INTRODUCTION

Republic of Türkiye has always acted as a liaison between East and West thanks to its geographic location. It is widely considered to be an upper middle-income, diversified Middle Eastern economy. However, its health has been shattered by high inflation and currency depreciation, caused by expansionary monetary and fiscal measures taken just before the 2023 elections. Right now, they are not in place, however, because of the galloping inflation. Generally, we can say that Türkiye is an industrializing economy with a large agricultural base.

The country also has certain geopolitical influence. Türkiye is a member of the UN since 1945 and NATO since 1952. Since 2005 there have been EU accession talks. Türkiye’s political system has been presidential since 2017. Türkiye’s population is close to 88 million people. According to the IMF’s data as of 2024 it was considered to be the 17th largest economy in the world and the 7th largest in Europe. Among its economic and political advantages are its geographic location between Europe and Asia. The country has access to the Black Sea and the Mediterranean Sea as well as a favorable climate, which is very useful for the country’s agricultural sector.

However, in the recent years the country’s economy has been struggling due to galloping inflation, very high unemployment figures, especially among young people.

ECONOMIC TRENDS

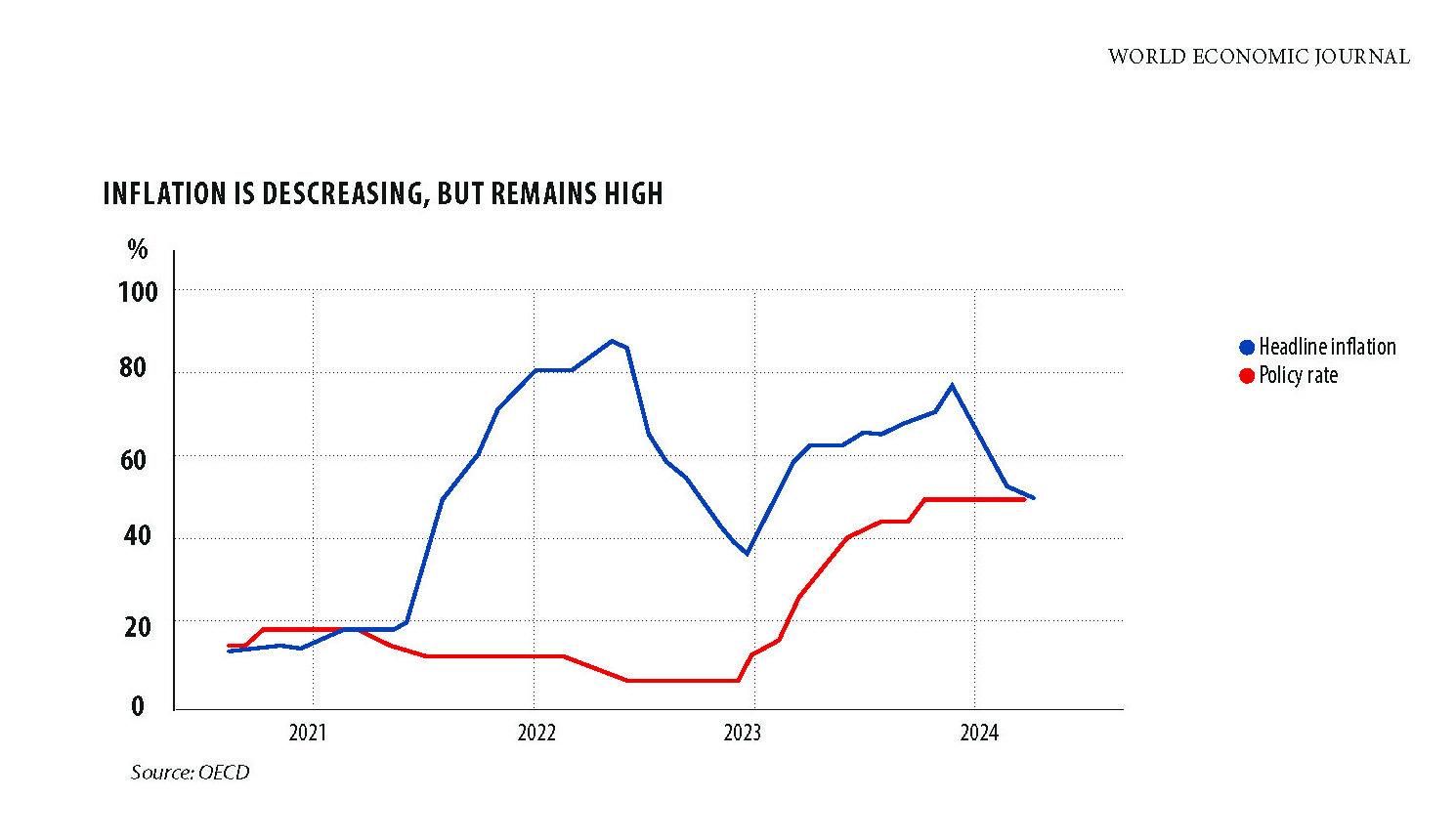

Türkiye’s economy has slowed in 2024. Its year-on-year GDP growth has lingered between 2% and 3% in the second half of 2024. This is very slow growth, given the country’s inflation rate of 44.38% as of December 2024. Still, this was a decrease from about 80% inflation readings recorded a couple of years ago. Tight financial conditions imposed by the central bank of Türkiye made the country’s inflation slow down almost twofold, while weighing on domestic demand. So, household spending and investment levels have decreased substantially. Additionally, other economic indicators, including manufacturing capacity utilization, the PMI (purchasing managers’ index), services production, and commercial loans in real terms have all dropped. All this suggests that economic activity could slow down even further. The unemployment rate is holding up just below 10%, which suggests stagflation (inflation and unemployment) of the Turkish economy.

Türkiye is an industrializing economy with a large agricultural base

According to OECD (Organisation for Economic Co-operation and Development), monetary and fiscal policies will remain tight. Türkiye’s central bank and the government have decided to keep policies tight as part of the effort to put Türkiye’s economy back on track. Only recently has the country’s central bank lowered the base interest rate from 50% to 45%. Price stability is still one of the main central bank’s priorities, while the country’s economic growth is slow. The high inflation readings are partly due to the country’s budget deficits and poor current account balances. This means that the government spends more than it earns, while the country imports more than it exports. Moreover, in 2024 the legal minimum wage has been raised by the government twofold.

But let me talk to you about Türkiye’s strongest economic sectors.

The first and most important one is the agricultural sector. It is crucial for Türkiye’s economy, making the country one of the world’s top ten agricultural producers. Türkiye’s agricultural sector mostly produces wheat, sugar beet, milk, poultry, cotton, vegetables, and fruit. Also, the country is the global leader in production of hazelnuts, apricots, and oregano.

About 50% of the country’s land is used in agriculture. The sector employs roughly 15% of the workforce and contributes about 10% of the country’s exports and over 5% of the national GDP. In 2024, over 380 billion lira has been used as government’s subsidies to finance agriculture. Türkiye is the fourth-largest supplier of vegetables and the seventh-largest supplier of fruit of the EU. Despite Türkiye being a major food producer, it relies on foreign supplies of wheat. Much of it comes from Russia and Ukraine.

Now, just a couple of words about the country’s industrial sector. Türkiye is quite strong in producing consumer electronics and home appliances. In fact, the country’s Vestel ranks as the largest television producer in Europe. It was accountable for about a quarter of all TVs sold across the continent in 2006. Also, Beko Türkiye and Profilo Telra are famous TV brands in Europe.

Equally important for Türkiye’s economy is its textile and clothing industry. The industry is the world’s fifth-largest exporter, which contributes almost 10% of Türkiye’s GDP and employed 750,000 people as of 2018. A substantial part of the country’s textile production is exported to the EU.

The automotive sector is also one of the pillars of Türkiye’s manufacturing industry, producing 1,352,648 motor vehicles as of 2022, thus making it the 13th largest vehicle producer all over the world. Turkish automotive brands, including TEMSA, Otokar, and BMC all produce vans, buses, and trucks. According to analysts, Türkiye’s Automobile Joint Venture Group is Türkiye’s leading EV company with great potential.

WHY IS TÜRKIYE AN ATTRACTIVE INVESTMENT?

Türkiye plays a major role in the geopolitics of the Black Sea area, connecting Europe, the Middle East, and Central Asia. It is also a NATO member. It, therefore, has close ties with the Middle East, the US, Europe, Russia and Ukraine, often acting as a mediator in peace talks.

According to the investment office of the presidency of the Republic of Türkiye, Türkiye is an attractive country to invest in because of the access to its large domestic market and also regional markets. There are also many multinational companies located in this country. Also, Türkiye has large population growth with half of its population under 33.5 years old. This means that there is enough young labor force, which is also quite educated and has high productivity. The country also has a liberal investment climate, has no barriers for FDI and offers strong protection for investors. Also, as I have mentioned before, some of the country’s economic sectors are strong.

KEY CHALLENGES

Türkiye’s very high inflation is the most important threat for the economy. However, reasonably high unemployment and not so high GDP growth do not allow the central bank to tighten the monetary policies further. Türkiye’s assets are likely to depreciate, if there is a global economic crisis because its assets are considered to be high-risk and always drop in value when there is market volatility. Türkiye’s key industries suggest there is potential for the country’s economy, given its technical expertise, its strong agricultural base and also its textile industry.

By Anna Sokolova