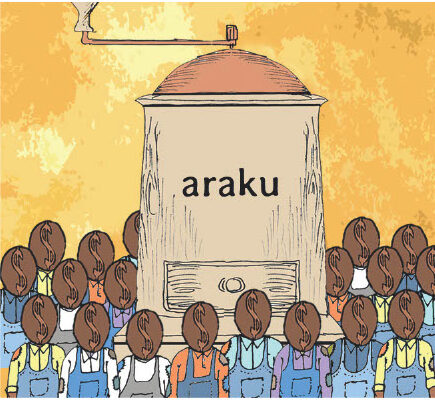

In a remote corner of India, deep in the Araku Valley, a remarkable transformation is unfolding. What was once a poverty-stricken agricultural area, home to vulnerable tribal groups, has turned into a thriving community of high-grade coffee producers, selling their product in markets as far-reaching as Paris and deserving a mention in The Economist.

In a remote corner of India, deep in the Araku Valley, a remarkable transformation is unfolding. What was once a poverty-stricken agricultural area, home to vulnerable tribal groups, has turned into a thriving community of high-grade coffee producers, selling their product in markets as far-reaching as Paris and deserving a mention in The Economist.

The catalyst for this change? An inclusive business model that empowers local farmers to transcend their previous limitations.

The story of Araku Coffee is not an isolated one. Across the globe, companies are embracing the concept of inclusive business—an approach that integrates low-income communities into the value chain as suppliers, distributors, and consumers. This model is not only proving to be profitable but is also making significant strides in addressing poverty, fostering social inclusion, and contributing to sustainable development. In essence, it represents a critical pathway toward achieving the UN’s Sustainable Development Goals (SDGs).

Inclusive business models are rapidly gaining recognition as efficient strategies for sustainable economic development. These models are premised on the idea that businesses can achieve profitability while also delivering social and environmental benefits. This dual focus on financial returns and social impact sets inclusive businesses apart from traditional corporate social responsibility (CSR) initiatives, which often treat social goals as secondary to financial performance.

For many large companies, inclusive business models can be seen as a practical approach to implementing the “Shared Value” concept

FROM MICROFINANCE TO LARGE COMPANIES

Microfinance institutions offer a prominent example of an inclusive business model. These entities provide financial services to underserved populations, enabling them to start businesses, improve their livelihoods and contribute to economic growth. The Grameen Bank in Bangladesh, founded by Nobel laureate Muhammad Yunus, pioneered this model. By offering microloans to the poor, particularly women, the bank has helped millions of people escape poverty, demonstrating that financial inclusion can be a profitable and scalable enterprise.

For many large companies, inclusive business models can be seen as a practical approach to implementing the “Shared Value” concept. Its authors Michael Porter and Mark Kramer argued (HBR, 2011) that companies can move beyond corporate social responsibility and gain competitive advantage by including social and environmental considerations in their strategies.

The relevance of inclusive business to the SDGs cannot be overstated. With a particular focus on poverty reduction, these models directly contribute to SDG 1 (No Poverty) by creating income-generating opportunities for low-income communities. By integrating marginalised groups into their value chains, businesses can uplift these communities economically and improve their quality of life.

The concept of inclusive business has gained traction among policymakers globally. In 2015, the G20, recognising its potential to drive sustainable development, established a working group to develop a policy framework for promoting inclusive business practices. The move underscored the notion that inclusive business models are not just a private sector initiative but a significant component of global development policy.

ACROSS INDUSTRIES

Inclusive business models are not limited to any single sector. They are being successfully implemented across various industries, including agriculture, healthcare, financial services, energy, and more. In agriculture, contract farming and fair-trade practices enable smallholder farmers to access global markets, secure fair prices and improve their livelihoods. Araku Coffee is a prime example of how inclusive business can transform agricultural communities. By providing training and support to local farmers, the company has helped them grow higher-quality coffee, which it then buys at premium prices. This approach not only enhances the farmers’ income but also ensures a sustainable supply of high-grade coffee for the company.

In financial services, microfinance organisations are not the only examples of inclusive business models. Mobile banking platforms are also revolutionising access to f inance, enabling broader groups of individuals, and small enterprises to actively participate in the economy.

BanhJi, a Cambodian FinTech, facilitates the integration of micro and small enterprises into formal financial markets, providing the required accounting software and within a broad range of financial services. Its vision is to “reduce the Cambodian MSMEs $3.7 billion financing gap.”

One of the strengths of inclusive business models lies in their potential for innovation. By concentrating on the needs of low-income communities, these models drive the creation of new products, services and delivery mechanisms that are both affordable and tailored to underserved markets. This often leads to creating entirely new market segments, offering businesses a competitive edge and increased profitability. In many cases, these innovations, initially designed for low-income consumers, later found success among higher-income groups as well (1).

Certainly, inclusive business models are not a cureall for the world’s challenges. While acknowledging their potential, some studies, like that of Mangnus (2023), have indicated that their impact on the livelihoods of marginalised communities can vary. Different groups within these communities experience diverse effects, depending on the specific objectives of the model’s design.

Nevertheless, inclusive business models undeniably offer a valuable approach to achieving sustainable and inclusive development, especially in Asia and Africa. Southeast Asia, in particular, has emerged as a pioneer in this area, with several ASEAN governments integrating inclusive business models into their development strategies and implementing related policies.

________________________________________________________________________________________________________________________

(1) For instance, Danone collaborated with Grameen in Bangladesh to produce affordable, nutrient-rich yogurts aimed at addressing childhood malnutrition. The insights gained from this initiative enabled Danone to introduce health-focused products in higher-income markets, such as fortified yogurts and functional foods, emphasising both affordability and health benefits to a wider audience.

By Max Bulakovsky

Stay informed anytime! Download the World Economic Journal app on the App Store and Google Play.

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal