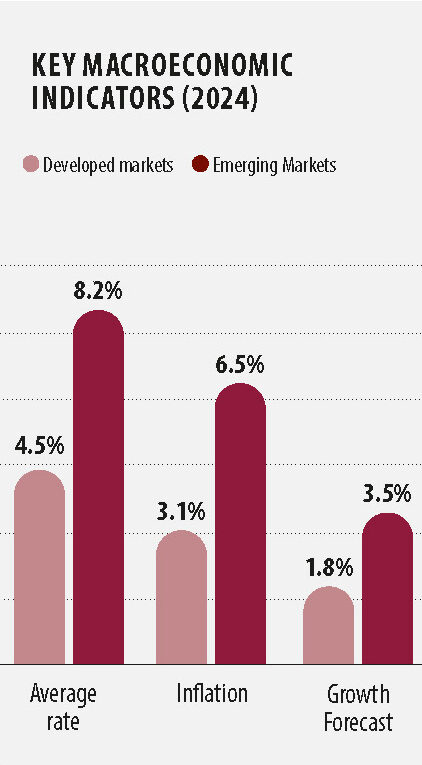

Central banks continued tightening policies in 2024, pushing average interest rates up to 4.5% in developed countries and 8% in emerging markets. This created significant obstacles for small and medium-sized businesses, limiting access to debt financing.

“Rate hikes are necessary to combat inflation, but their consequences make things more difficult for many companies, especially in highly indebted countries,” said James Robertson, World Bank.

Main consequences:

1. Reduction in lending volumes:

Small and medium-sized businesses, which are most dependent on borrowed funds, face difficulties in financing.

2. Growing debt burden: Companies with high debt loads experience increased debt servicing costs.

3. Decrease in investment: High rates limit investment activity in infrastructure and technology projects.

• The rise of digitalization. The digitalization of financial systems continues to accelerate. One of the main trends is the introduction of central bank digital currencies (CBDC). Russia has completed a pilot project for a digital ruble, and China is actively developing its digital yuan, strengthening its position in the innovation market.

Advantages:

1. Reducing transaction costs: Facilitating settlements between banks and companies.

2. Increase transparency: Increasing confidence in financial transactions.

3. Accelerate payments: Reduced processing time for international transactions.

ESG AND SUSTAINABLE DEVELOPMENT

According to Bloomberg, 50% of global funds have already integrated ESG criteria into their strategies, which ensures the stability of their assets even in conditions of market volatility. This share could rise to 60% in 2025, thanks to tighter regulations in Europe and increased investment in low-carbon projects.

“Companies that embrace ESG gain a competitive advantage in the long term,” says Julia Hunter, analyst at MSCI.

TRENDS 2025: IMPACT OF CENTRAL BANK RATE HIKE

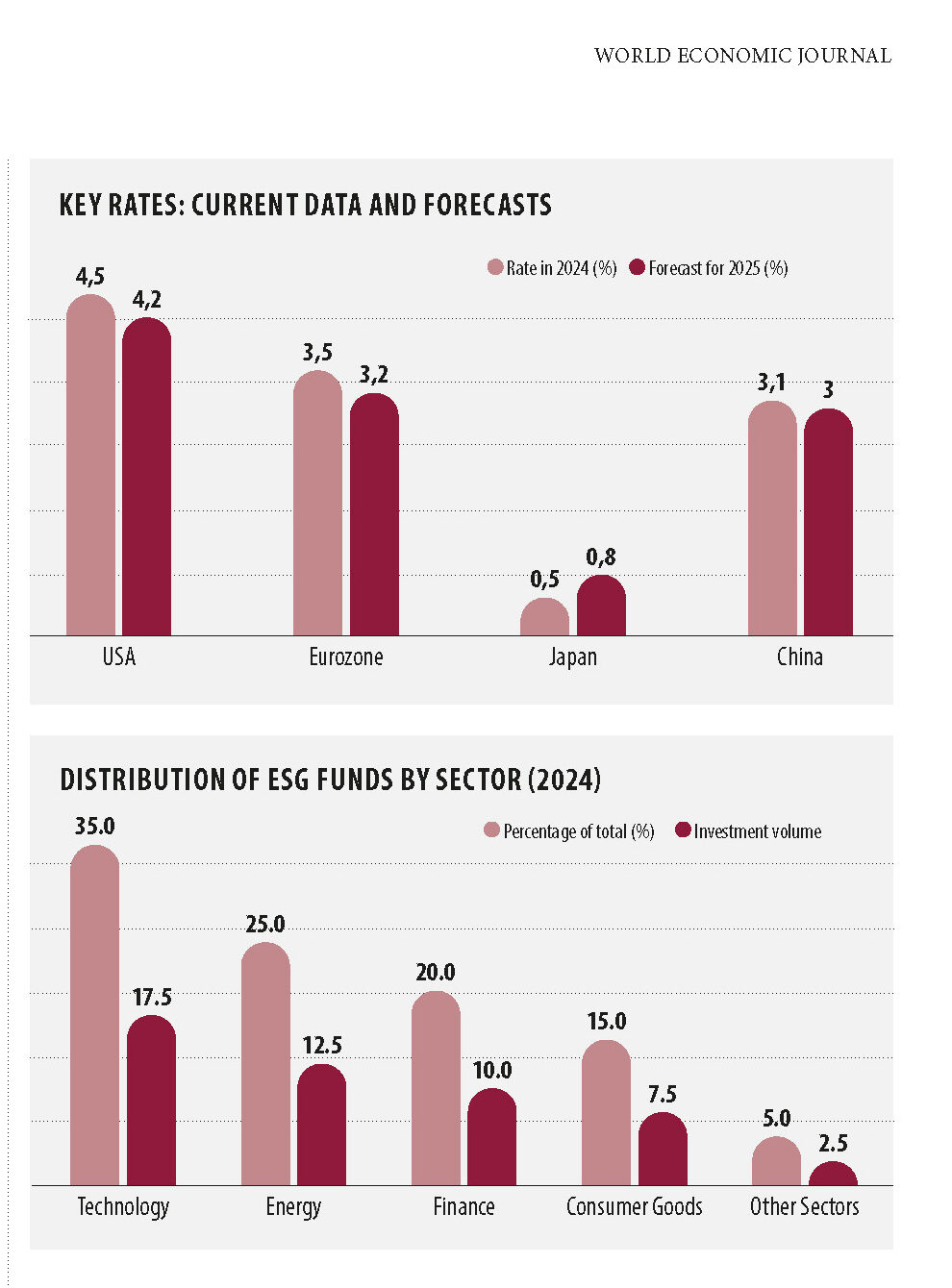

In recent years, central banks around the world have been aggressively raising key interest rates in an effort to combat inflation. This process has had a significant impact on the global economy, changing investor behavior and lending conditions. According to the International Monetary Fund (IMF), in 2024 the average interest rate in developed countries reached 4.5%, which is the highest value in the last two decades.

By 2025 expected, that central banks will continue to keep rates high to control inflation. However, this could lead to a decline in investment activity and a slowdown in economic growth.

• Impact on the global economy

Higher interest rates lead to higher lending costs, which in turn reduces spending by companies and households. According to Bloomberg, in 2024, corporate borrowing fell by 15% compared to the previous year. This limits opportunities for business development and job creation.

“High rates are necessary to contain inflation, but they must be balanced with support for economic growth,” said Christine Lagarde, president of the ECB.

• Risks and challenges for developing countries

Rising rates pose a particular threat to developing economies. According to a World Bank study, rising borrowing costs are increasing the debt burden, making it difficult to finance infrastructure projects and social programs. In Nigeria, for example, the cost of public debt servicing increased by 30% in 2024.

At the same time, higher rates help strengthen national currencies against the US dollar, which positively affects imports. However, this benefit is often offset by a reduction in foreign direct investment flows, as investors prefer markets with higher returns.

“A longer period of high interest rates is creating difficulties for borrowers, especially in developing countries. Combining monetary measures with policies aimed at stimulating investment is critical” — Tobias Adrian, Senior Economist, IMF.

For many developing countries, such as India and Brazil, finding alternative sources of financing is becoming a key focus. Government bonds denominated in local currencies are becoming increasingly popular due to their reduced exposure to dollar fluctuations.

• Forecasts for 2025

Experts predict that in 2025, key rates will begin to decline gradually, especially in developed countries. Reducing inflation to target levels (around 2%) will be the main driver of easing monetary policy. However, rates may remain high in developing countries due to pressure on national currencies.

For businesses and investors, this means adapting to a high cost of capital environment. Companies will be forced to optimize their operating costs and seek new sources of financing, including green bonds and private equity.

TRENDS FOR 2025: GROWING ROLE OF ESG INVESTING

In recent years, the concept of ESG (environmental, social responsibility, and corporate governance) has become central to the strategies of investors around the world. According to MSCI, the volume of assets under management that meet ESG criteria will reach US$50 trillion in 2024 and continue to grow. Growing interest in ESG investing is due not only to ethical considerations but also to the proven stability of such assets in conditions of market volatility.

By 2025, it is expected that ESG will become the standard in investment management, thanks to increased regulation, higher investor expectations, and increased awareness among companies of the importance of sustainability. However, with this growth come challenges, such as the problem of greenwashing and the lack of globally accepted ESG assessment standards.

• ESG as a Market Driving Force

ESG criteria are becoming an important factor in investment decisions. Investors increasingly evaluate companies not only on financial indicators but also on their environmental impact, social responsibility, and the quality of corporate governance. According to Bloomberg, in 2024, 40% of global funds took into account ESG criteria in their strategies.

“ESG is becoming not just a trend but a necessity for companies looking to raise capital. Investors are demanding transparency and real action on sustainability,” says Julia Hunter, analyst at MSCI.

CHALLENGES AND PROSPECTS OF ESG INVESTMENTS

Despite their growing popularity, ESG investing faces a number of challenges. The main one is the problem of “greenwashing,” where companies artificially inflate their sustainability achievements. According to a study by the European Commission, in 2024, more than 30% of companies’ ESG reports contained unsubstantiated data.

“Only companies that can demonstrate their commitment to ESG principles through real actions, not just declarations, will be able to maintain investor confidence,” says Carlos Rivera, consultant European Commission.

In 2025, the introduction of new international standards is expected, which will unify the approach to ESG assessment and reduce the level of greenwashing.

For investors, ESG remains one of the most promising areas. Companies that integrate sustainable development into their strategy become more attractive for investment. At the same time, the importance of competent regulation of the ESG market and the implementation of international assessment standards cannot be overestimated.

Investors should pay attention to the quality of companies’ ESG reporting and avoid greenwashing. In 2025, low-carbon technologies and projects aimed at social development will become the main priorities of ESG investments.

KEY CHALLENGES: RISK MANAGEMENT AND COMMODITY MARKET VOLATILITY

The year 2025 will bring many challenges for the global economy, with risk management remaining a key priority. Global instability is increasing due to geopolitical tensions, climate change, the effects of the pandemic, and inflation waves. According to the Bank for International Settlements (BIS), the global debt stock will reach $305 trillion in 2024, posing new challenges for corporations and financial institutions.

Example: Financial risks Large corporations such as Volkswagen and Toyota are adapting to volatility through hedging strategies. In 2024, automakers actively used futures contracts to protect against rising metal prices.

Example: Technological risks Digitalization of the economy also creates new challenges According to KPMG, 68% of CEOs in large companies fear cyber threats as a factor of destabilization. In response, banks such as HSBC have begun to implement artificial intelligence to monitor and prevent fraud.

Commodity Market Volatility

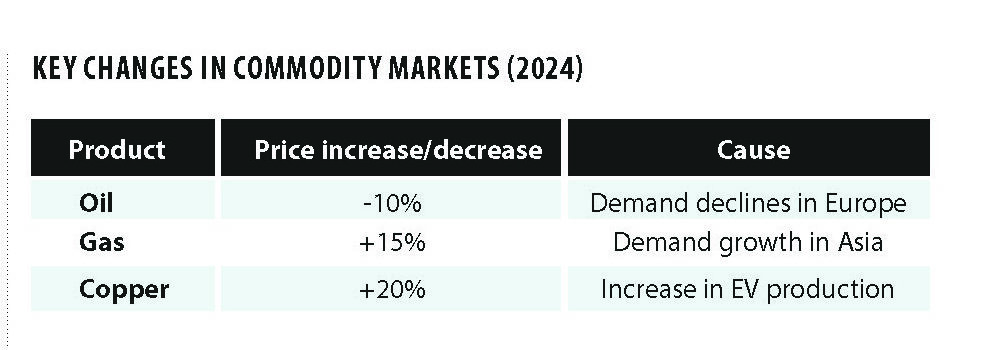

Commodity markets remain extremely volatile due to various factors, including the energy transition, geopolitical conflicts, and economic recovery from the pandemic. For example, in 2024, the price of oil varied between $70 and $85 per barrel, which created difficulties for energy companies.

Example: Energy Transition According to the International Energy Agency IEA, increasing investment in renewable energy is reducing long-term demand for hydrocarbons. However, the transition period is accompanied by instability as countries seek a balance between traditional and new energy sources.

Expert of World Bank John Smith comments: “Commodities play a central role in the energy transition, and their volatility affects the cost of green economy projects.”

KEY CHALLENGES: LIQUIDITY ISSUES IN EMERGING MARKETS

Let’s take a closer look at the risks associated with emerging markets.

• Key Liquidity Challenges

The International Monetary Fund (IMF) reports emerging markets continue to face severe liquidity challenges. Net capital outflows in 2024 were $1.2 trillion, the highest in two decades. Rising interest rates in developed countries and a stronger US dollar were the main drivers of the outflow.

• Causes of the problem:

1. Rising interest rates: The US Federal Reserve’s policies have pushed up Treasury yields, making them more attractive to investors than emerging market assets.

2. Debt burden: According to Bloomberg, about 45% of developing countries’ public debt is denominated in dollars. A stronger dollar increases the cost of servicing the debt.

3. Lack of domestic investment: In 2024, according to the World Bank, for example, the share of domestic investment in Latin American economies fell by 7%.

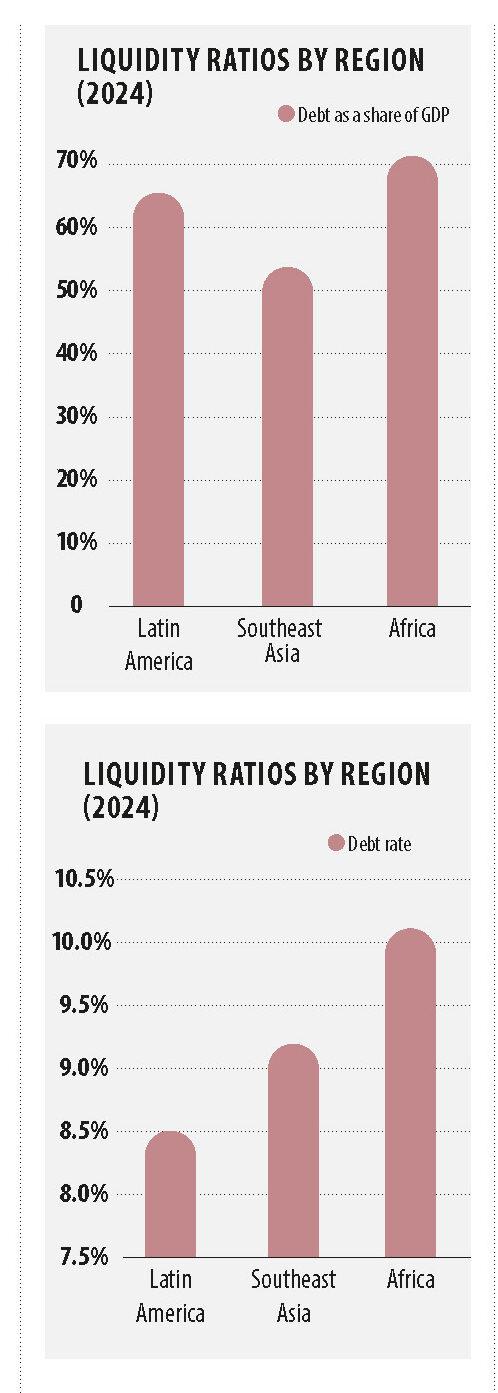

• Regional differences

Liquidity problems vary across regions. For example, Latin American countries face high debt servicing costs, while Southeast Asian countries suffer from a lack of foreign investment in infrastructure. In Africa, for example, the liquidity crunch is exacerbated by poor access to international capital markets. According to Fitch, international bond issuance in the region fell by 20% in 2024.

• Impact on the economy

Liquidity problems are slowing economic growth. Inflation in African countries has reached 11%, which limits purchasing power. At the same time, Latin American countries have been forced to raise key rates to 10%, which limits access to credit for businesses.

Example: Financial Crisis in Argentina In 2024, Argentina found itself in another debt crisis. According to the IMF, inflation reached 120%, forcing the country to seek additional financial assistance.

Economist James Carter of Bloomberg emphasizes: “Liquidity crises in emerging markets are becoming a catalyst for global financial turmoil. Global institutions need to support these countries.”

Recommendations for solving the problem

To improve liquidity, experts recommend the following measures:

1. Developing domestic capital markets. Increasing local borrowing could reduce reliance on dollar debt.

2. Diversification of funding sources. Increasing the share of local currency bonds will increase sustainability.

3. Cooperation with international institutions. Reforms supported by the IMF and World Bank, can ease the pressure on countries’ budgets.

INNOVATION AND NEW OPPORTUNITIES: APPLICATION OF AI AND MACHINE LEARNING TECHNOLOGIES

Artificial intelligence (AI) and machine learning (ML) have revolutionized industries, unlocking innovative solutions and creating opportunities across various sectors. These technologies improve efficiency, streamline decision-making, and drive growth by leveraging data in unprecedented ways. Below, we explore the transformative applications of AI and ML and their impact on businesses and individuals.

• AI technologies and their place in the financial sector

In 2025, artificial intelligence (AI) and machine learning (ML) will continue to play a key role in transforming the financial sector; according to a consulting firm, McKinsey, 70% of global financial institutions are already using AI to automate processes and improve forecast accuracy. These technologies have become tools for optimizing operations, managing risks, and improving security.

• AI in Risk Management

Financial institutions are actively using AI to analyze their clients’ creditworthiness. Banks such as HSBC and Citi implemented machine learning algorithms to assess borrowers’ risks, which reduced the level of non-performing loans by 20%. At the same time, AI helps to identify fraudulent transactions. Thus, in 2024, anomaly recognition algorithms helped prevent fraud worth $500 million in the United States.

• Automation of financial analysis

AI enables the processing of vast amounts of data in real-time, making financial analysis faster and more accurate. Algorithms can analyze market trends, evaluate assets, and predict price changes.

Example: Robo-advisors Investment platforms, such as Betterment and Wealthfront, use robo-advisors to manage client portfolios. These systems analyze investor preferences and market data to optimize investments. In 2024, the robo-advisor market grew by 25%, reaching $1.5 trillion in assets under management.

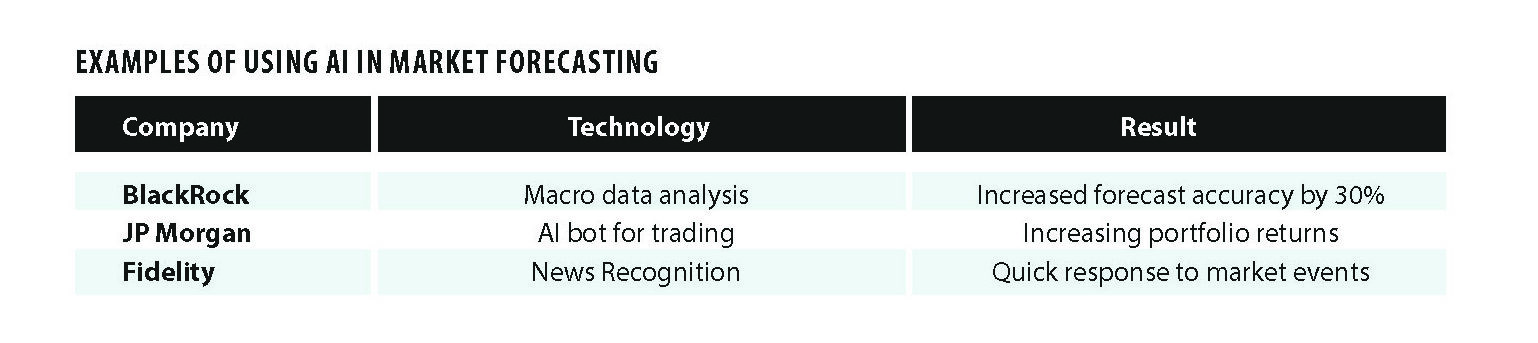

• AI in financial market forecasting

One of the most promising areas is using AI to predict market trends. Investment funds such as BlackRock are implementing ML to analyze macroeconomic data, corporate reports, and news, allowing them to predict asset price changes.

• The Future of AI in Finance

Gartner predicts that by 2030, AI will be a determining factor in decision-making for most financial companies. The technology promises personalized financial services, using AI to develop products considering individual customer needs, cost reduction, and full operations automation, such as loan processing or insurance claims.

INNOVATIONS AND NEW OPPORTUNITIES: DEVELOPMENT OF FINTECH SERVICES

The rise of fintech services has ushered in a new era of innovation, changing how financial transactions are conducted and managed. From seamless digital payments to personalized financial planning tools, fintech is breaking down barriers and creating opportunities for businesses and consumers alike. Below, we look at cutting-edge advancements in fintech and their transformative impact on the global economy.

• The Role of Fintech in Transforming the Financial Sector

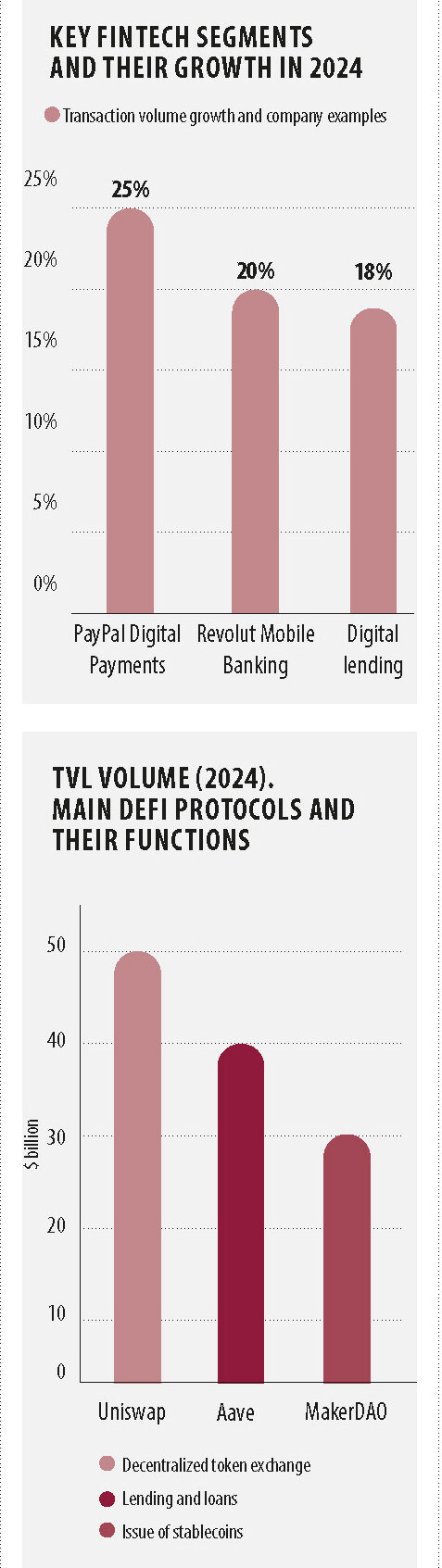

Fintech services continue to transform the financial industry by providing new solutions for users. According to CB Insights, the volume of investments in fintech in 2024 exceeded $200 billion, 30% more than the previous year. Companies like PayPal and Revolut set the standard for digital payments, personal finance management, and lending.

Example: Fintech expansion in developing countries In India, the UPI (Unified Payments Interface) platform has seen digital transactions grow by 40% in 2024, allowing small businesses to cut costs and attract new customers.

Digital payments expert Jane Doe of the World Bank noted: “Fintech has an important role to play in increasing financial inclusion, especially in developing economies.”

• Main directions of fintech development

1. Digital payments. Payment platforms like Stripe and Square make international transactions more accessible. In 2024, the volume of cross-border payments through fintech platforms grew by 25%, according to McKinsey.

2. Mobile banking. Banking apps are replacing traditional branches. Companies like Chime and Monzo offer digital banking services, including lending and savings management.

3. Digital lending: Platforms like LendingClub use AI algorithms to analyze borrowers’ creditworthiness, speeding up the approval process and making loans more accessible.

• The Impact of Fintech on Customers

Fintech services significantly increase the availability of financial services for various categories of the population. For example, in African countries, mobile payment platforms such as M-Pesa provide access to banking services to more than 50 million users who previously did not have a bank account.

Expert McKinsey John Smith comments: “Fintech services are lowering the barriers to entry and making financial services accessible even to those who have never used traditional banks.”

• The Future of Fintech

The fintech sector is expected to grow by adopting artificial intelligence and blockchain technologies. Statista predicts that the fintech services market will reach $500 billion by 2030.

Key trends of the future:

• AI integration, expense forecasting, budget automation, asset tokenization, and the creation of digital tokens for real estate and stock investments.

• Partnership with traditional banks. Fintech companies are increasingly collaborating with banks to develop joint products.

INNOVATION AND OPPORTUNITIES: DECENTRALIZED FINANCE (DEFI)

Decentralized finance (DeFi) is revolutionizing the financial landscape by eliminating intermediaries and enabling direct peer-to-peer transactions using blockchain technology. This innovative approach opens up new opportunities for financial inclusion, transparency, and accessibility while disrupting traditional banking systems. Below, we look at the key innovations in DeFi and the huge potential they hold to change the future of finance.

• Concept and Basic Principles of DeFi

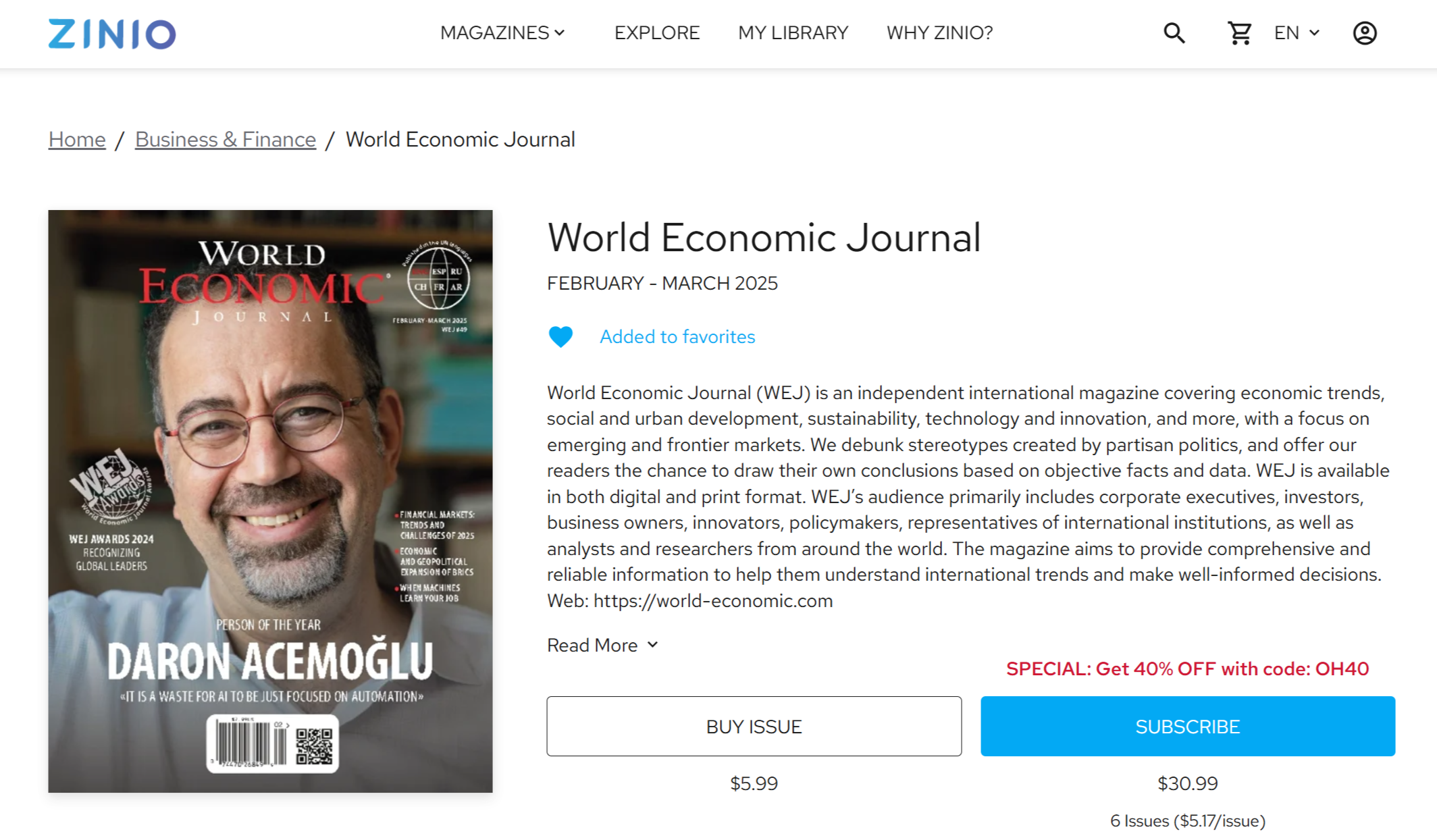

Decentralized finance (DeFi) is an ecosystem of financial services built on the blockchain. Unlike the traditional system, DeFi eliminates intermediaries such as banks and brokers, giving users direct access to financial transactions through smart contracts. According to DeFi Pulse, the volume of assets locked (TVL) in DeFi protocols reached $250 billion in 2024, an increase of 30% compared to the previous year.

Key benefits of DeFi include:

1. Transparency. All transactions are recorded in the blockchain and are available for verification.

2. Global availability. Anyone with access to the Internet can use financial services.

3. Flexibility. The ability to automate complex financial transactions thanks to smart contracts.

Examples of DeFi Protocols

DeFi protocols offer a wide range of services, from cryptocurrency exchange to lending. Let’s look at the most popular platforms.

1. Uniswap— a decentralized exchange (DEX) where users can exchange tokens without the involvement of centralized operators.

2. Aave— a platform for decentralized lending that allows you to earn interest on deposits and receive loans secured by collateral.

3. MakerDAO— a protocol that enables the issuance of stablecoins, such as DAI, pegged to fiat currencies.

• Risks and Challenges of DeFi

Despite the benefits, DeFi faces a number of challenges:

1. Security risks. Smart contracts can contain vulnerabilities that are exploited by hackers. In 2024, the damage from hacks amounted to $2 billion.

2. Regulatory uncertainties. The lack of a clear legal framework is holding back the adoption of DeFi into the traditional financial system.

3. High volatility. Sharp fluctuations in crypto asset prices can lead to significant losses for users.

• The Future of DeFi

According to Messari, the volume of assets locked in DeFi is expected to reach $1 trillion by 2030.

The main areas of development will be:

1. Integration with traditional finance. Banks will start using smart contracts to automate financial transactions.

2. Tokenization of assets. Real assets, such as real estate or art, will be digitized to make investment easier.

3. Scaling. Technological improvements such as the move to second-layer blockchains will increase the speed and reduce the cost of transactions.

RECOMMENDATIONS AND PROSPECTS: FORECASTS FOR 2025

Looking ahead to 2025, industry experts provide predictions and advice on navigating the ever-changing technology and business landscape. These insights provide insight into emerging trends, potential challenges, and growth opportunities across sectors. Below, we explore key predictions and strategies to capitalize on the opportunities that lie ahead.

• Forecasts for 2025: Key Macroeconomic Factors

The 2025 economy will continue to adapt to new challenges, including the impact of the pandemic, changes in commodity markets, and the need for accelerated technology adoption; according to the International Monetary Fund (IMF), global growth will be 3.5%, with emerging markets (4.8%) outperforming developed economies (2.2%).

“Emerging economies will account for almost two-thirds of global economic growth in 2025, underscoring their growing importance in the global economy,” says John Marsh, analyst at the World Bank.

Growth factors

1. Investments in green energy:

The environmental agenda is becoming a priority for most countries and companies. According to Bloomberg, investments in renewable energy projects will grow by 25%, which is associated with the acceleration of the transition to carbon neutrality. For example, in Europe, 60% of new energy projects are focused on solar and wind energy.

2. Technological transformation:

The use of technologies such as artificial intelligence (AI) and blockchain will continue to grow. Financial sector companies such as HSBC are actively implementing AI to minimize operational risks. McKinsey predicts that up to 50% of all large organizations will integrate blockchain into their processes by 2025.

Challenges

1. Regulatory uncertainty:

The lack of global standards for digital assets remains a significant obstacle for companies, according to the European Commission.

“Only countries that have implemented transparent regulatory mechanisms will be able to fully realize the potential of digital assets,” says Carlos Rivera, consultant European Commission.

2. Volatility in commodity markets:

Global commodity prices remain highly volatile. For example, copper prices are set to rise by 20% in 2024 due to increased demand from electric vehicle manufacturers.

Analysts at the World Bank emphasize: “The energy transition will inevitably lead to higher prices for metals such as lithium and nickel, which creates new challenges for the energy sector.”

RESULTS

Growing volatility and the need to adapt to environmental and technological agendas create both risks and opportunities for market participants. Countries and companies that are able to quickly respond to changes will take the lead. 2024 has become a year of transformational changes for the global economy and financial markets. An analysis of the key trends presented in the article allows us to highlight several key conclusions and proposals.

1. Tightening of monetary policy and its consequences

Central banks worldwide have been forced to keep interest rates high to combat inflation. This has significantly limited access to credit for companies and individuals, reduced investment activity, and increased debt burdens, especially in developing countries. To mitigate the impact, developing economies should seek alternative sources of financing, including government bonds denominated in domestic currencies.

2. Digitalization as a driver of change:

The introduction of central bank digital currencies and the growth of fintech services have opened new opportunities to simplify financial transactions and reduce transaction costs. However, according to CB Insights, further development of the regulatory framework and international cooperation are necessary for the successful scaling of these technologies.

3. ESG investing is becoming the standard:

Companies integrating ESG criteria into their strategy are already gaining competitive advantages. However, the growing popularity of ESG requires the introduction of international assessment standards to combat the problem of “greenwashing” by the European Commission.

4. The role of innovation in financial inclusion:

Fintech products such as mobile payments and digital lending play an important role in expanding financial inclusion, especially in developing countries. These technologies have the potential to reduce barriers to entry for underbanked populations significantly.

5. Decentralized Finance (DeFi):

DeFi offers solutions that could change the global financial architecture. Transparency, global accessibility, and flexibility make these technologies promising, but they face security and regulatory challenges.

RECOMMENDATIONS

International financial institutions, such as the IMF and World Bank, support developing countries through technical assistance, and funding programs should be increased. Governments need to strengthen cooperation with fintech companies, creating conditions for innovation and ensuring fair regulation. Investors need to evaluate companies’ ESG reporting in light of new standards, avoiding “greenwashing.” Market participants should take advantage of DeFi opportunities while ensuring a robust regulatory framework to minimize risks.

The global economy in 2025 faces a choice: seize the opportunities of digitalization, DeFi, and ESG initiatives, or risk missing out on sustainable development. Those companies and countries that adapt to the new conditions will be able to overcome current challenges and take a leading position in the global economy.

By Stan Black

PHOTO: PEDROSEK / SHUTTERSTOCK;

Stay informed anytime! Download the World Economic Journal app on the App Store, Google Play, ZINIO, Magzter and Issuu:

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal

https://www.magzter.com/publishers/World-Economic-Journal

Issue FEBRUARY – MARCH 2025 – World Economic Journal https://www.zinio.com/publications/world-economic-journal/44375