There’s a lot of buzz around “impact investing.” The sector has experienced remarkable growth in recent years, capturing the attention of investors, entrepreneurs and philanthropists. Recognising the urgency and complexity of global challenges like poverty, inequality, and climate change, there is a growing global movement advocating for the need to allocate more capital to improving lives and the health of our planet. More than just a buzzword, impact investing holds the potential to play a historic role in reshaping the role of capital.

Despite its rapid growth and surge in popularity, impact investing evokes both promise and criticism. Sceptics raise concerns about “green and impact washing,” the lack of standardised and comparable measurement, the challenges around proving contribution to impact, and the trade-offs between financial and impact returns.

While these criticisms contribute to confusion and misunderstandings about what impact investing really means, the field continues to attract a wide variety of investors who seek to finance solutions across developed and emerging markets. At Sturgeon Capital, for example, we believe that investing in early-stage, high growth technology companies, can be a catalyst for meaningful transformation, particularly for low-and middle-income people in countries with nascent digital ecosystems.

Let us unpack the core meaning of impact investing and discuss its specifics in frontier and emerging markets while addressing some misconceptions.

HOW TRUKKR DIGITISES AND BANKS PAKISTANI SHIPPERS AND CARRIERS

- Problem: In Pakistan, just 21% have access to financial accounts. In the logistic sector, inefficiencies, predominantly paper-based systems, and undocumented shipping activities create barriers for carriers to access formal credit.

- Solution: Trukkr’s online logistics management platform offers SaaS solutions with embedded finance capabilities to drive efficiency across the logistics spectrum. Trukkr is digitising and banking a historically underserved sector in Pakistan, optimising supply chains, and improving f inancial outcomes for both shippers and carriers.

- Company achievements: Trukkr has onboarded over 30,000 carriers to date, with at least 336 accounts created for the first time. Throughout 2023, Trukkr used its crucial sector-specific data and visibility into real-time trip execution to underwrite and deploy over 11,000 working capital loans to MSMEs carriers, many who were previously unbanked. So far, Trukkr has provided nearly $20 million in capital loans, bringing financial inclusion in the logistics sector to a new level.

- Sturgeon Capital’s support: Trukkr secured an investment from the fund in 2022. Sturgeon also supported the team with raising subsequent funding from co-investors like Accion Venture Labs.

THE EVOLUTION OF IMPACT INVESTING

The concept of socially responsible investing is not new. Originating primarily within development finance institutions (DFIs), this approach gained momentum in the private sector with the rise of microfinance institutions in the 1970s and their aim to use private capital and microloans to foster financial inclusion in emerging markets. Over time, impact investing has evolved across asset classes including debt and equity, introducing a private market perspective to contribute to global development across sectors and regions.

It was not until the mid-2000s that the Rockefeller Foundation coined the term “impact investing” and incubated the Global Impact Investing Network (GIIN), the leading network of practitioners.

The market has grown substantially over the past decades, reflecting the growing awareness of global challenges and the consensus that investors can and should be contributing to the solutions. Businesses are awakening to their potential for positive impact, while consumers are shifting their purchasing preferences towards purpose-driven companies.

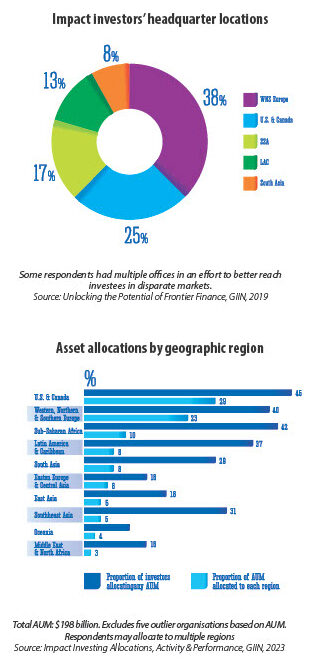

In the GIIN’s latest market sizing report (2022), the size of the worldwide impact investing market is estimated to be $1.164 trillion in assets under management with over 3,300 organisations. And although the impact investing market is still maturing, efforts to accelerate the development, scale and effectiveness of the industry are gaining significant momentum.

