For decades, Central Asia—a region home to approximately 70 million people across f ive post-Soviet states: Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan—has remained largely uncharted on the global logistics map. Domestic demand was largely met by facilities inherited from the Soviet era. With few exceptions, there was minimal need for modern warehousing facilities, and infrastructure development attracted little interest.

However, over the past ten years, the development of regional logistics and warehouse infrastructure was spurred by new impulses:

- The development of China’s Belt and Road global infrastructure initiative since 2013, including one of its key components, the Trans-Caspian International Transport Route (aka Middle Corridor);

- The Covid pandemic, in 2019-2021, which fuelled a surge in e-commerce, resulting in a sharp increase in demand for quality warehousing facilities;

- The region’s rapid economic growth1, driven by a young and tech-savvy population;

Starting from 2022, the imposition of international sanctions against Russia—a key trade partner of the region at Kazakhstan’s northern border— which prompted the development of existing or new transit routes.

All this gave the region a unique opportunity to position itself as a major transport and logistics hub across the continent, revitalising the ancient Silk Road in a modern economic context.

FROM 53 TO 18 DAYS

Bypassing Russia, the Middle Corridor (2)—which consists of about 4,250 km of rail lines and about 500 km of seaway via Kazakhstan, Azerbaijan and Georgia—is the shortest transport route from China to Europe. Cargo is routed through the Caspian Sea, using the ports of Aktau (Kazakhstan), Baku (Azerbaijan) and Poti (Georgia), before reaching Türkey or continuing to the EU Black Sea ports of Burgas (Bulgaria) and Constanța (Romania).

In 2023, this route facilitated the delivery of 2.76 million tonnes of various goods, marking a 65% increase from 2022. In 2024, the traffic is expected to reach 3.29 million tonnes. While the cargo transit time has already been reduced from 38-53 days to 18-23 days, it is highly likely that this period will soon be further shortened to 14-18 days, with only five of those days spent within Kazakhstan’s borders.

Russia also relies on logistical capacities and transport connections in this region. Recently, traffic has significantly increased along the North-South Corridor, which links Russia with Iran and India via the Caspian Sea. This 7,200km multi-modal transport network currently traverses Azerbaijan and Iran, bypassing Central Asia, although new routes under consideration do include Kazakhstan and Turkmenistan. With proper efforts, the Middle Corridor and North-South Corridor will reach a capacity of 10 million tonnes each by 2027.

To sustain this growth, considerable investments are required, particularly in supply chain and logistics infrastructure. The EBRD estimates that €18.5 billion in cumulative investments are required to make the Middle Corridor fully productive. In comparison, net cumulative foreign direct investment (FDI) in Central Asia for 2023 amounted to $7.4 billion (€6.8 billion), according to UNCTAD.

Trans-Caspian International Transport Route

INFRASTRUCTURE UNDER PRESSURE

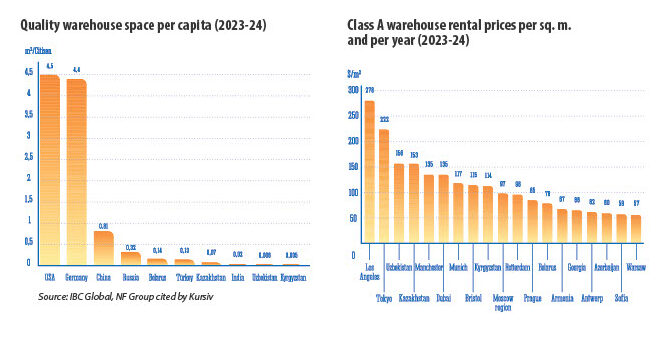

Demand for warehousing facilities in the region has surged to unprecedented levels, driven by four main types of customers: major international brands, online marketplaces, domestic retailers and foreign logistics companies, predominantly from Russia. According to our calculations, these customer types alone require approximately 1.2 million sq. m. of quality warehouse space in Kazakhstan alone. However, the country’s total available quality warehouse space barely exceeds 1.4 million sq. m.—equating to just 0.07 sq. m. per inhabitant.

Under government plans3, an additional 2 million sq. m. of facilities are set to become available in the next three to four years. Adjusted for population growth, this will increase the country’s quality warehousing space to 0.16 sq. m. per capita by 2027. This level will roughly align with infrastructure development in Türkey and Belarus, but will still be less than half of Russia’s current capacity, five times less than China’s, and several dozen times less than that of Western Europe or the USA.

The severe shortage of warehouse space in Central Asia has driven rental rates to unprecedented levels

QUALITY WAREHOUSE SPACE PER CAPITA (2023-24)

The severe shortage of warehouse space in Central Asia has driven rental rates to unprecedented levels. In Tashkent and Almaty, the average annual rate exceeds $152-156 per sq. m.4, according to NF Group, which is about 15% higher than in Dubai or Manchester, notes Savills, and 40-60%5 higher than in the Moscow region, our data indicate. Kyrgyzstan ranks similarly to Munich or Bristol in terms of storage costs ($114 per sq. m.), far outpacing major major EU port locations such as Rotterdam and Antwerp, as well as Eastern European countries and the Caucasus states.

With an average annual yield of 17-20%, investments are expected to be recouped within just five to six years

While the high rental rates and limited options may deter some tenants, investors are enjoying extremely favourable conditions. In Central Asia, the payback period for warehouse complexes is only half as long as in Europe. With an average annual yield of 17-20%, investments are expected to be recouped within just five to six years (6).

INVESTMENT BOOM

Kazakhstan’s President Kassym-Jomart Tokayev has identif ied the transport and logistics industry as a key driver of the country’s economic development. He has tasked his country with solidifying its role as a transit hub in Eurasia, with the long-term goal of becoming a fully-fledged transport and logistics power. The share of the transport and logistics sector in the country’s GDP is expected to increase by one and a half times, reaching some 9% within three years.

Priority infrastructure projects in Kazakhstan include constructing railway lines in the eastern, southeastern and southern regions near the borders with China, Kyrgyzstan and Uzbekistan. Simultaneously, plans are underway to develop a network of bonded warehouses in the country’s major cities—Astana, Almaty and Shymkent. Additional initiatives involve establishing goods-processing hubs at border areas shared with other countries of Central Asia, creating a container facility known as the ‘Caspian Hub’ and building container terminals in western Kazakhstan.

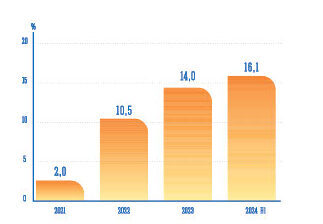

From January to June 2024, the transport and warehousing sector received investments totaling 1.07 trillion tenge ($2.1 billion), up 33% from the same period of the previous year. Over half of this funding has been allocated to freight storage and auxiliary transportation services.

In the first three months of 2024, Kazakhstan’s economy saw a net inflow of $1.94 billion in FDI. Of this total, 13.2% was directed towards the transport and warehousing sector. Specifically, the warehousing sector received $70.2 million, nearly equivalent to the combined total of the previous two years.

CHINA, EUROPE AND RUSSIA IN THE GAME

For China, Kazakhstan is a crucial component in the execution of the ‘One Belt, One Road’ initiative and, specifically, the Middle Corridor. In spring 2023, Shandong Port Group Corporation announced plans to develop a significant warehouse cluster and dry port near Almaty.

A closed logistics cycle is gradually taking shape between China, Kazakhstan and Russia. This involves consolidating cargo bases in Xi’an (China) and Selyatino (Moscow region) and organising transit traffic through Kazakhstan. The capabilities of Lianyungang port, the dry port in Xi’an, and the free economic zone “Khorgos-Eastern Gate” will be actively utilised, Xinhua News Agency reported.

The European Union is also turning its attention to Central Asia. During the January 2024 investment forum ‘The Global Gateway’ in Brussels, European Commission Executive Vice President Valdis Dombrovskis presented an EU-led investment plan for the Middle Corridor totaling €10 billion.

Meanwhile, Russian private market players are significantly boosting Kazakhstan’s warehouse infrastructure. Online marketplace Wildberries has announced plans to launch two logistics centres next year—one in Almaty, spanning 100,000 sq. m., and another in Astana, covering 150,000 sq. m. The total investment in these facilities amounts to $132 million, covering construction costs alone, not including equipment and warehouse inventory.

Share of investments in fixed capital allocated to transport and warehousing in Kazakhstan

Meanwhile, Ozon’s 38,000 sq. m. full-field centre in Astana, launched in early 2023, is expected to expand by 30,000 square metres in the near future. Additionally, the Russian e-commerce giant has announced the construction of a 42,000 sq. m. logistics facility in the Almaty region, requiring an investment of $31 million.

The Russian Export Centre offers asset insurance for manufacturers and distributors operating internationally, covering up to 90% of the amount owed by foreign counterparties that fail to meet their obligations. This is particularly valuable in Central Asia, a region perceived as having persistent risks of economic and socio-political instability.

Central Asian countries have much to achieve to bring their logistics to the required level. In addition to constructing warehouses and transport routes, they must continue developing their human capital, investing in digital infrastructure, reforming legislation and fiscal policies, ensuring property rights protection and promoting regional integration.

If these efforts come to fruition, Central Asia could see the development of up to 20 million sq. m. of quality warehouse space. The growth potential is considerable, with demand expected to increase by 4.6 times in Kazakhstan, 8.8 times in Uzbekistan and 20 times in Tajikistan.

____________________________________________________________________________________________________

(1) Annual GDP growth reaches 4.5-5.5% in Kazakhstan and 7.0% in Kyrgyzstan and Uzbekistan (EBRD forecast for 2025).

(2) Also known as the Trans-Caspian International Transport Route (TITR)

(3) “Concept for the Development of Transport and Logistics Potential of the Republic of Kazakhstan until 2030

(4) Here and further, including OPEX, excluding VAT

(5) Depending on currency exchange variations

(6) The shortage in the warehouse segment has led to a trend of irrevocable contracts with terms of up to 10 years, allowing investors to recoup their investments well before the contract expires. Such long-term agreements are unique to this segment. Another outcome of this shortage is the growing popularity of the Built-to-Suit (BTS) format, where a developer constructs a complex tailored to a specific customer. The tenant agrees to long-term commitments from the outset, ensuring 100% occupancy and stable income for the owner. In the current market, 93% of potential clients are willing to opt for the BTS option.

By Stanislav Akhmedzyanov

Stay informed anytime! Download the World Economic Journal app on the App Store and Google Play.

https://apps.apple.com/kg/app/world-economic-journal-mag/id6702013422

https://play.google.com/store/apps/details?id=com.magzter.worldeconomicjournal

https://www.magzter.com/publishers/World-Economic-Journal