With a population of almost 100 million, Vietnam is a new Southeast Asian ‘dragon’ that has shown amazing endurance and steady development, making it a dynamic force in the global economy. It is one of the fastest-growing economies in the area, ranking 24th in terms of purchasing power parity (PPP) and 34th globally in terms of nominal GDP in 2023, according to the World Bank.

VIETNAM’S CURRENT ECONOMIC LANDSCAPE: A GLOBAL FORCE IN THE MAKING

The Đổi Mới (New Way) reforms, which were started in 1986 and signaled a relatively successful transition from a centrally planned economy to a market economy with a socialist bent, are primarily responsible for this quick and sustainable change. Over this period, real GDP per capita rose from under US$700 in 1986 to nearly US$4500 in 2023, while the proportion of people living in poverty dropped sharply from 14% in 2010 to below 4% in 2023. The foundation for such long-term growth was laid by the changes that gave priority to economic liberalization, promoted the growth of the private sector, and allowed foreign investment in Vietnam.

Vietnam has achieved remarkable growth in international trade by effectively blending market-driven strategies with socialist-oriented economic principles. This approach has strengthened its trade relationships with key partners such as Japan, Singapore, Hong Kong, Taiwan, Korea, and the European Union.

In an era of increasing regionalization and globalization, Vietnam’s membership in the World Trade Organization (WTO), the Association of Southeast Asian Nations (ASEAN), and the Asia-Pacific Economic Cooperation (APEC) have played a pivotal role in boosting its economy and facilitating its integration into the global market.

In 2022, Vietnam’s exports of intermediate goods reached an impressive value of US$49.358 million, accounting for a 13.31% share of its total trade, underscoring its growing role in global supply chains.

Vietnam’s Key Industrial Sectors

Vietnam’s industrial sectors have been instrumental in driving its economic growth. The World Bank reported that Vietnam’s GDP grew at an annual rate of 6.4% in 2024, up from 5% in 2023. This growth was fueled by strong manufacturing exports, rising domestic consumption, and increasing foreign direct investment (FDI).

According to the General Statistics Office, the added value by industries in Q1 2024 rose by 6.18% compared to the same period last year, contributing 2.02% to the economy’s total added value. Key contributors included:

• Manufacturing: Increased by 6.98%.

• Electricity production and distribution: Grew significantly by 11.97%.

• In early 2024, companies like Samsung produced 40% of their global smartphones in the country, with electronics accounting for 15% of the nation’s exports.

• Water supply, garbage, and waste management: Rose by 4.99%.

• Mining industry: Declined by 5.84%.

• Construction industry: Demonstrated strong growth at 6.83%.

Industrial Production Highlights

• The industrial production index (IPI) for Q1 2024 increased in 54 localities.

• The consumption index of manufacturing grew by 8.2% in Q1 2024.

• The inventory index in manufacturing rose by 14.1% compared to the same period last year.

• The number of employees in industrial enterprises, as of March 1, 2024, increased by 1.1% compared to the same time last year.

The green economy in Vietnam is rapidly gaining momentum, driven by a national commitment to sustainable development. Companies that prioritize sustainability are poised to benefit from government incentives, enhanced brand reputation, and access to eco-conscious consumers” – Rizwan Khan, Managing Partner, Acclime Vietnam.

Electronics and High-Performing Sectors

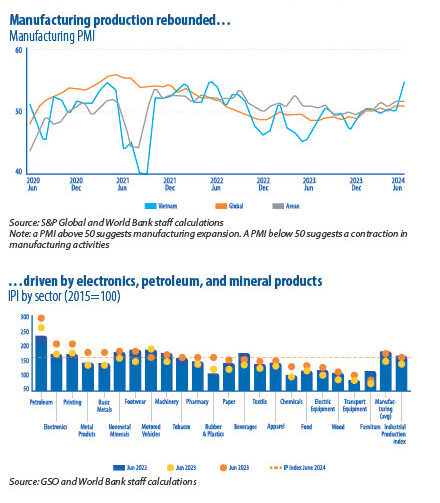

According to World Bank’s 2024 report,

• The Purchasing Managers Index (PMI) rose sharply to 55,5 in June 2024—its highest level since June 2022 and well above the ASEAN average.

• Electronics production surged by 39 pp in June 2024, driving much of the growth in industrial output.

• Petroleum production increased by 34 pp, while metal products grew by 45 pp.

• Traditional industries like footwear and textiles recovered modestly by 1.9% but from a low base.

It is projected to reduce poverty by 600.000 people at the $5.50/day poverty line by 2030

Trade and International Cooperation

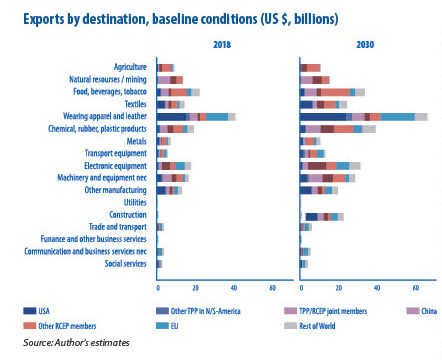

Vietnam’s integration into the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has positioned it as one of the agreement’s top beneficiaries. By 2030, the CPTPP is projected to significantly impact Vietnam’s economy:

• Increase Vietnam’s GDP by 3.5% under conservative productivity assumptions.

• Higher gains of 6.6% are possible under the TPP-12 scenario compared to 1% under RCEP.

• Boost Vietnam’s exports by 4.2% and imports by 5.3%.

• With productivity gains, exports could rise 6.9% and imports 7.6%.

• Lower average trade-weighted tariffs faced by Vietnamese exporters to CPTPP markets from 1.7% to 0.2%.

• Reduce non-tariff measures (NTMs) faced by Vietnam in CPTPP markets by 3.6 percentage points in ad valorem tariff-equivalent terms. Sectorally, the largest growth in output under CPTPP is expected in food, beverages, tobacco, clothing and leather, and textiles, along with more modest growth in other manufacturing subsectors and services. At the same time, imports are expected to grow across all sectors.

CPTPP is also expected to have a positive social impact. It is projected to reduce poverty by 600.000 people at the $5.50/day poverty line by 2030. Although all income groups are set to benefit, highly skilled workers in the top 60% of the income distribution will likely see the greatest gains, highlighting the need for investments in human capital to maximize the agreement’s benefits.

THE ‘CHINA PLUS ONE’ STRATEGY

The China Plus One strategy has further strengthened Vietnam’s status as an alternative manufacturing hub. Rising labor costs in China, combined with geopolitical uncertainties, have prompted global firms to diversify operations. Vietnam has positioned itself as a prime destination, offering competitive labor costs, proximity to China, and a business-friendly environment.

Vietnam’s ‘bamboo diplomacy,’ which balances relations with major powers while maintaining neutrality, has further solidified its appeal. The nation has negotiated free trade agreements with 15 countries, allowing it to integrate seamlessly into regional supply chains.

Key corporate investments reflect Vietnam’s growing prominence:

• Samsung employs over 200.000 people and has invested $17 billion in facilities to produce smartphones and other devices.

• Foxconn Technology assembles Apple’s MacBooks outside Hanoi and plans to expand into electric vehicle charger production.

• Recent partnerships in AI and semiconductors, including those announced by Nvidia and Microsoft, highlight Vietnam’s growing role in high-tech industries.

In 2023, FDI reached record levels, rising 54% to $15.3 billion in the first ten months, contrasting with China’s negative FDI during the same period. Vietnam’s low industrial wages and untapped rural labor pool, combined with its strategic policy and infrastructure investments, have made it a cornerstone of the ‘China Plus One’ strategy.

URBAN TRANSPORT CHALLENGES

Despite Vietnam’s success over the past decade in the provision of infrastructure services, changes are required in the way that infrastructure is supplied and managed in order to deal with important shifts in the economy. The World Bank ‘Urban Development Strategy’ report highlighted that Vietnam has the highest motorcycle ownership per capita in the world, with over 1.5 million motorcycles registered in Hanoi and 2.5 million in Ho Chi Minh City.

Road safety is a significant concern, as the country records one of the highest traffic accident rates globally. In Hanoi, only 11% of the city’s land area is dedicated to transportation facilities, far below the proposed standard of 25%. Encroachment into transportation rights-of-way, often for commercial or residential use, further reduces road capacity and contributes to traffic issues.

HOUSING CHALLENGES

In 2002, around 25% of Vietnam’s urban population lived in substandard or temporary housing, with significant regional differences influenced by climate, materials, and income levels. Slums are more prevalent in the south, with an estimated 300.000 people in Ho Chi Minh City living in such conditions, while 30% of Hanoi’s population faces overcrowding, averaging just 3 square meters per person compared to the 14 square meters target set by the Ministry of Construction.

A market-driven housing boom in major cities, led by state-owned developers, primarily benefits middle- and upper-income groups, leaving low-income residents underserved. Land speculation has exacerbated affordability issues, with inflated land prices and a ‘freeze’ in the real estate market since 2004. Meanwhile, informal construction dominated until the 2004 Land Law, which aimed to regulate developments and encourage planned housing.

The Asian Development Bank (ADB) has committed $16.5 billion to Vietnam to address these challenges. Key initiatives include:

• Developing climate-resilient transportation systems to enhance connectivity and mitigate disaster risks.

• Promoting sustainable urban planning to manage increasing urban populations.

• Expanding rural infrastructure to alleviate regional disparities and reduce poverty. Energy infrastructure remains a critical bottleneck. Vietnam’s Power Development Plan VIII aims to achieve 32% renewable energy in its energy mix by 2030, but outdated grid systems and regulatory obstacles have slowed progress. Industrial zones in northern Vietnam faced planned blackouts in 2024, emphasizing the need for grid modernization and diversified energy sources.

Efforts to address these issues include collaborations under the Just Energy Transition Partnership (JETP), which pledged $15.5 billion to support Vietnam’s transition to renewable energy. Investments in wind and solar projects combined with regulatory reforms are essential to meeting the country’s energy demands while reducing environmental impacts.

Vietnam has positioned itself as a prime destination, offering competitive labor costs, proximity to China, and a business-friendly environment

VIETNAM’S KEY 2025 PERSPECTIVES

Vietnam’s economy is projected to grow at a robust pace in 2025, driven by domestic consumption, infrastructure investments, and favorable demographic and economic dynamics. Key forecasts and perspectives highlight the interplay of these factors in shaping the country’s near-term economic trajectory.

Economic Growth Projections

Vietnam is expected to achieve a GDP growth of 6.5% in 2025, provided the government actively stimulates the real estate market and accelerates infrastructure spending. This optimistic scenario hinges on consumer confidence and domestic demand offsetting slower export growth. If government action is limited to infrastructure spending without addressing real estate market challenges, growth is estimated at 5%. A scenario with no significant intervention could see GDP growth dip to 4.5%, reflecting weaker external demand, particularly from the US, Vietnam’s largest export market.

The Asian Development Bank (ADB) has also revised Vietnam’s 2025 growth forecast to 6.6%, emphasizing stronger trade activities, accelerated public investment, and supportive fiscal and monetary policies.

Drivers of Growth

Vietnam’s growth outlook is shaped by key long-term drivers, including:

• Demographics and Urbanization: Vietnam’s young and growing population continues to support consumption and labor force expansion.

• Education and the Digital Economy: Investments in education and technological advancements contribute to sustained productivity and innovation.

• Infrastructure Development: Major projects such as Ho Chi Minh City’s new airport and Hanoi’s ring roads are expected to bolster consumer confidence through improved connectivity and the ‘wealth effect’ associated with rising property values.

Consumption as a Key Growth Engine

Domestic consumption, which accounts for over 60% of the economy, is critical to Vietnam’s economic performance. Consumer sentiment, subdued throughout much of 2024, is projected to improve significantly in 2025. The combination of fiscal stimulus, infrastructure projects, and the easing of real estate market pressures is expected to spur spending among middle-income consumers.

KEY RECOMMENDATIONS

Based on KPMG’s ‘The Investor’s Guide to Growth’ 2024 report, the following aspects of Vietnam’s economy are recommended as key focus areas for investors:

Focus on High-Value-Added Production

Investors should align their investments with industries and sectors that offer high-value-added opportunities, such as high-tech, education, and healthcare. Vietnam’s government is focusing incentives on these areas to enhance its competitive advantage and attract sustainable growth.

Choose the Appropriate Business Form

Foreign investors need to carefully select the type of legal entity for their operations in Vietnam based on their strategic objectives. Options include a limited liability company (LLC), jointstock company (JSC), or a partnership, each offering distinct advantages regarding liability, bond issuance, and shareholder requirements. Choosing the right structure is critical for regulatory compliance and long-term success.

“Vietnam has a young and energetic workforce that is eager to work and learn new skills. T his makes the country an attractive place for companies looking to hire employees” – Do Thi Thao, Partner, Acclime Vietnam.

“To succeed in the Vietnamese market, investors should seek to synergize their international best practices and commercial practices that made them successful in the first place, with a solid, practical understanding of the Vietnamese business environment and regulatory context.” – Vlad Savin, Partner, Acclime Vietnam.

Leverage Investment Incentives

Investors should actively pursue projects that qualify for Vietnam’s robust investment incentives, including corporate income tax (CIT) reductions, import duty exemptions for raw materials, and land use tax exemptions. These incentives are particularly attractive in prioritized sectors and disadvantaged regions, making them essential for maximizing profitability and competitiveness in the Vietnamese market.

With the help of its strategic reforms, strong industrial growth, and integration of international trade, Vietnam has become a resilient and dynamic force in the global economy. Urbanization, consumer spending, and infrastructure development have all contributed to its ability to draw in multinational firms, serving as a model for sustainable economic change.

By Robert Abdullah

____________________________________________________________________________________________________

PHOTO: QUANG PRAHA / PIXABAY; PHOTO: BEN KOORENGEVEL / UNSPLASH; ACCLIME VIETNAM;

Stay informed anytime! Download the World Economic Journal app on the App Store and Google Play.

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal

https://www.magzter.com/publishers/World-Economic-Journal