DEFINITION AND CORE CHARACTERISTICS

The GIIN defines impact investing as “investments made with the intention to generate positive, measurable social and/or environmental impact alongside a financial return.”

- Intention: While all investments have an “impact”—both short and long-term, positive and negative—impact investing implies the explicit aim of accomplishing specific goals that are beneficial for society, to finance solutions to problems. Without the intent to be impactful, it’s just investing. T his commitment includes articulating a clear impact thesis, transparent impact goals, and strategies for achieving the impact.

- Measurability: Translating this intent into action, and then committing to measure, manage, and report on the social and/or environmental performance of portfolio companies is integral. Impact measurement and management (IMM), hailed as the “hallmark of impact investing,” is arguably the biggest challenge for participants1. Impact data must not only be measured, but leveraged for investment decision-making, identifying risks and mitigating negative consequences. Lastly, actual impact performance must be disclosed in a comparable and actionable manner to stakeholders.

The Core Characteristics of Impact Investing, as defined by the GIIN, complement the above definition and provide clarity on the terms of participating in credible impact investing. These include the “use of evidence and impact data in investment design,” and the “contribution to the growth of the impact investing industry.”

Impact investing and ESG investing are not to be confused. ESG (environmental, social and governance) encompasses the criteria used to assess corporate behaviour and screen investments. In essence, it highlights the potential financial losses a company may face by neglecting ESG risks and the financial gains achievable by capitalising on ESG opportunities.

ESG investing is more about how these factors affect the company and less about their effect on the world. By seeking to avoid harm and potentially benefit stakeholders, the primary objective of ESG investing remains financial returns, which may not always result in net-positive outcomes. Impact investors go beyond avoiding harm and make conscious decisions to use capital to contribute to solutions.

IN UZBEKISTAN, BILLZ HELPS MSMES DIGITISE AND ACCESS WORKING CAPITAL

- Problem: Contributing to 78% of the workforce and 60% of GDP, Uzbekistan’s micro-, small and medium enterprises (MSMEs) grapple with operational ineff iciencies and limited access to financial products. Challenges include perceived risks, lack of collateral, and insufficient digital adoption, with 83% of MSMEs lacking access to digital tools.

- Solution: Billz is an all-in-one retail management software that serves as a comprehensive solution to the challenges faced by MSMEs. Their software supports the digital transformation of offline stores and enables MSMEs to access working capital loans to grow their business.

- Company results: As of June 2024, the company had empowered over 1,800 MSMEs in retail locations across Central Asia. The platform had generated over $73 million in revenue for its customers, putting them on track to achieve an annualised customer turnover of more than $800 million. By producing over 10,000 educational resources, Billz enabled 76% of its clients to adopt a digital tool for the first time. Digitalisation not only offers a path to formality but can also equip MSMEs with greater access to global markets and reach to customers. It improves the productivity, competitiveness, and profitability of the MSME sector, thereby stimulating economic growth and job creation.

- Sturgeon Capital’s support: The fund injected $300,000 into Billz in 2022. It also helped the company partner with a f inancial institution to leverage collected data and facilitate 250 collateral-free loans worth over $7 million to date.

IMPACT INVESTING IN FRONTIER AND EMERGING MARKETS

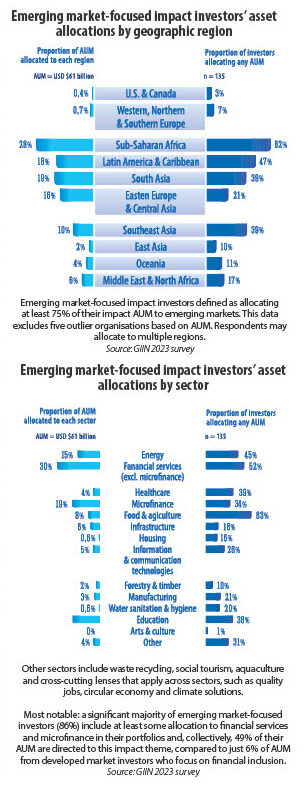

Frontier and emerging markets (FEMs) offer a unique mix of challenges and opportunities, with less mature and stable financial markets, and uncertainties related to the currency, market, political situations and regulatory environments. However, when investors collaborate with local partners, leverage local expertise and implement robust risk management strategies, impact investing in FEMs has the potential to generate higher impact and f inancial returns than in developed markets.

