Not all is rosy in the Middle Kingdom. Since 2021, its economy has been destabilized by two major crises, challenging the country’s development model and sparking concerns about potential impacts on the global economy.

As the country urbanised, Chinese growth had long leaned heavily on real estate. Investment in this sector exceeded 14% of GDP in 2013, according to official sources. Today, the country boasts one of the highest rates of homeownership (exceeding 80% of all urban households) and multiple/second home ownership (exceeding 20%) in the world.

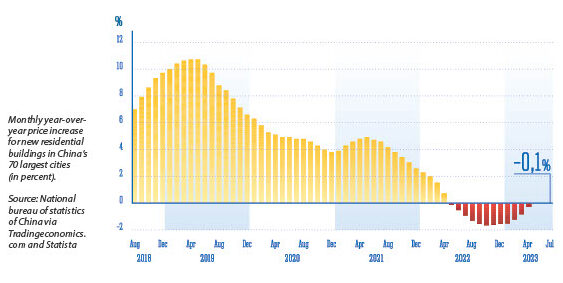

While the demand for homes in Chinese cities boomed over the past decades, early signs of a housing bubble began to percolate before the pandemic. Taking note, developers took out eye-popping amounts of debt to keep pace, eventually catching President Xi Jinping’s attention.

THE UNRAVELING

In an attempt to ward off a housing crisis, Xi implemented regulations to deleverage the real estate industry. Banks were also constrained from making further loans to developers, all of which would seemingly mitigate the chances of a pending disaster.

But the sector began to unravel in August 2021, when the country’s second-largest property developer, the Evergrande Group, promptly halted construction. The following month, the property giant missed two offshore bond coupon payments for a total of $131 million, and the crisis soon spread to fellow developers such as Fantasia Holdings, Kaisa Group, Country Garden, Modern Land, Sunac, and Sinic Holdings.

By November 2021, the sheer size of the loans to property developers began taking their toll on Chinese banks. Combined with an overall economic slowdown, several mid-tier banks went under. This was expected, but it wasn’t until relatively recently, when 40 Chinese banks disappeared, that global markets began to take notice. Mismanaged Chinese banks lent heavily to real-estate developers, thus exposing themselves to the housing crisis. As of mid2024, the number of banks that had failed was four times the figure in all of 2023, according to industry insiders cited by Chinese financial news agency Yicai Global.

WHAT NEXT?

The possibility of direct or indirect effects on the global economy from the Chinese property and banking crises cannot be ignored.

“The potential impact of a banking crisis in China could be exponentially greater than even the US subprime mortgage crisis of 2007-08, given the size and interconnectedness of Chinese banks with the global financial system,” warned Arturo Bris, professor of finance and Director of the IMD World Competitiveness, in a February 2024 article.

Since the four biggest banks in the world by total assets are all Chinese—led by the Industrial and Commercial Bank of China with assets totaling $5.4 trillion,—the global f inancial system could hardly remain immune to a major issue in the Chinese banking system, the expert explained.

Moreover, global supply chains could be disrupted, since many multinational companies outsource production to Chinese manufacturers. “This could impact industries ranging from technology to automotive to consumer goods, all of which rely on China as ‘the world’s factory,’” believes Bris.

In some cases in the past, shocks originating in China had even larger spillover effects on commodity markets than those of shocks originating in the United States

The potential global repercussions might not stop here. Should the country’s economy decelerate, exporters to China would certainly be hit, Euromonitor International underscored in a 2023 note. The country is among the largest consumers of machinery, hi-tech goods, luxury goods, as well as commodities, which China imports massively from Latin America and Australia.

In some cases in the past, shocks originating in China had even larger spillover effects on commodity markets than those of shocks originating in the United States, the European Central Bank observed in 2022. “China consumes a similar amount of energy goods to the United States and yet a significantly higher share of global non-energy commodities, such as metals,” noted the ECB analysts.

GROWTH PERSISTS

So far, however, these risks have remained more theoretical than practical, as China’s property crisis and banking instability have not brought the economy to collapse. In May 2024, following a “strong” first quarter, the IMF even upgraded its GDP growth forecast for 2024 by 0.4 percentage points—to 5% in 2024 and 4.5% in 2025.

The economy’s resilience in the face of the crisis has been strongly bolstered by government support. In May 2024, the authorities unveiled a historic $138 billion package in funding to stabilize the property sector, coupled with an easing of mortgage rules and even some local governments buying over-supplied apartments.

In the banking sector, stability is maintained through substantial state ownership, with the government holding majority stakes in the five largest commercial banks. This represents more than half of the country’s banking system, notes Bris, who nonetheless points out a “systemic risk” tied to this significant reliance on state support.

By Peter Frerichs and Adrien Henni

Stay informed anytime! Download the World Economic Journal app on the App Store and Google Play.

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal

https://www.magzter.com/publishers/World-Economic-Journal