Compared with developed countries, FEMs typically face, on average, higher levels of poverty, inequality, and less rigorous environmental regulations. These problems are reflected in indicators such as the Human Development Index (HDI), which links income levels to broader development indicators, incorporating not only traditional economic metrics like GNI or GDP to measure success, but also vital social and environmental factors that impact well-being. On average, FEMs exhibit lower GDP per capita and lower, or often troubling, HDI scores.

This impact approach empowers companies to better understand their customers, design more effective businesses, build authentic brands and attract new talent and capital

As a consequence, FEMs offer greater potential to create deep, lasting impact, and at a lower cost; one dollar invested goes a lot further in addressing a pressing need.

FEMs also produce more investable impact where profitability and impactful outcomes are closely aligned, capitalising on the inherent correlation between socio-economic progress with business and market growth. This challenges a common misconception that impact investing involves a trade-off between impact and financial returns2. Increasing research indicates that strong risk-adjusted financial returns are not only possible but are being achieved in FEMs.

For instance, investing in companies providing essential goods and services tends to be more stable, less subject to discretionary spending, and often resilient during economic downturns, making it a sound business strategy in uncertain times. A 2019 GIIN study supports this, with 87% of FEM investors seeking risk-adjusted, market-returns surveyed found their “investments meeting or exceeding financial performance expectations.”

At Sturgeon, we view financial and impact returns as complementary and mutually reinforcing, rather than contradictory and competing priorities. This aligns with a strategy coined Impact Alpha, recognising that the integration of impact objectives into the investment process can add value across our portfolio, and ultimately enhance overall investment performance. Impact considerations can provide unique insights not yet valued by the broader market and promote additional rigour in operations, stakeholder engagement and risk management. This impact approach empowers companies to better understand their customers, design more effective businesses, build authentic brands and attract new talent and capital.

From a macroeconomic perspective, FEMs are typically characterised by capital scarcity, combined with higher economic and demographic growth, and an emerging consumer class. T his dynamic presents an attractive opportunity for investors to capitalise on economic development while being rewarded for leveraging their capital—the scarce resource. Capital gaps, both in volume and type, are particularly pronounced in frontier markets, where investment opportunities often lack track records. FEM-focused impact investors, like Sturgeon Capital, play a crucial role in bridging this gap by funding underdeveloped financial markets and acting as catalysts for attracting further investments from mainstream investors.

Although research in this young market segment is still limited and evolving, and not every investment will guarantee high returns, many believe that these markets have the potential to outperform investments in more developed economies over the long term.

The impact investing sector is full of compelling success stories, as witnessed by Sturgeon Capital’s portfolio. These narratives highlight how impact investors strategically deploy their capital, showcase global entrepreneurs with innovative ideas, and illustrate how end consumers and other stakeholders have benefitted from novel solutions.

_______________________________________________________________________________________________________

(2) At its core, impact investing challenges the traditional notion that financial returns and social and/or environmental impact are incompatible – impact investors seek a financial return on capital, albeit across a spectrum that ranges from below-market-rate to risk-adjusted market rate. An increasing number of asset owners and investors are recognizing the advantages of incorporating impact considerations, moving away from the trade-off mindset regarding investment performance and purpose-driven goals. In fact, according to the 2023 GIINSight Series, 74% of impact investors target risk-adjusted market-rate returns. At the same time, many companies are offering products and services where positive value creation is intrinsic to the business model. When such businesses grow and achieve commercial success, so does their positive impact. Studies such as the 2021 Net Impact Report by the Upright Project, conclude that impact is definitely not at odds with profit.

By McKinley Richards

Stay informed anytime! Download the World Economic Journal app on the App Store and Google Play.

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal